In the fast-evolving world of biopharma manufacturing, where innovation meets urgent medical needs, BICO Group AB stands as a pivotal player with a sharp focus on lab automation and supply chain solutions. The biopharma sector, particularly the realm of cell and gene therapies (CGTs), is on a trajectory to reach a staggering market size of USD 117.46 billion by 2034, propelled by an impressive 18.7% compound annual growth rate. This explosive growth signals an insatiable demand for scalable, automated systems to streamline production and reduce costs. BICO, navigating a landscape fraught with economic challenges, is strategically positioning itself to meet these needs. Despite recent financial setbacks, the company’s forward-thinking approach, rooted in partnerships and operational recalibration, hints at a promising role in shaping the future of biopharma. This narrative unfolds a tale of resilience and ambition, as BICO balances immediate hurdles with the long-term potential of a transformative industry.

Financial Performance and Challenges

Q2 2025 Results: A Tough Reality

The financial landscape for BICO Group AB in Q2 2025 paints a picture of significant struggle, reflecting broader industry and economic pressures. Net sales plummeted by 23.4% year-over-year to SEK 324.2 million, a decline driven by external factors such as funding cuts from the National Institutes of Health (NIH) and global tariff constraints. These challenges have been compounded by delayed capital expenditures from clients hesitant to invest amid uncertainty. The Lab Automation segment, particularly the BioSero division, bore the brunt of this downturn, experiencing a staggering 58% negative organic growth. Project delays and operational inefficiencies led to a re-estimation of project hours, costing an estimated SEK 40 million. This resulted in a negative adjusted EBITDA of SEK -48.8 million for the segment, underscoring the acute operational challenges BICO faces in maintaining profitability during turbulent times.

Beyond the headline numbers, the impact of these financial struggles reveals deeper systemic issues that BICO must address to regain stability. The sharp decline in the Lab Automation segment highlights vulnerabilities in project execution and client dependency, which have been exacerbated by macroeconomic headwinds. Funding cuts from key institutions like the NIH have not only constrained research budgets but also slowed down the pipeline of projects that BICO relies on for revenue. Additionally, the ripple effects of global trade barriers have disrupted supply chains, further delaying critical initiatives. While these external forces are largely beyond BICO’s control, the internal missteps in project management suggest a need for tighter oversight and more robust contingency planning. Addressing these pain points will be critical if BICO is to weather the current storm and emerge stronger in a competitive biopharma market.

Financial Resilience: Strategic Moves

Amid the financial turbulence, BICO Group AB has demonstrated a commitment to stabilizing its balance sheet through calculated and decisive actions. A notable move was the divestiture of non-core assets, such as MatTek and Visikol, sold to Sartorius for USD 80 million, generating net cash of SEK 740 million. This transaction, coupled with convertible bond buybacks worth SEK 98 million in August 2025, reflects a disciplined approach to debt management, especially with a SEK 492 million convertible bond maturing in March 2026. These steps have bolstered BICO’s liquidity, with a cash position of SEK 1.4 billion providing a critical buffer. This financial prudence signals to investors and stakeholders that the company is prioritizing long-term stability over short-term gains, even as it grapples with immediate revenue declines.

Furthermore, BICO’s focus on financial restructuring extends beyond mere asset sales and debt reduction, aiming to create a leaner, more agile organization. The influx of cash from divestitures offers flexibility to reinvest in core areas like lab automation, where growth potential remains high despite current setbacks. This strategic reallocation of resources is designed to mitigate risks associated with operational inefficiencies and external funding constraints. By strengthening its financial foundation, BICO is not only safeguarding against near-term volatility but also positioning itself to seize opportunities in the rapidly expanding CGT market. The emphasis on liquidity and debt management serves as a testament to the company’s foresight, ensuring it can navigate uncertainties while maintaining the capacity to innovate and scale in a competitive sector.

Strategic Vision and Industry Alignment

BICO 2.0 Roadmap: A New Direction

At the heart of BICO Group AB’s response to current challenges lies the “BICO 2.0” roadmap, a strategic blueprint crafted to drive operational excellence and commercial scalability. This initiative marks a deliberate shift toward specialization in lab automation and selected biopharma workflows, positioning the company as a first-choice partner for pharma and biotech firms seeking efficient solutions. By honing in on automation, BICO aims to address the industry’s pressing need for streamlined production processes, particularly in the high-growth area of cell and gene therapies. The roadmap prioritizes enhancing internal efficiencies, from project execution to customer engagement, ensuring that the company can deliver consistent value. This strategic pivot is not just about survival but about redefining BICO’s role in a sector hungry for innovation and reliability.

Delving deeper into the “BICO 2.0” strategy, it becomes clear that the focus extends beyond mere operational tweaks to a broader vision of market leadership. The emphasis on becoming a trusted partner involves tailoring solutions to meet the specific demands of CGT manufacturing, where scalability and precision are paramount. Efforts to improve commercial scalability include refining sales processes and targeting high-value clients who can benefit from BICO’s automation expertise. Additionally, the roadmap incorporates a commitment to sustainable growth, balancing profitability with investment in cutting-edge technologies. While challenges like the underperformance of certain segments persist, this strategic framework provides a clear path forward, aligning BICO with the long-term trends shaping biopharma. The success of this vision will depend on execution, but the direction signals a proactive stance in a competitive landscape.

Partnerships: Building a Strong Network

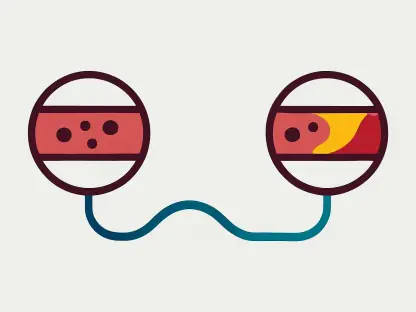

BICO Group AB’s strategic alliances with industry leaders such as ScaleReady and Cytiva are proving to be a linchpin in its efforts to address the complex supply chain challenges inherent in biopharma manufacturing. Through collaborations like the G-Rex platform with ScaleReady, BICO is tackling critical bottlenecks in CGT production, including cold chain logistics and patient-specific batch processing. These partnerships enable the company to offer end-to-end solutions that significantly reduce time-to-clinic timelines, in some cases from 18–24 months to as little as 12 months. By integrating its automation expertise with the capabilities of established players, BICO enhances its relevance in a sector where speed and precision are non-negotiable, positioning itself as a key enabler of advanced therapies.

Moreover, these collaborative efforts underscore BICO’s role within a broader ecosystem of innovation, where no single entity can address the multifaceted demands of CGT manufacturing alone. The partnership with Cytiva, for instance, focuses on overcoming hurdles in viral vector production, a critical component of many advanced therapies. This alliance not only strengthens BICO’s technical capabilities but also amplifies its market reach by aligning with trusted names in biopharma. Such strategic relationships mitigate some of the risks associated with operational setbacks by diversifying BICO’s offerings and client base. As the industry continues to shift toward collaborative models, BICO’s ability to forge and maintain these connections will be a defining factor in its growth trajectory, ensuring it remains at the forefront of supply chain transformation.

Market Opportunities and Global Reach

Regulatory and Market Tailwinds

The biopharma industry is experiencing favorable regulatory and market conditions that BICO Group AB is well-positioned to leverage for growth. In regions like Japan, accelerated approval frameworks under the PMDA’s conditional approvals are speeding up the introduction of advanced therapies. Similarly, South Korea’s GIFT framework is fostering innovation in CGT development. Meanwhile, the U.S. market for cell and gene therapies is expanding at an 18.8% compound annual growth rate, driven by increasing demand for personalized treatments. These tailwinds create a fertile ground for companies like BICO, whose automation solutions align directly with the need for compliant, scalable production systems. Capitalizing on these opportunities could provide a significant boost to BICO’s market presence and revenue potential in high-growth areas.

Adding to this promising outlook, the global shift toward advanced therapies underscores the importance of regulatory agility and market adaptability, areas where BICO is making strides. Over 80% of these therapies rely on contract development and manufacturing organizations (CDMOs) for Good Manufacturing Practice (GMP)-compliant production, amplifying the demand for automation solutions that BICO offers through divisions like BioSero. The regulatory landscapes in key markets are evolving to prioritize faster approvals without compromising safety, creating a window for companies to bring innovations to market sooner. BICO’s focus on aligning its offerings with these standards positions it to benefit from both regional incentives and the broader industry trend toward personalized medicine. Navigating these dynamics effectively will be crucial for sustained growth in a competitive field.

Expanding Horizons: Distributor Networks

BICO Group AB is strategically expanding its global footprint through an enhanced distributor network in Asia and Europe, a move designed to tap into rising demand for biopharma solutions. This expansion enables the company to reach emerging markets where CGT adoption is accelerating, despite near-term challenges like funding constraints and trade barriers. By establishing a stronger presence in these regions, BICO can diversify its revenue streams and reduce reliance on any single market. This approach not only mitigates risks associated with localized economic downturns but also positions BICO to meet the growing needs of biotech and pharma companies seeking reliable automation partners. The focus on global reach reflects a forward-looking strategy to secure a foothold in areas with significant growth potential.

In parallel, the expansion of distributor networks serves as a bridge to overcome some of the immediate hurdles BICO faces, such as client investment delays and operational inefficiencies. By partnering with local distributors, the company gains insights into regional market dynamics and regulatory nuances, which are critical for tailoring solutions to specific needs. This localized approach enhances BICO’s ability to compete with larger players while building trust with clients across diverse geographies. Furthermore, the strategic emphasis on Asia and Europe aligns with projections of robust biopharma growth in these regions over the coming years, from 2025 onward. As BICO strengthens these networks, it lays the groundwork for long-term success, ensuring it can respond swiftly to global demand shifts and maintain relevance in an increasingly interconnected industry.