The Medical Imaging Confidence Index (MICI) for the third quarter of 2025 reveals a multifaceted landscape within the radiology sector. Amidst this dynamic environment, radiology administrators in the United States exhibit a complex mix of optimism for growth and apprehension about current Medicare reimbursement issues. Derived from the responses of administrators and business managers participating in the imagePRO panel, the MICI report captures a composite score representing confidence across various critical areas, including a practice’s ability to sustain or grow its status as a profit center, the potential for increased monthly diagnostic and interventional volumes, access to capital for necessary equipment and IT enhancements, and the variability of internal operating and staffing costs.

Optimism in Imaging Growth

A significant highlight within the report is the pronounced confidence among administrators concerning the sustained profitability of imaging practices. Scoring 139 out of a possible 150, the data underscores a prevailing sentiment that imaging operations will continue contributing positively to their financial performance. This widespread confidence echoes through expectations for diagnostic and interventional radiology volume growth, which maintains a high score of 132, consistent with previous quarters. These indicators signal a robust demand for radiology services, prompting numerous administrations to gear up for expansion, both in service offerings and daily procedure numbers.

The confidence in volume and profitability growth is not without reason. The rising demand for personalized health care, driven by technological advancements and an aging population, is pushing imaging services to the forefront. Many industry players are preparing to enhance their capabilities by integrating cutting-edge technology, such as AI-driven image analysis, to improve accuracy and efficiency. This progressive outlook represents a shift towards a more robust healthcare system capable of leveraging technology to meet evolving demands. However, this optimism is tempered by the ever-present challenges of securing appropriate reimbursements.

Challenges with Medicare Reimbursement

Despite the buoyant outlook on growth, administrators express significant concerns regarding Medicare reimbursement. Markedly less optimistic, the confidence score concerning reimbursement from Medicare decreased to 76 from the previous quarter’s 85. This drop reflects longstanding uncertainties in federal healthcare policies, which pose a particular challenge to rural health settings where imaging services are crucial. Political developments, including potential tariffs and Medicaid cuts, further fuel these concerns, threatening reimbursement levels that radiology practices heavily rely on.

This persistent uncertainty exacerbates the difficulties in financial planning for imaging departments. With fluctuating reimbursement structures, administrators confront the dual challenge of maintaining service quality while managing operational costs effectively. The apprehension surrounding reimbursements underscores a broader concern within the healthcare industry, where policy shifts directly impact financial sustainability. The lack of a stable reimbursement framework complicates long-term strategic planning, pushing radiology practices to navigate these waters cautiously while striving for growth.

Operational Concerns and Capital Challenges

As imaging departments anticipate growth, the struggle to maintain consistent internal operational and staffing costs looms as another pressing issue. Rated neutrally at a score of 99 in terms of confidence, these challenges stem from wage inflation and an increased reliance on contract staffing. The vacation season of June and July often leads to slight decreases in volumes, further complicating budgeting efforts and highlighting the variable nature of operational costs. This area reflects a broader uncertainty about maintaining balanced financial operations amidst fluctuating market conditions.

Additionally, amid growing service demand, access to capital remains a pressing concern. The neutral confidence score of 99 indicates unresolved challenges in securing essential capital for equipment and IT upgrades. This difficulty in financial resource allocation for necessary technological advancements pinpoints an industry-wide hesitation. Despite the recognized need for innovation in imaging capabilities, the path towards achieving it remains fraught with uncertainty. This scenario emphasizes the healthcare sector’s broader struggle in accessing financial resources needed to foster future growth and improve patient care.

Regional Disparities and Strategic Adaptations

A deeper look into the MICI report reveals significant regional disparities within the United States, where confidence levels in growth and reimbursement differ widely. Regions like the Mid-Atlantic, East North Central, and East South Central report higher confidence in volume and profit growth. Meanwhile, areas such as the Mountain, West North Central, and West South Central experience lower confidence, particularly concerning reimbursement and capital access. These variations highlight diverse financial and operational realities confronting radiology departments across different geographies.

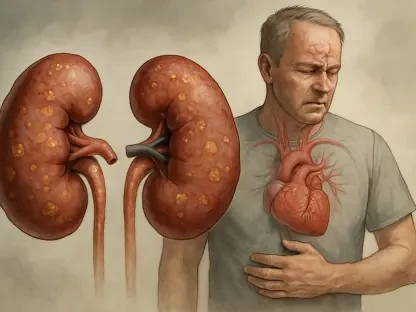

Despite these disparities, administrators are actively adapting their strategies to foster growth while navigating uncertainties. Many demonstrate optimism by diversifying service lines, with plans to expand in specialized areas like cardiac imaging. The incorporation of new procedures and specialized providers into their portfolios reflects a conscious effort to position themselves strategically for future demand. However, these growth themes coexist with caution, as fluid healthcare policies and potential tariffs on critical medical supplies, such as contrast media, persist as looming challenges.

Future Considerations and Strategic Growth

A major point highlighted in the report is the strong confidence among administrators in the continued profitability of imaging practices, reflected by a score of 139 out of 150. This indicates a strong belief that imaging operations will keep contributing positively to financial outcomes. Administrators are confident about the growth of diagnostic and interventional radiology volumes, which achieved a score of 132, consistent with previous quarters. These metrics suggest a significant demand for radiology services, prompting many administrations to plan for expansion in both service offerings and daily procedures. This optimism is supported by the growing demand for personalized healthcare, fueled by technological advancements and an aging population. Many in the industry are preparing to enhance their capabilities through cutting-edge technology like AI-driven image analysis to improve precision and efficiency. This forward-thinking approach aims to strengthen the healthcare system to meet evolving demands. However, securing appropriate reimbursements remains a consistent challenge.