In the ever-evolving landscape of the medical devices and supplies industry, the latest Q2 earnings reports have unveiled a striking dichotomy within the imaging and diagnostics sector, where some companies soar while others falter under intense pressures. Notable players such as GE HealthCare (NASDAGEHC) have demonstrated remarkable resilience and growth, capitalizing on innovation to exceed market expectations. Meanwhile, Lantheus Holdings (NASDALNTH) finds itself grappling with significant challenges, marked by declining revenues and a steep drop in investor confidence. This disparity in performance not only highlights the competitive nature of the field but also underscores broader industry trends that are shaping the future of healthcare technology. As financial results and stock movements come into focus, a deeper analysis reveals the underlying forces driving success and struggle in this critical segment of the market, offering insights into what lies ahead for these key industry participants.

Industry Challenges and Emerging Opportunities

The imaging and diagnostics sector within medical devices operates on a foundation of stability, driven by consistent demand for essential diagnostic tools and steady revenue streams from consumables and maintenance contracts. However, this stability comes with significant challenges that test even the most established companies. High costs associated with research and development, coupled with stringent regulatory requirements, place a heavy burden on financial resources. Additionally, healthcare providers, under pressure to manage costs, often negotiate aggressively on pricing, squeezing margins for manufacturers. These dynamics create a complex environment where balancing innovation with profitability becomes a constant struggle. The sector’s capital-intensive nature means that any misstep in product development or market positioning can have outsized consequences, as seen in the varied earnings outcomes across the industry during the recent quarter.

Looking to the horizon, the sector is poised for transformation through technological advancements that could redefine diagnostic capabilities. The integration of artificial intelligence (AI) stands out as a game-changer, promising to enhance accuracy and streamline operations for healthcare providers. Moreover, demographic shifts, particularly the aging global population, are expected to drive sustained demand for imaging solutions over the coming years. Yet, these opportunities are tempered by looming risks, including potential cuts in healthcare reimbursements that could delay capital equipment purchases. Cybersecurity threats tied to increasingly connected medical devices also pose a growing concern, as breaches could undermine trust and disrupt operations. This dual landscape of promise and peril shapes the strategic decisions of companies in the field, influencing how they allocate resources and position themselves for future growth amid economic and regulatory uncertainties.

Performance Highlights of Key Players

Emerging as the frontrunner in the Q2 earnings reports, GE HealthCare (NASDAGEHC) has solidified its position as a leader in the imaging and diagnostics space with an impressive revenue of $5.01 billion, reflecting a 3.5% increase year on year. This figure not only surpassed analyst expectations by 1% but also underscored the company’s ability to leverage its strengths in medical imaging equipment, patient monitoring systems, and AI-enabled solutions. A robust full-year earnings per share (EPS) forecast further signaled confidence in sustained growth. However, despite these strong financials, the stock price remained largely unchanged at $77.76 following the earnings release, suggesting that the market had already anticipated this positive performance. This stability in stock value indicates a mature investor base that views the company as a reliable performer, even as it continues to innovate and expand its technological footprint in healthcare.

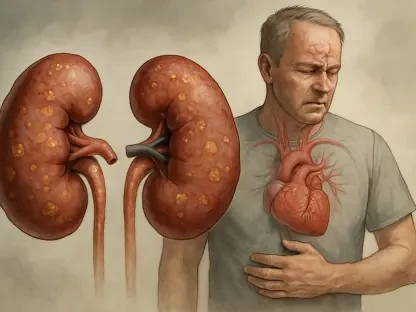

On the opposite end of the spectrum, Lantheus Holdings (NASDALNTH) faced a challenging quarter, reporting Q2 revenues of $378 million, a decline of 4.1% compared to the previous year and falling short of analyst estimates by 2.5%. The company, known for its radiopharmaceuticals and imaging agents, attributed much of this downturn to intensified competition in the PSMA PET imaging market, particularly affecting its flagship product, PYLARIFY. Efforts to diversify revenue through strategic acquisitions have yet to yield the desired impact, and a disappointing full-year revenue guidance further eroded market trust. Consequently, the stock price plummeted by 28.1% to $52.20 since the earnings announcement, reflecting significant investor concern over the company’s ability to navigate competitive pressures and regain its footing in a rapidly evolving sector where specialized products face constant threats from emerging alternatives.

Sector-Wide Trends and Varied Outcomes

Beyond the standout performances of the top and bottom players, the broader imaging and diagnostics sector displayed a fragmented landscape in Q2 earnings, with mixed results among other key companies. Hologic (NASDAHOLX), a leader in women’s health diagnostics and 3D mammography technology, reported revenues of $1.02 billion, marking a 1.2% year-on-year increase and beating analyst expectations by 1.7%. Despite this achievement and a strong next-quarter EPS guidance, the stock price saw a slight decline of 2.2% to $63.55 post-earnings, hinting at underlying market apprehensions possibly tied to economic factors or industry-wide concerns. This discrepancy between solid financial results and negative stock movement illustrates how external perceptions and broader uncertainties can overshadow individual company successes, creating a cautious environment for investors evaluating long-term potential in niche markets.

Meanwhile, QuidelOrtho (NASDAQDEL) presented a puzzling case with Q2 revenues of $613.9 million, down 3.6% year on year, aligning with analyst predictions but missing full-year EPS guidance. Despite these operational setbacks, the stock price surged by an unexpected 22% to $28.92 since the earnings release, potentially reflecting investor optimism about a longer-term recovery or belief in the company’s undervaluation prior to the report. This divergence between financial performance and market reaction underscores the complex interplay of sentiment and fundamentals in the sector. Across the group of analyzed companies, an average stock price decline of 2.1% signals a guarded investor outlook, balancing the promise of technological advancements and demographic tailwinds against immediate challenges such as cost containment in healthcare and emerging risks that could impact future profitability and growth trajectories.

Navigating a Complex Future

Reflecting on the Q2 earnings, it’s evident that the imaging and diagnostics sector navigated a period of significant divergence, where innovation and market focus propelled some companies forward while others stumbled under competitive and operational weights. GE HealthCare and Hologic demonstrated how leveraging technological advancements and niche strengths could yield positive results, even if market reactions didn’t always align with financial success. Conversely, Lantheus and QuidelOrtho faced hurdles that highlighted vulnerabilities in specific product segments and broader strategic challenges. The cautious investor sentiment, evidenced by the average stock price dip, pointed to a market weighing long-term potential against immediate economic and industry-specific risks that shaped perceptions during this reporting cycle.

Moving forward, companies in this space must prioritize strategic adaptation to address the evolving landscape, focusing on innovation to stay ahead of competitors while managing costs in a price-sensitive environment. Strengthening cybersecurity measures for connected devices will be critical to maintaining trust and operational integrity. Additionally, navigating potential policy shifts and economic variables, such as changes in healthcare spending or reimbursement structures, will require agility and foresight. As the sector balances these challenges with opportunities like AI integration and demographic-driven demand, the lessons from this quarter’s earnings underscored the importance of resilience and targeted investment in securing a sustainable path to growth and stability.