The relationship between Big Pharma and AI-focused biotechs is at a crossroads, with implications that could redefine the landscape of drug research and development. For years, the promise of artificial intelligence (AI) has enticed major pharmaceutical companies to collaborate with nimble biotech firms, hoping to leverage cutting-edge technology to expedite drug discovery and clinical trials. Yet, a trend seems to be emerging where Big Pharma’s investments in AI technologies are positioning them not as partners but as potential competitors to the very biotechs they once sought to ally with. Data from an S&P Global report supports this shift, highlighting that the global pharma-AI market, valued at $1 billion in 2022, is projected to skyrocket to nearly $22 billion by 2027. This substantial growth underscores the significant investment and competitive edge that these large pharmaceutical companies are gaining over smaller, independent AI-focused biotechs.

A Shift in Collaborations and Investments

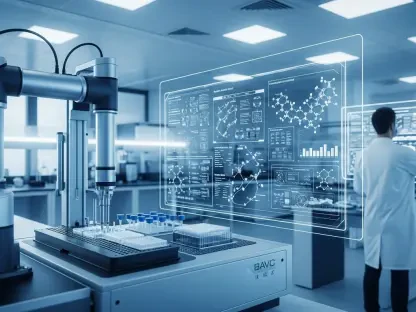

In the early days of AI adoption in pharmaceuticals, collaborations were the norm. Prominent examples include Pfizer teaming up with IBM Watson and Novartis working alongside Microsoft. These collaborations were symbiotic, with each partner bringing unique strengths to the table. Over time, however, Big Pharma has strategically shifted its focus toward forming partnerships with specialized biotechs. Notable collaborations include AstraZeneca with BenevolentAI and GlaxoSmithKline (GSK) with Insilico Medicine. These partnerships aimed at integrating AI into drug discovery processes promised to streamline research timelines and foster innovation.

Despite these collaborative efforts, a growing divide has become evident. While independent AI biotechs have played a crucial role in advancing pharmaceutical research, they are often heavily reliant on funding and market access provided by their Big Pharma counterparts. This dependency has created a dynamic where AI biotechs, even though cutting-edge, must align closely with their larger partners’ objectives and timelines. The situation is exacerbated by the significant financial resources that Big Pharma can invest in their internal AI capabilities, potentially turning these collaborations into competitive relationships. Analysts from S&P Global have observed that AI’s primary advantage lies in its ability to drastically reduce development timelines, making the technology an invaluable asset to Big Pharma’s R&D arsenal.

The Potential and Pitfalls of AI in Pharma

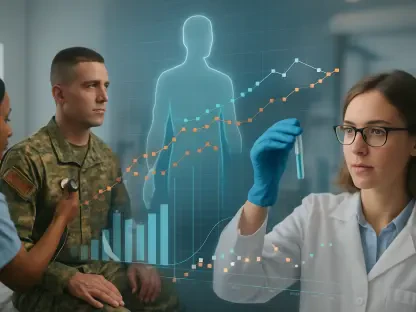

AI’s impact on pharmaceutical R&D is already evident, particularly in the fields of oncology and neurology. By harnessing AI’s capabilities, researchers have made considerable strides in addressing critical health issues more promptly. On average, drug discovery processes that incorporate AI can yield results within two to three years, compared to the traditional four to seven years. Similarly, clinical development timelines have been shortened to three to five years from the conventional seven to nine years. These advancements not only expedite the delivery of life-saving drugs to patients but also provide a competitive edge to companies that can bring their products to market faster.

However, the full spectrum of AI’s advantages in biopharma will take years to fully materialize. This long-term horizon necessitates continuous investment, diligent process adoption, and effective change management. While the acceleration of drug development is a significant benefit, it does not guarantee the production of more blockbuster drugs. The complex nature of drug discovery and the myriad variables involved mean that while AI can streamline processes, the inherent challenges of creating effective and safe medications remain. Thus, the promise of AI in pharma hinges not just on technological capabilities but also on how adeptly industry players can integrate and leverage these tools within their existing frameworks.