I’m thrilled to sit down with Ivan Kairatov, a renowned biopharma expert with extensive experience in tech and innovation within the industry. With a strong background in research and development, Ivan brings a unique perspective on the evolving landscape of telehealth. Today, we’re diving into the recent milestones of a U.K.-based telehealth platform, exploring their impressive $60 million funding round, their expansion into women’s health, and their ambitious plans for growth both domestically and internationally. Let’s get started!

Can you walk us through the journey of a telehealth platform like this one since its inception in 2018?

Absolutely. Starting a telehealth platform in 2018, especially one focused on men’s health, was no small feat. The early years were likely marked by challenges like building trust with users around sensitive health issues and navigating a regulatory landscape that was still adapting to digital healthcare. Convincing patients to seek care online for personal topics like erectile dysfunction or testosterone therapy required a strong emphasis on privacy and user-friendly design. Over time, as the platform gained traction, it probably saw an opportunity to broaden its scope. Expanding beyond men’s health into areas like women’s hormonal health would’ve come from recognizing unmet needs in the market and leveraging their expertise in personalized care to address a wider audience.

What were some of the biggest hurdles in those early days of focusing solely on men’s health services?

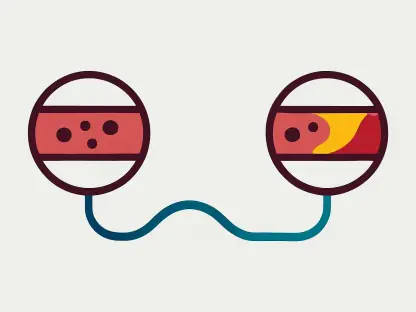

I’d say one of the biggest hurdles was stigma. Men’s health topics, particularly around sexual health or hormone deficiencies, often carry a social taboo, making it tough to get patients to engage. On top of that, there’s the challenge of educating both users and healthcare providers about the legitimacy and safety of online consultations. Building a robust system for remote diagnostics—like personalized blood testing—while ensuring compliance with medical standards would’ve been a steep climb. And let’s not forget the competition; even in 2018, the digital health space was heating up, so differentiating through quality care and trust was critical.

How do you think a company decides to pivot from a niche focus like men’s health to a broader audience, including women’s health?

It often comes down to market demand and strategic vision. Once a company establishes credibility in a specific area like men’s health, they’ve already built the infrastructure for telehealth—things like secure platforms, clinician networks, and patient trust. From there, it’s a natural progression to look at adjacent markets where similar needs exist. Women’s hormonal health, for instance, is an area with significant gaps in accessible care, much like men’s health was. The decision likely stemmed from data showing high demand for personalized solutions in this space, coupled with the company’s ability to adapt their existing model to serve a new demographic while maintaining their core expertise in sensitive, tailored healthcare.

Securing $60 million in funding is a major achievement. Can you share your insights on how a funding round of this scale comes together for a telehealth company?

It’s a complex process, but at its core, it’s about storytelling and proof of impact. A telehealth company at this stage would need to demonstrate strong growth metrics—like doubling revenue to over $90 million—and a clear path to profitability, which they’ve achieved. They’d pitch to investors by showcasing their patient base, in this case over 650,000, and highlighting innovative offerings like AI-powered health coaching. Getting major players on board often involves months of relationship-building, due diligence, and aligning on a shared vision for scaling the business. The mix of equity investment and growth capital, like the $27 million from a banking partner, suggests a strategic balance of long-term backers and immediate operational funding to fuel expansion.

How does the focus on both men’s and women’s health services play into their growth strategy with this new funding?

It’s a smart move to diversify their offerings. By enhancing men’s health services—perhaps deepening their focus on root causes like testosterone deficiency—they solidify their core market while addressing a broader range of issues. Simultaneously, launching hormonal health solutions for women taps into a massive, underserved segment. This dual approach not only widens their user base but also positions them as a comprehensive health platform rather than a niche provider. With the funding, they can invest in specialized clinicians, expand marketing to reach new demographics, and refine their tech to handle diverse health needs, all of which drive sustained growth.

What’s your take on their decision to expand internationally, starting with a market like Greece?

Choosing Greece as an entry point for international expansion is intriguing. It could be driven by a combination of market readiness and opportunity. Greece might have a growing demand for accessible healthcare solutions due to gaps in traditional systems, especially for sensitive issues that telehealth can address discreetly. Additionally, the regulatory environment might be more favorable compared to other European markets, allowing for a smoother rollout. It’s also possible they see Greece as a testing ground to refine their international strategy before tackling larger or more competitive regions. This move signals an intent to adapt their model to different cultural and healthcare contexts, which is crucial for global success.

With revenue doubling to over $90 million and reaching profitability, what do you think were the key drivers behind such financial success?

Several factors likely contributed to this. First, the surge in demand for telehealth post-pandemic played a huge role—people are now far more comfortable seeking care online. Their focus on high-demand areas like weight-loss medications and men’s health treatments probably captured a significant market share. Doubling revenue suggests they’ve scaled their user acquisition effectively, perhaps through targeted digital marketing or partnerships. Hitting profitability is a testament to operational efficiency—balancing growth investments with cost management. It’s also likely that their personalized approach, like offering blood testing and tailored therapies, created high patient retention and word-of-mouth referrals, further boosting revenue.

Looking ahead, how do you see innovations like an AI-powered health coach shaping the future of telehealth platforms like this one?

AI-powered health coaches are a game-changer. They can provide scalable, personalized support—think daily check-ins, behavior nudges, or tracking progress on weight loss or hormone therapy—that would otherwise require significant human resources. For a platform like this, it enhances user engagement and outcomes, which are critical for retention and growth. Early results probably show improved adherence to treatment plans or better lifestyle changes among users. In the long term, AI can help analyze vast amounts of patient data to refine care models, predict health trends, and even prevent issues before they arise. It’s a cornerstone for staying competitive in a crowded telehealth market.

What’s your forecast for the telehealth industry, especially with companies expanding into both men’s and women’s health on a global scale?

I’m very bullish on the telehealth industry over the next decade. As platforms expand into comprehensive care—covering both men’s and women’s health—they’re poised to become primary touchpoints for healthcare, rivaling traditional systems. Global expansion will accelerate as technology bridges access gaps in underserved regions, but it’ll come with challenges like navigating diverse regulations and cultural attitudes toward digital care. We’ll likely see more integration of AI and data analytics to personalize treatments at scale, alongside partnerships with insurers and employers to embed telehealth into everyday life. The winners will be those who balance innovation with trust, ensuring patients feel safe and supported no matter where they are in the world.