In the dynamic realm of telemedicine, where digital solutions are reshaping healthcare delivery, Amwell (AMWL) emerges as a compelling contender striving to redefine its trajectory in the mental health technology space, sparking curiosity about whether its recent gains can translate into enduring success. With a surge in subscription revenue and a notable reduction in financial losses, the company is at a pivotal moment. As mental health care continues to migrate to virtual platforms, driven by post-pandemic demand and technological advancements, Amwell’s efforts to stabilize its finances and innovate offer a fascinating glimpse into the future of the sector. This exploration delves into the core elements of Amwell’s strategic overhaul, assessing if its current momentum can withstand the pressures of a fiercely competitive market. The stakes are high, and the path forward is fraught with both opportunity and uncertainty.

Financial Progress and Subscription Surge

A Shift Toward Fiscal Discipline

Amwell’s recent financial performance reflects a determined push toward stability, a critical move for a company historically burdened by significant losses. In the second quarter of this year, the adjusted EBITDA loss was reduced to $4.7 million, a stark improvement from the $12.2 million reported in the prior quarter, marking a 61% enhancement. This progress stems from stringent cost management and a deliberate pivot to high-margin subscription software offerings. Moreover, the gross margin rose to 56.1%, indicating greater efficiency in delivering virtual care services. While these strides are encouraging, the broader financial picture remains complex, with a trailing twelve-month EBITDA of -$137.27 million and an operating margin of -66.08%. These figures underscore the ongoing challenge of achieving consistent profitability while scaling operations in a capital-intensive industry.

Subscription Revenue as a Growth Engine

The surge in subscription revenue stands as a cornerstone of Amwell’s financial revival, signaling a shift to a more sustainable business model. In the latest quarter, subscription earnings reached $40.4 million, accounting for 57% of total revenue and reflecting a 47% increase compared to the same period last year. Forecasts suggest that margins on these offerings could climb to an impressive 75–90% in upcoming quarters, a prospect that could significantly bolster the bottom line. A key driver of this growth is a $1.2 billion contract with the U.S. military health system, which has expanded the volume of scheduled virtual visits and demonstrated the scalability of Amwell’s platform. This focus on recurring revenue streams not only provides financial predictability but also positions the company to capitalize on long-term industry trends favoring software-driven healthcare solutions.

Competitive Edge in a Crowded Market

Standing Out with Specialized Solutions

In the bustling U.S. telehealth market, Amwell holds a respectable 13.14% share, trailing behind Zoom’s commanding 36.16% but distinguishing itself through a laser focus on healthcare-specific applications. Unlike general-purpose platforms, Amwell’s technology integrates seamlessly with electronic health records (EHRs) and claims portals, making it a valuable partner for mental health and behavioral care providers. This niche positioning sets it apart from competitors like Teladoc Health and Cerebral, which often target broader telehealth needs. Strategic partnerships with major insurers, such as Florida Blue, further enhance its appeal to large healthcare systems. By prioritizing enterprise-grade solutions, Amwell addresses the unique demands of medical professionals, carving out a defensible space in an increasingly crowded field.

Expanding Global Reach and Market Presence

Beyond its domestic footprint, Amwell is actively broadening its international presence, a move that strengthens its competitive stance in the global mental health tech arena. The acquisition of SilverCloud Health in 2021 has provided a gateway to new markets, enabling the company to offer digital therapeutic tools tailored to behavioral health needs across borders. This expansion aligns with projections that the digital mental health sector will grow at a compound annual growth rate of 15.8–20% through 2030, driven by rising demand for accessible care. By forging alliances with international healthcare entities, Amwell not only diversifies its revenue sources but also mitigates risks tied to reliance on specific regional markets. This strategic outreach underscores a commitment to becoming a global leader in virtual care, even as it navigates the complexities of varying regulatory and cultural landscapes.

Innovation and Industry Alignment

Harnessing AI for Operational Excellence

Technological innovation, particularly through artificial intelligence, forms a vital pillar of Amwell’s strategy to enhance service delivery and reduce costs. AI-driven tools for care coordination, predictive analytics, and automated virtual visit scheduling are streamlining operations by alleviating administrative burdens on clinicians and improving patient outcomes. These advancements are not merely incremental but transformative, enabling more efficient use of resources while maintaining high standards of care. As the telemedicine landscape evolves, Amwell’s investment in cutting-edge technology positions it to meet the growing expectations of healthcare providers and patients alike. This focus on efficiency through AI reflects a broader industry shift toward data-driven solutions that prioritize accessibility and scalability in mental health services.

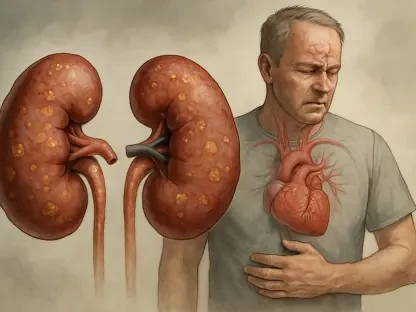

Riding the Wave of Digital Health Demand

Amwell’s technological strides are well-aligned with the surging demand for digital mental health solutions, a trend accelerated by the lasting impacts of the global health crisis. The widespread acceptance of telemedicine has created a fertile ground for companies that can deliver reliable, user-friendly platforms, and Amwell is capitalizing on this momentum. Its offerings cater to a critical need for remote care options, especially in underserved areas where traditional mental health services are scarce. Industry forecasts reinforce this trajectory, highlighting significant growth potential as virtual care becomes a mainstream component of healthcare systems. By embedding itself within this expanding ecosystem, Amwell is poised to benefit from the cultural and structural shifts favoring digital-first approaches, provided it can sustain its innovative edge amid rapid market evolution.

Risks and Investor Considerations

Grappling with Operational Challenges

Despite the positive indicators, Amwell faces substantial risks that could undermine its recent progress and long-term viability. A concerning 23% year-over-year decline in completed visits raises questions about user retention and the effectiveness of its virtual care model in maintaining patient engagement. This drop suggests potential gaps in user experience or accessibility that need urgent attention to prevent further erosion of its client base. Additionally, operational inefficiencies tied to scaling virtual services in diverse healthcare settings could strain resources if not addressed strategically. These internal challenges, while surmountable, require focused efforts to refine the platform’s usability and ensure consistent delivery of value to both providers and patients in a highly scrutinized industry.

Weighing External Volatility and Investor Outlook

External factors add another layer of complexity to Amwell’s journey, particularly its dependence on government contracts, which introduce significant revenue volatility. The 2026 extension of the DHA contract, which excludes behavioral health programs, serves as a stark reminder of the unpredictability inherent in such agreements, potentially impacting future earnings. For investors, Amwell presents a nuanced opportunity: those with a long-term horizon may find promise in the secular growth of digital mental health, betting on the company’s ability to scale. However, near-term caution is advised due to persistent losses and market fluctuations that could sway financial outcomes. Balancing these risks against strategic advancements remains essential, as the path to profitability hinges on navigating both competitive pressures and external uncertainties with precision and foresight.

Reflecting on Strategic Milestones

Looking back, Amwell’s efforts to narrow its EBITDA losses and accelerate subscription revenue marked a defining chapter in its quest for stability within the mental health tech landscape. The integration of AI-driven tools and a steadfast focus on enterprise solutions set a strong foundation for differentiation in a crowded field. Yet, challenges like declining visit volumes and volatile government contracts underscored the fragility of its recovery. Moving forward, the emphasis must shift to refining user engagement strategies and diversifying revenue streams to mitigate external risks. Strengthening partnerships with healthcare systems and investing in scalable innovations could prove pivotal. As the digital mental health sector continues to expand, Amwell’s ability to adapt and maintain fiscal discipline will determine if this turnaround story evolves into a lasting legacy of impact and growth.