The telehealth sector is witnessing a transformative phase marked by regulatory changes and shifting market dynamics, especially in the realm of compounded medications. Among the most pressing developments is the conclusion of the U.S. Food and Drug Administration’s (FDA) 90-day offramp period, which determined the drug semaglutide is no longer in shortage. This regulatory milestone, effective from May 22, has ushered in a new wave of operational challenges and strategic realignments for telehealth companies and compounding pharmacies that previously thrived on the ability to supply such drugs. The landscape that allowed these entities to circulate cheaper copies, facilitated by the prior shortage classification, is now reshaping, creating hurdles for enterprises that have built substantial revenue from these practices. The impending changes raise questions about the strategies these companies will need to employ to sustain their market presence as they transition from a period of abundance back to regulated standards.

Regulatory Impact on Telehealth Business Models

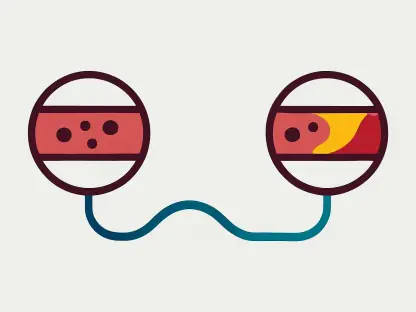

Telehealth companies capitalized on the FDA’s temporary shortage designation of semaglutide, allowing them to offer cost-effective alternatives free from the constraints of pharmaceutical patents. Lower production costs and competitive pricing strategies enabled entities to navigate around Novo Nordisk’s branded products, such as Ozempic and Wegovy, thereby significantly boosting their market shares. However, the cessation of this drug shortage classification has altered the playing field, compelling these businesses to reconsider their operational strategies. As the legal environment evolves, the focus on personalized compounding solutions becomes even more pertinent, permitting companies to legally produce customized formulations based on individual patient needs. Alterations such as dose adjustments or allergen-free versions become avenues for maintaining service relevance while adhering to legal stipulations. The adaptability of business models in response to these regulatory shifts will determine the sustainability and competitiveness of telehealth offerings in the face of newly reinforced patent protections.

While personalization offers a tactical approach, concerns remain regarding the ethical application of these exemptions. Critics argue about the potential for misuse, highlighting the risk of companies misleading consumers by promoting personalized medicine while engaging in mass production under the guise of bespoke drug solutions. Navigating this gray area warrants stringent self-regulation and integrity from telehealth companies to align with ethical standards and avoid deceptive practices. Adherence to ethical compounding ensures compliance with regulatory frameworks but also fosters consumer trust, an invaluable asset in maintaining a competitive edge in this evolving field. As companies grapple with these legal complexities, their ability to innovate within lawful and ethical boundaries will significantly influence telehealth’s future landscape and long-term viability.

Financial Ramifications and Strategic Diversification

With compounded semaglutide contributing significantly to the revenue streams of telehealth companies in recent years, notably forming a vast portion of Hims & Hers’ $1.5 billion earnings, the revocation of its shortage status presents formidable fiscal challenges. These companies must brace for altered financial trajectories, necessitating a shift in strategic focus to ensure business continuity and profitability. A potential escalation of legal actions akin to those experienced with compounded tirzepatide could further complicate fiscal expectations. Companies confronted with such litigation must carefully navigate these legal waters, all while seeking alternative revenue streams to stabilize and grow their fiscal performance. Hims & Hers exemplifies a proactive approach by diversifying its weight-loss offerings through partnerships with established pharmaceutical firms like Novo Nordisk. By incorporating branded medications and expanding drug portfolios, these businesses endeavor to mitigate dependence on compounded solutions and diminish potential revenue volatility.

The evolving financial constraints challenge companies to innovate and explore additional avenues to sustain growth. Collaborations, novel product introductions, and extended healthcare solutions shaped by broader market needs offer pathways to overcome these hurdles. In tandem with these diversification strategies, investing in technology-driven solutions and enhanced customer experience can secure a competitive position. The broader telehealth industry must remain agile and responsive, aligning strategic business initiatives with emerging regulatory landscapes to safeguard profitability and fortify against economic disruptions. Navigating these financial and operational pivots will be essential for telehealth entities striving to maintain a foothold in an increasingly competitive and regulated market.

Broad Market Trends and Future Prospects

Telehealth’s shift is part of larger, transformative trends reshaping drug production and distribution driven by a combination of regulatory adaptation, patent dynamics, and technological evolution. As pharmacies and telehealth enterprises pivot to compliant models, a broader recalibration of pharmaceutical practices mirrors similar shifts in related industries, illustrating a unifying theme of responsiveness to regulatory stimuli. From vehicular manufacture to technological ventures like OpenAI’s innovations, industries are adjusting to incremental changes, embracing new paradigms, and seizing opportunities for growth spurred by such shifts. These adaptations underscore a key tenet—innovation thrives when entities align with regulatory and market forces, fostering efficiency and resilience in business operations.

The telehealth sector’s adaptability showcases the potential for healthcare delivery improvements beyond transitions sparked by drug shortages, setting a precedent for ongoing evolution in service provision and customer engagement. Telehealth is on the cusp of redefining healthcare: it aligns medical accessibility with patient-centered needs while continuing to harness advancements that expand service reach and efficacy. Understanding these broader industry trends offers valuable insights for stakeholders, allowing them to anticipate and prepare for enduring challenges and opportunities arising from this ongoing transformation in the healthcare sphere.

Navigating the Road Ahead: Challenges and Opportunities

While telehealth companies face significant shifts, anticipating and adapting to these transitions can unlock strategic advantages. The cessation of the FDA’s semaglutide shortage classification heralded a notable challenge, encouraging businesses to innovate within stringent legal frameworks. The broader theme revolves around balancing compliance with creativity—how businesses leverage regulatory leeway to introduce transformative health solutions without crossing ethical boundaries. The capacity to innovate within these confines is crucial, emphasizing the importance of technological advancements, consumer transparency, and ethical business practices in navigating this evolving landscape.

As pharmaceutically compounded drug sales face commodification, emphasizing patient-specific solutions might offer a sustainable path forward. Telehealth entities need to reassess their definitions of personalization, moving beyond perfunctory customization to genuinely tailored therapies designed to improve outcomes. This deepened focus on true customization can enhance patient engagement, drive satisfaction, and distinguish telehealth services in a crowded market. Partnerships with pharmaceutical giants and strategic alliances with healthcare providers can also bolster telehealth’s position, offering expanded service portfolios that bridge gaps between traditional and virtual care. Such collaborations illuminate a pathway to not only sustain but enhance telehealth’s viability in the face of rapidly changing regulations and evolving patient expectations.

Concluding Thoughts on Telehealth’s Path Forward

The telehealth industry is experiencing a significant transformation due to regulatory updates and evolving market dynamics, notably in the area of compounded medications. Central to these changes is the conclusion of the U.S. Food and Drug Administration’s (FDA) 90-day offramp period, during which the drug semaglutide was assessed and is now no longer considered in shortage. This regulatory change became effective on May 22, marking a new era of operational challenges and strategic shifts for telehealth companies and compounding pharmacies that had previously thrived on the ability to distribute cheaper copies of this drug under its former shortage classification. As a result, these companies face a reshaping landscape, presenting hurdles for businesses that previously benefited financially from these practices. The situation prompts critical questions about the strategies these companies must develop to maintain their market foothold as they transition back to more regulated standards, impacting how they operate in a post-abundance era.