I’m thrilled to sit down with Ivan Kairatov, a renowned biopharma expert with extensive experience in research and development, as well as a deep understanding of technology and innovation in the pharmaceutical industry. Today, we’re diving into the latest developments surrounding obesity and diabetes treatments, focusing on the recent Phase 3 trial results of an experimental oral drug, alongside broader market trends and financial implications for major players in this space. Our conversation will explore the clinical outcomes, investor reactions, competitive landscape, patient convenience factors, and potential challenges ahead for this promising yet complex field.

Can you walk us through the key findings from the recent Phase 3 study of the experimental obesity pill and what stood out to you about the weight loss results?

Certainly, the Phase 3 study results for this oral obesity drug showed that participants on the highest dose lost an average of 11 percentage points more body weight than those on placebo after 72 weeks. That translates to about 27 pounds of weight loss compared to just 2 pounds for the placebo group. What stood out to me was the fact that while these results are significant, they didn’t quite meet the high expectations set by investors and analysts. It’s a step forward for an oral treatment, but the numbers suggest there’s still a gap when you look at the broader landscape of obesity therapies.

How do you interpret the sharp market reaction to these trial results, particularly the substantial drop in stock value for the company involved?

The market reaction was indeed striking, with a 14% drop in share price and a loss of roughly $100 billion in market value. I think this reflects a combination of high expectations and disappointment in the drug’s performance relative to those benchmarks. Investors were likely hoping for results closer to what we’ve seen with injectable therapies, and when the data came in more modest, it triggered a selloff. It also signals some uncertainty about how this drug will carve out a space in a highly competitive market, especially with other oral and injectable options already making waves.

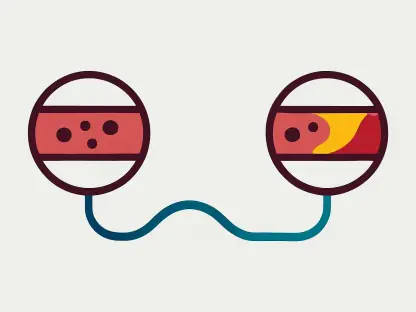

When comparing this oral drug to other obesity treatments, how does its effectiveness stack up against the leading injectable options available today?

That’s a critical point. This oral drug achieved about 11% body weight loss, which is notable but falls short of the injectable heavyweights. For instance, some injectables have shown weight loss percentages as high as 21% in clinical testing, and another major competitor’s injectable option reached around 15%. So, while the oral format offers a different kind of appeal, its efficacy is visibly lower. This gap could influence how physicians and patients weigh their options, especially for those prioritizing maximum weight reduction over ease of use.

Speaking of ease of use, the company has emphasized the convenience of this once-daily pill. Why do you think that aspect is being highlighted so strongly?

Convenience is a huge factor in patient adherence and overall treatment success. A once-daily pill that can be taken without worrying about food or water restrictions is a stark contrast to injectables, which often require specific timing, storage conditions, and, of course, the discomfort of needles. The company is banking on the idea that simplicity can attract a significant portion of patients who might shy away from injections, even if the weight loss isn’t as dramatic. It’s about broadening access and meeting people where they are in terms of comfort and lifestyle.

One concern from the trial was the higher discontinuation rate due to side effects. Can you shed some light on what might be driving that and how it could affect the drug’s future?

Yes, the trial data showed a discontinuation rate of 10.3% at the highest dose compared to just 2.6% for placebo, which is a red flag. This likely stems from adverse events—possibly gastrointestinal issues or other tolerability challenges often seen with this class of drugs. It’s something that could impact patient willingness to stick with the treatment long-term and might raise eyebrows at the regulatory level as well. If side effects are perceived as outweighing the benefits, especially with lower efficacy compared to competitors, it could limit the drug’s market potential or require additional studies to address these concerns.

Shifting gears to the financial side, the company reported impressive quarterly earnings despite the trial disappointment. How do you see these strong sales figures influencing their overall strategy in the obesity and diabetes space?

The financials were indeed a bright spot, with sales of their diabetes and obesity drugs surpassing expectations—bringing in billions and driving an upward revision of their revenue forecast for the year. This shows they’ve got a solid foundation in the GLP-1 market, particularly with their existing therapies. I think it gives them breathing room to continue investing heavily in R&D, including refining this oral drug and exploring other pipeline candidates. It also suggests that while the trial results were a setback, their broader portfolio is still a powerhouse, which could help temper long-term investor concerns.

Looking ahead, what’s your forecast for the future of oral obesity treatments in this increasingly competitive market?

I’m cautiously optimistic about oral obesity treatments. They have the potential to democratize access to care by offering a less invasive, more convenient option, which could capture a huge segment of the population hesitant about injectables. However, the competition is fierce, and efficacy will remain a key battleground. If companies can refine these oral drugs to close the gap with injectables—while keeping side effects in check—I think we’ll see a significant shift in prescribing patterns over the next five to ten years. Pricing and insurance coverage will also play a big role, as affordability could ultimately determine how widely these treatments are adopted.