A powerful convergence of artificial intelligence, novel therapeutic platforms, and fierce market competition is fundamentally reshaping the biopharmaceutical industry, accelerating the pace of discovery from the laboratory to the clinic. This period of rapid advancement is not defined by a single breakthrough but by a confluence of forces creating a dynamic ecosystem where technological prowess and biological insight are equally critical. The result is an industry on the cusp of delivering transformative medicines for some of the world’s most challenging diseases.

A New Era for Medicine: The Current Biopharma Ecosystem

The modern biopharmaceutical landscape is characterized by its global scale and profound impact on human health, driven by a continuous cycle of research, development, and commercialization. This ecosystem is a complex interplay of established giants and nimble innovators, all working toward a common goal: translating complex science into viable treatments. The industry’s influence extends beyond patient outcomes, acting as a significant engine of economic growth and technological progress worldwide.

At the forefront of this movement are several key therapeutic segments, with metabolic diseases, oncology, and neurology commanding significant attention and investment. In the metabolic space, the pursuit of next-generation obesity treatments has created an intense rivalry between major players. Meanwhile, oncology continues to be a hotbed of innovation, with novel combination therapies changing the standard of care. This dynamic environment is populated by pharmaceutical titans like Merck and Pfizer, whose vast resources allow them to advance large-scale clinical programs and acquire promising assets. They operate alongside agile biotechnology firms that often serve as the primary source of disruptive technologies and novel scientific approaches.

This era is foundationally shaped by the integration of breakthrough technologies and a growing reliance on collaborative R&D models. The traditional, siloed approach to drug development is giving way to a more interconnected strategy where large pharmaceutical companies actively seek partnerships with specialized biotechs to gain access to cutting-edge platforms. These collaborations, which leverage expertise in areas like RNA targeting and immune profiling, are essential for tackling diseases with complex underlying biology and unlocking new therapeutic avenues that would be difficult for any single entity to pursue alone.

Decoding the Catalysts: Trends and Projections Shaping the Future

Key Movers: Technologies and Tactics Fueling Momentum

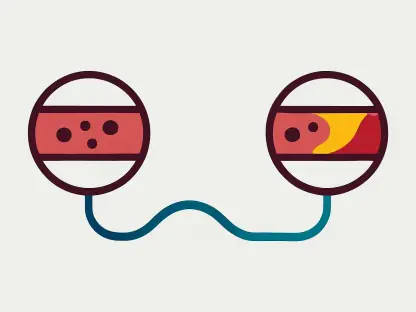

A key trend fueling momentum is the strategic use of combination therapies, particularly in oncology. The success of pairing immunotherapies with antibody-drug conjugates (ADCs), such as the Keytruda and Padcev regimen for bladder cancer, demonstrates the power of synergistic mechanisms to achieve superior clinical outcomes. This approach allows for a multi-pronged attack on cancer cells, improving efficacy and overcoming resistance, thereby setting new benchmarks for patient care in previously hard-to-treat settings.

Simultaneously, artificial intelligence is emerging as a critical accelerator in the earliest stages of drug discovery. Companies like Chai Discovery are leveraging advanced AI to predict molecular interactions with unprecedented speed and accuracy, enabling the identification of novel ways to engage “hard-to-drug” targets. This technological leap is complemented by the rise of platform-driven innovation. Specialized firms are developing sophisticated tools, from RNA-targeting antisense oligonucleotides that can modulate gene expression to T cell receptor mapping technologies that decode the complexities of the immune system, providing a new toolkit for creating highly specific and potent medicines.

Underpinning much of this R&D fervor is the intense market competition in high-value therapeutic areas. The race to dominate the obesity market, for instance, has spurred companies like Novo Nordisk and Eli Lilly to not only innovate on efficacy but also on delivery mechanisms and novel biological pathways. This competitive pressure acts as a powerful catalyst, compelling companies to invest heavily in next-generation treatments and differentiate their products in a rapidly evolving marketplace, ultimately benefiting patients by bringing more effective and convenient options to the forefront.

By the Numbers: Market Dynamics and Growth Horizons

The financial landscape of the biopharma industry reflects these powerful trends, particularly in the multi-billion dollar obesity drug market. The parallel regulatory submissions from Novo Nordisk for its combination therapy CagriSema and Eli Lilly for its oral GLP-1 agonist signal a market poised for explosive growth from 2025 forward. This expansion is driven by a combination of high unmet medical need and the demonstrated efficacy of new therapeutic classes, attracting immense investment and setting the stage for a prolonged period of commercial rivalry and innovation.

Venture capital and strategic investment patterns further illuminate the industry’s priorities, with a significant influx of capital directed toward AI-driven drug discovery platforms. The ability of companies like Chai Discovery to secure substantial funding, including a recent $130 million Series B round, underscores investor confidence in AI’s potential to revolutionize the drug development process. This enthusiasm is based on the promise that AI can reduce timelines, lower costs, and increase the probability of success by identifying more viable drug candidates early on.

The valuation of strategic partnerships and licensing deals has also reached new heights as companies seek to bolster their pipelines with external innovation. Agreements such as GSK’s potential $440 million collaboration with Camp4 Therapeutics and Pfizer’s up to $890 million deal with Adaptive Biotechnologies highlight the premium placed on accessing novel technology platforms. These deals are crucial for large pharma to tap into specialized expertise in areas like RNA therapeutics and TCR mapping, ensuring a competitive edge. Consequently, forecasting for key therapeutic areas is increasingly tied to the success of these collaborations and the clinical validation of the novel technologies they aim to advance.

Navigating the Gauntlet: Overcoming Biopharma’s Toughest Hurdles

Despite the rapid pace of innovation, the path from discovery to market is fraught with challenges. The high-stakes nature of clinical trials remains a primary hurdle, where success is measured not only by scientific outcomes but also by the ability to meet predefined endpoints and manage investor expectations. A trial that demonstrates profound efficacy, yet falls short on a secondary endpoint, can be perceived as a disappointment, creating volatility and pressure on development teams.

This challenge is amplified by the sheer scientific complexity of many target diseases, especially in fields like neurodegenerative and autoimmune disorders. Unraveling the intricate biological pathways of conditions like rheumatoid arthritis or genetic kidney diseases requires sophisticated tools and a deep understanding of underlying mechanisms. Progress in these areas is often incremental and carries a higher risk of failure, demanding long-term commitment and substantial R&D investment from sponsoring companies.

Adding to the complexity are the significant economic pressures inherent in the industry. The staggering costs associated with R&D and clinical trials must be balanced against the societal demand for accessible and affordable medicines. This tension creates a difficult operating environment where companies must make strategic decisions about which programs to advance while navigating pricing and reimbursement negotiations. Furthermore, the intensifying competition in lucrative markets means that simply developing an effective drug is no longer enough; companies must also find ways to differentiate their products in crowded fields to secure a viable market position.

The Regulatory Compass: Charting a Course Through Compliance and Approvals

In the race to bring new medicines to patients, regulatory submissions serve as a critical and defining milestone. The strategic timing and quality of these applications, such as Novo Nordisk’s recent filing for its next-generation obesity treatment, can determine a company’s leadership position and commercial trajectory. Successfully navigating this process requires a deep understanding of the requirements set forth by authorities like the U.S. Food and Drug Administration (FDA) and their global counterparts.

The increasing prevalence of novel combination therapies presents unique regulatory challenges. Health authorities require robust data demonstrating that the combination provides a benefit superior to its individual components, along with a clear safety profile. For regimens like the Keytruda-Padcev duo in bladder cancer, this involves meticulously designed trials that can isolate the synergistic effects and justify the use of multiple agents in a specific patient population, often across different stages of a disease.

Central to any approval pathway is the generation of data that is not only “statistically significant” but also “clinically meaningful.” This distinction is crucial, as regulators and clinicians must be convinced that a new therapy offers a tangible improvement over the existing standard of care. Meeting this high bar shapes trial design, endpoint selection, and the overall development strategy. The evolving standards for drug safety, efficacy, and post-market surveillance further demand that companies maintain a rigorous approach to data collection and analysis throughout a product’s lifecycle.

The Next Horizon: Predicting Tomorrow’s Breakthroughs and Disruptors

Looking ahead, the trajectory of AI in biopharma is set to expand far beyond its current role in target discovery. The next frontier involves leveraging artificial intelligence for predictive clinical trial modeling, allowing researchers to simulate outcomes, optimize patient selection, and potentially de-risk development programs before they even begin. This evolution promises to make the entire R&D process more efficient and data-driven.

The push toward personalized medicine will also accelerate, powered by advanced genomic and immune-profiling platforms. Technologies that can map an individual’s unique T cell receptors or genetic predispositions are enabling the development of bespoke therapies for autoimmune and neurodegenerative diseases. This shift from a one-size-fits-all approach to tailored treatments represents a fundamental change in how complex conditions are managed.

Innovation in drug delivery is another key area of focus, with a concerted push toward developing more convenient oral formulations to replace injectables. The development of an oral GLP-1 agonist for obesity exemplifies this trend, which aims to improve patient adherence and quality of life. Alongside these advancements, researchers continue to identify emerging therapeutic targets by exploring novel biological pathways, from RNA modulation to new immunological checkpoints, paving the way for entirely new standards of care in the coming years.

Synthesizing the Future: Strategic Imperatives and Investment Insights

The analysis of recent industry developments revealed a clear set of innovation drivers. The integration of artificial intelligence into drug discovery, the strategic necessity of cross-company collaborations to access specialized technologies, and the proven clinical power of therapeutic synergy in combination treatments were consistently highlighted as the primary forces shaping the next generation of medicines.

This convergence underscored the transformative potential of fully integrating advanced technology with deep biological understanding. The most successful ventures were those that adeptly bridged the gap between computational power and laboratory science, creating a feedback loop that accelerated discovery and refined therapeutic hypotheses. This synthesis is no longer an aspiration but a core operational imperative for any organization aiming to lead in this competitive landscape.

The trends identified pointed toward several promising areas for investment. Specialized technology platforms, particularly those focused on AI, RNA targeting, and immune system mapping, stood out as critical enablers of future breakthroughs. Additionally, early-stage innovators with novel approaches to “hard-to-drug” targets or complex diseases represented high-growth opportunities. For stakeholders, capitalizing on this next wave of biopharma advancement required a strategy centered on agility, technological adoption, and a forward-looking approach to partnership and pipeline development.