A strategic maneuver from the titan of mRNA vaccine technology has shifted a potentially life-changing therapy for a rare disease into the hands of a specialized pharmaceutical firm, signaling a significant recalibration of priorities for both companies. In a deal that highlights the complex economics of modern drug development, Moderna has out-licensed its promising candidate for propionic acidemia to Recordati, an Italian company focused on niche medical markets. This partnership not only charts a new course for a therapy that could transform thousands of lives but also raises crucial questions about the future direction of big biotech.

A Strategic Pivot from a Global Vaccine Titan

The decision by Moderna, a company synonymous with its global blockbuster COVID-19 vaccine, to hand off a late-stage rare disease asset appears counterintuitive at first glance. However, the move reflects a deliberate and calculated pivot toward streamlining its operations and sharpening its focus. By monetizing mRNA-3927, the company is doubling down on its core therapeutic areas of oncology and infectious diseases, where it believes its platform can generate the most significant impact and financial returns.

This transaction underscores a broader strategic realignment within Moderna, aimed at optimizing resource allocation and managing costs in a post-pandemic landscape. Deferring the initiation of new pivotal trials for other rare disease programs further solidifies this direction. The deal with Recordati allows Moderna to recoup investment and secure future revenue through milestones and royalties while entrusting the complex and resource-intensive commercialization process to a partner with established expertise in the rare disease sector.

The High Stakes World of Propionic Acidemia

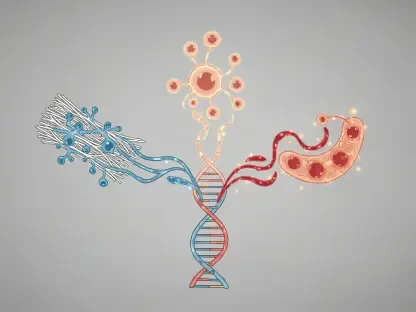

Propionic acidemia (PA) is a devastating and life-threatening inherited metabolic disorder with no approved therapies. The condition is caused by a deficiency in a critical enzyme, leading to the toxic buildup of metabolites in the body. This accumulation can trigger sudden and severe metabolic decompensation events, which are medical emergencies that can result in irreversible neurological damage, coma, or death. The relentless threat of these crises places an immense and constant strain on patients and their families.

Current management of PA is a daily battle fought on two fronts: a highly restrictive diet that severely limits protein intake and, in the most severe cases, the drastic measure of a liver transplant. These interventions are burdensome and come with their own significant risks and complications. The profound unmet medical need for a dedicated, effective treatment is clear, as a targeted therapy could fundamentally alter the course of the disease, reduce the risk of life-threatening events, and vastly improve the quality of life for the small but vulnerable patient population.

Unpacking the Landmark Agreement

At the heart of the agreement is mRNA-3927, a novel drug candidate that uses a sophisticated dual-mRNA technology. This approach aims to correct the underlying enzyme deficiency by providing the genetic instructions for the body to produce the missing functional protein. By doing so, the therapy is designed to prevent the dangerous buildup of toxic substances, directly addressing the root cause of propionic acidemia.

The financial architecture of the partnership is structured to benefit both parties. Recordati has made an upfront payment of $50 million, securing the global commercialization rights. The deal also includes potential future payments of up to $110 million tied to near-term development and regulatory milestones, along with additional commercial milestones and tiered royalties on net sales. Under this blueprint, Moderna will continue to spearhead the ongoing clinical development, while Recordati will leverage its global infrastructure to prepare for a potential market launch, aiming to bring this groundbreaking therapy to patients worldwide.

The Promising Data Behind the Deal

The confidence fueling this partnership is built upon compelling clinical evidence. The pivotal Phase 1/2 study for mRNA-3927 is now fully enrolled, with registrational data expected this year that will be critical for regulatory submissions. The decision to move forward was heavily influenced by earlier results from the trial, which were highly encouraging for the PA community.

Specifically, data from the initial phase of the study demonstrated a significant clinical benefit, showing a 76% relative risk reduction in the frequency of life-threatening metabolic decompensation events among treated patients. This statistic represents a potentially dramatic improvement over the current standard of care and provides a strong scientific rationale for the drug’s potential as a first-in-class treatment. Moderna officially framed the deal as a strategic decision to monetize a valuable asset, allowing it to streamline its portfolio while ensuring the program continues to advance toward a patient population in desperate need.

What This Strategic Shift Means for the Future

For Moderna, this deal crystalized a deliberate pivot away from the rare disease space, enabling the company to concentrate its considerable resources and scientific expertise on its expansive oncology and infectious disease pipelines. This sharpened focus is intended to accelerate development in areas with broader market potential and reinforce its leadership in mRNA technology beyond its pandemic response.

Conversely, the agreement represented a major opportunity for Recordati, positioning the company to potentially become the first to market an approved, dedicated therapy for propionic acidemia. This move could solidify its reputation as a leader in rare disease commercialization. From a broader industry perspective, this partnership model, which pairs a biotech innovator with a commercialization expert, provided a viable template for advancing niche therapies, ensuring that promising treatments for smaller patient populations have a clear path to market.