Imagine a world where melanoma, one of the deadliest forms of skin cancer, could be tackled with a groundbreaking vaccine that boosts existing treatments for patients who currently have limited options. This scenario lies at the heart of recent discussions surrounding IO Biotech’s experimental vaccine, Cylembio, designed to target immune checkpoints in melanoma patients. Despite a significant setback in a Phase 3 clinical trial, the biopharmaceutical community remains abuzz with opinions on whether this “near miss” could still pave the way for regulatory approval. This roundup gathers diverse perspectives from industry analysts, clinical researchers, and financial experts to unpack the promise and challenges of Cylembio, offering a comprehensive look at its potential impact on cancer care.

Diving into Cylembio’s Role in Melanoma Treatment

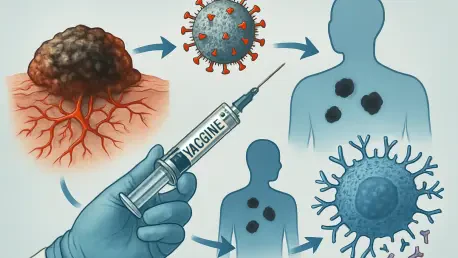

The journey of Cylembio begins with IO Biotech’s innovative approach to enhancing immunotherapy for melanoma, a disease with rising incidence rates globally. Industry observers note that the vaccine’s design, which targets immune checkpoints like PD-L1 and IDO1, represents a novel attempt to amplify the effectiveness of drugs like Keytruda. Many in the field highlight the urgency of such advancements, given that a significant portion of patients still fail to respond adequately to current therapies, underscoring an unmet need in oncology.

Beyond the science, there’s a broader conversation about how Cylembio fits into the evolving landscape of cancer treatment. Some biopharma analysts emphasize that the vaccine’s “off-the-shelf” nature—unlike personalized alternatives from competitors—could make it more accessible and cost-effective if approved. However, others caution that technological innovation alone doesn’t guarantee success, especially when clinical trial results fall short of primary goals, sparking debates about its viability in a competitive market.

Analyzing the Phase 3 Trial Outcomes

Unpacking the Primary Endpoint Shortfall

The core of the discussion around Cylembio centers on its Phase 3 trial, which tested the vaccine alongside Keytruda in over 400 patients with advanced melanoma. Clinical trial experts point out that the combination achieved a 23% reduction in the risk of disease progression or death but narrowly missed statistical significance. This outcome has led to varied interpretations, with some researchers suggesting that such a close result might still hold weight in regulatory contexts under certain conditions.

Financial and regulatory analysts, however, express skepticism about the implications of missing the main endpoint. They argue that while the data shows promise, the lack of statistical significance could pose a major hurdle with bodies like the FDA, which often prioritize clear-cut results. This perspective fuels broader concern about whether “near misses” can translate into approvals without additional evidence or trials.

A contrasting view comes from oncology specialists who believe the trial’s design and patient scale offer valuable insights despite the setback. They note that the large sample size provides a robust dataset, potentially opening doors for further analysis or discussions with regulators. This optimism hinges on the hope that nuanced interpretations of data might influence decision-making in favor of patient access to new options.

Highlighting Success in Specific Patient Groups

Shifting focus to subgroup results, many in the medical community are encouraged by Cylembio’s performance in certain patient populations. Notably, patients lacking a key immunotherapy response protein showed a striking 46% risk reduction, a finding that some clinical researchers view as a potential game-changer for those with limited treatment responses. This data, part of the pre-specified analysis plan, is often cited as a strong point in favor of targeted approvals.

On the flip side, regulatory consultants warn that while subgroup successes are promising, they may not fully sway authorities, especially for findings like the 26% risk reduction in treatment-naive patients, which wasn’t part of the original plan. They stress that post-hoc analyses often face scrutiny, as they can be perceived as less reliable. This tension between clinical hope and regulatory caution remains a hot topic in discussions about the vaccine’s future.

Additionally, patient advocacy groups weigh in, emphasizing the real-world impact of these subgroup findings. They argue that even if approval is limited to specific populations, it could address critical gaps in care for melanoma patients who currently face dismal outcomes. This perspective adds a human dimension to the debate, pushing for a balance between strict regulatory standards and urgent medical needs.

Evaluating Innovations in Vaccine Design

Cylembio’s “off-the-shelf” approach garners significant attention for its potential to streamline production compared to personalized vaccines. Biotech innovators highlight that this method could reduce costs and improve scalability, making the treatment more feasible for widespread adoption if proven effective. Such an advantage is seen as a key differentiator in a field crowded with complex, individualized therapies.

However, manufacturing experts caution that simplicity in design doesn’t automatically equate to market success or regulatory favor. They point out that regional differences in healthcare systems and approval processes could affect how this innovation is received, with some markets potentially prioritizing cost over unproven efficacy. This raises questions about global accessibility and the vaccine’s commercial strategy moving forward.

Furthermore, some technology analysts suggest that while the design is a step toward broader cancer care solutions, the trial setback might dampen enthusiasm among stakeholders. They argue that without clear clinical wins, the benefits of an off-the-shelf model remain theoretical, urging IO Biotech to focus on demonstrating consistent outcomes. This critique underscores the challenge of aligning innovation with tangible results.

Assessing Financial and Market Responses

The financial fallout from the trial results has sparked intense discussion among market watchers, who note a steep 20% drop in IO Biotech’s stock price immediately following the announcement. Investment analysts interpret this as a reflection of broader investor unease, especially given the company’s history of losses since going public a few years ago. The reaction highlights the high stakes of clinical trial outcomes in biotech markets.

On the financial stability front, some industry commentators point to IO Biotech’s $28 million cash reserve, sufficient to fund operations into early 2026, as a buffer against immediate concerns. They also mention a potential loan from the European Investment Bank, contingent on positive developments, as a possible lifeline. However, comparisons to other clinical-stage biotechs suggest that this funding level is modest, raising questions about long-term sustainability.

A differing opinion comes from venture capital experts who speculate that positive signals from upcoming FDA discussions could shift market sentiment. They argue that investor confidence might rebound if regulatory pathways become clearer, potentially attracting new funding. This view paints a picture of cautious hope, balancing current financial challenges with the possibility of future recovery.

Strategic Directions for IO Biotech

Looking at strategic next steps, biopharma consultants recommend that IO Biotech prioritize FDA engagement to leverage subgroup data for potential approvals. Many agree that focusing on patients with specific biomarkers could carve out a niche, addressing unmet needs while building a case for broader application. This targeted approach is seen as a pragmatic way to navigate regulatory hurdles.

Financial advisors also stress the importance of securing additional capital to sustain momentum through 2026 and beyond. They suggest exploring partnerships or further loans to bolster resources, especially if trial setbacks delay revenue generation. Such moves are viewed as critical to maintaining investor trust and supporting ongoing research efforts.

From a market strategy perspective, some analysts advocate for transparent communication with stakeholders about trial nuances and regulatory plans. They believe that educating investors and the public on the significance of subgroup successes could mitigate skepticism, fostering a more balanced view of the company’s trajectory. This emphasis on clarity aims to align corporate goals with market expectations.

Reflecting on Cylembio’s Broader Implications

Looking back, the discourse around Cylembio encapsulates a pivotal moment in cancer vaccine development, where scientific ambition grapples with clinical and financial realities. The diverse opinions—from clinical optimism to regulatory caution and investor wariness—paint a complex picture of innovation under pressure. Each perspective contributes to a deeper understanding of the challenges faced by IO Biotech during this critical phase.

For those following this journey, the next steps involve closely monitoring outcomes of FDA discussions and any updates on approval submissions. Exploring additional resources on melanoma treatment advancements and biotech funding trends can provide further context. Staying informed about how clinical trial nuances influence regulatory and market outcomes remains essential for anyone invested in the future of oncology innovations.