Cardurion Pharmaceuticals has recently made headlines by securing a $260 million Series B financing round. This substantial investment underscores the fierce commitment to advancing the treatment of heart disease, one of the leading causes of mortality worldwide. The funds raised will propel Cardurion’s innovative drugs through vital clinical trial phases and support the acquisition of new cardiovascular therapies. This significant infusion of capital signals a promising future for cardiovascular drug development and highlights the critical need for improved treatment options for heart failure and other heart muscle dysfunctions.

Cardurion Pharmaceuticals’ Journey So Far

Founded in 2017 through a strategic alliance with Takeda, Cardurion Pharmaceuticals has rapidly established itself as a significant player in the field of cardiovascular disease treatment. By targeting heart failure and other heart muscle dysfunctions, the company has focused on a patient-centric approach, ensuring that their therapeutic solutions can address the most pressing needs. As a startup, Cardurion has demonstrated a remarkable ability to navigate the complex landscape of pharmaceutical development, leveraging partnerships and strategic acquisitions to bolster its innovative pipeline.In 2022, Cardurion’s strategic acquisition of a drug from the now-defunct Imara highlighted its ambition and drive to diversify its therapeutic portfolio. This move provided the necessary impetus to fortify its position in a competitive market. The recent $260 million Series B funding, backed by heavyweight investors like Bain Capital and NEA, marks a pivotal moment for Cardurion, enabling further development and scaling of its promising pipeline. This level of financial backing not only underscores the investors’ confidence in Cardurion’s strategic direction but also emphasizes the critical importance of developing new treatments for heart disease.

Advancement of Heart Disease Treatments

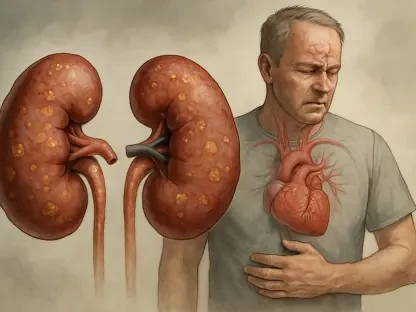

The primary use of the newly raised funds is aimed at progressing two key heart disease treatments, CRD-740 and CRD-750, into mid- and late-stage clinical trials. CRD-740 recently showcased encouraging Phase 2 trial data, demonstrating its potential to increase levels of cGMP, a crucial molecule, within four weeks of treatment. This significant finding paves the way for Cardurion’s continued efforts toward innovative, effective solutions for heart failure. The transition from Phase 2 to later stages of clinical trials is a critical phase in drug development, determining the treatment’s efficacy and safety on a larger scale.Heart failure remains a daunting condition, with patients facing a 50% mortality rate within five years of diagnosis despite existing treatments like Novartis’ Entresto. Cardurion’s CRD-750 aims to offer a breakthrough, particularly targeting subpopulations with specific heart failure conditions. This focused approach not only promises to enhance therapeutic outcomes but also highlights the company’s commitment to precision medicine. By targeting particular segments of the heart failure population, Cardurion’s innovative strategies could significantly improve survival rates and quality of life for patients afflicted with this chronic condition.

Strategic Acquisitions and Alliances

Cardurion’s strategy extends beyond internal development to include strategic acquisitions and alliances. The acquisition of Imara’s drug assets exemplifies how Cardurion leverages partnerships to strengthen its pipeline. Such moves are integral to maintaining momentum in a rapidly evolving field, ensuring that the company remains at the forefront of cardiovascular research. These strategic decisions not only enhance Cardurion’s portfolio but also provide a competitive edge in developing treatments that address substantial unmet medical needs.Investments from established venture capital firms like Bain Capital and GV further cement the credibility and potential of Cardurion’s approach. These partnerships do more than just provide financial support; they enable a rich exchange of expertise and resources, further propelling the development of groundbreaking therapies. The alliances with seasoned investors and biotech entities are crucial for Cardurion to navigate the complexities of drug development, regulatory requirements, and market dynamics. This synergy between financial backing and strategic collaboration fosters an environment conducive to innovative breakthroughs.

Innovating in the Heart Failure Treatment Arena

Despite the presence of established treatments, there is a critical need for new, more effective heart failure therapies. Cardurion’s innovative approach targets the enzyme PDE9, which plays a regulatory role in heart muscle relaxation. This novel mechanism seeks to enhance the heart’s pumping efficiency, potentially setting new standards in heart failure treatment. The ability to modulate heart muscle function through PDE9 inhibition could revolutionize treatment paradigms, offering a lifeline to patients who have not responded to current therapies.The potential of PDE9 inhibitors like CRD-750 to improve heart function can significantly alter the landscape of heart failure management. By focusing on enhancing the mechanical properties of heart muscles, these treatments can address fundamental issues contributing to heart failure. Cardurion’s focused research and development efforts in this area highlight their dedication to addressing unmet medical needs, potentially transforming the outcomes for millions of heart failure patients globally. The promise of CRD-750 and similar compounds exemplifies Cardurion’s commitment to groundbreaking research and its potential impact on cardiovascular health.

Rising Interest and Investment in Cardiovascular Research

The surge in investment towards cardiovascular and metabolic disease startups is driven by the significant unmet needs and potential for substantial returns. The successes of drugs like Wegovy and Zepbound, which offer dual benefits of weight loss and improved heart health, underscore this trend. Cardurion’s robust pipeline positions it well within this landscape of innovation and opportunity, making it an attractive prospect for investors looking to make meaningful advancements in medical science.High-profile deals such as Bristol Myers Squibb’s $13 billion acquisition of MyoKardia and Novartis’ $10 billion acquisition of a cholesterol medication from The Medicines Co. reflect the growing interest and stakes in cardiovascular research. These investments not only highlight the lucrative potential but also emphasize the critical need for advanced therapies, further validating Cardurion’s strategic direction. The influx of capital into the cardiovascular sector underscores the broad acknowledgment of the importance of innovative treatments, providing Cardurion with the financial muscle and strategic partnerships necessary to pioneer new therapeutic frontiers.

Financial Strategy and Future Prospects

Cardurion’s ability to attract $260 million in Series B funding is a testament to its strong financial strategy and the belief investors have in its vision. A portion of the funds will be allocated to exploring new therapeutic indications and acquiring additional assets related to cardiovascular diseases, showcasing a forward-thinking approach aimed at broadening the company’s impact. This financial strategy not only strengthens Cardurion’s current pipeline but also positions the company for sustained growth and innovation.The remaining funds will drive pivotal Phase 3 trials, setting the stage for potential FDA approval and market entry. Success at these stages could not only provide life-saving treatments to patients but also position Cardurion as a leader in the field, creating long-term value for investors and stakeholders alike. The company’s comprehensive approach to utilizing the funds reflects its strategic commitment to enhancing cardiovascular care and solidifying its market position. Cardurion’s ability to navigate financial, regulatory, and developmental pathways effectively will be crucial in translating its innovative research into therapeutic realities.

Shaping the Future of Cardiovascular Care

Cardurion Pharmaceuticals has recently made headlines by securing an impressive $260 million in a Series B financing round. This substantial investment underscores the company’s dedication to advancing the treatment of heart disease, which remains one of the leading causes of death globally. The funds will be pivotal in propelling Cardurion’s innovative drugs through critical clinical trial phases. Additionally, the financing will support the acquisition and development of new cardiovascular therapies.This significant capital infusion not only signals a promising future for cardiovascular drug development but also highlights the urgent need for improved treatment options for heart failure and other forms of heart muscle dysfunction. With heart disease continuing to be a major health concern, the advancement of effective treatments is of paramount importance. The support from the Series B financing round will empower Cardurion to push the boundaries of what’s possible in cardiovascular medicine, aiming to bring new hope and improved quality of life to millions of patients worldwide.