Tango Therapeutics, a biotechnology company specializing in cancer treatments, has taken significant measures to address the challenging financial landscape. Recently, the company announced layoffs affecting approximately 20% of its workforce, a strategic move designed to extend its cash runway. As of December 31, Tango employed 155 full-time staff and held $258 million in cash, equivalents, and short-term securities. This report provides an in-depth analysis of Tango’s current situation, its strategic initiatives, and the broader industry context.

Overview of the Industry’s Current State

The biotechnology sector faces a tumultuous financial environment, characterized by diminishing investment and policy uncertainties. Several companies, including Tango Therapeutics, have implemented restructuring efforts to maintain financial stability. Notably, IGM Biosciences, Intellia Therapeutics, and Caribou Biosciences have announced layoffs this year, reflecting widespread challenges across the industry. Companies are focusing on streamlining operations and prioritizing key clinical programs to adapt to constrained financial conditions and evolving market demands.

Detailed Analysis: Trends, Data, and Forecasts

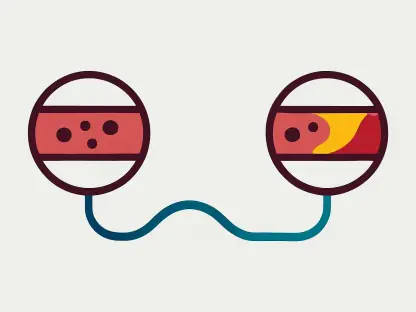

Tango Therapeutics’ decision to lay off approximately 30 employees is part of a strategic shift towards prioritizing its clinical programs. The layoffs primarily target preclinical research, enabling Tango to allocate resources to its most promising programs. The company is concentrating on PRMT5 inhibitors, specifically TNG462, which is currently showing potential in the treatment of pancreatic and lung cancers. Early clinical data suggest that TNG462 may have a favorable safety and tolerability profile compared to competitors.

This shift follows Tango’s decision to discontinue the development of TNG348 due to liver function abnormalities in trial participants, highlighting the importance of prudent resource allocation. Furthermore, Tango is deprioritizing one of its other PRMT5 inhibitors while continuing to develop TNG456 in collaboration with Eli Lilly’s drug Verzenio for glioblastoma. These decisions underscore Tango’s emphasis on advancing its most promising therapeutic approaches in a challenging biotech landscape.

Strategic Partnerships and Financial Position

Despite financial pressures, Tango’s partnership with Gilead Sciences remains a crucial element of its strategy. Last year, Gilead licensed a Tango drug discovery program for $12 million, contributing significantly to Tango’s financial support. Since the collaboration began in 2018, Tango has received considerable payments from Gilead, reinforcing its financial position. Tango’s cash reserves, projected to last into 2026, provide a buffer that allows the company to navigate current market conditions.

However, Tango’s stock performance has experienced fluctuations, with shares recently trading at just over $1, indicating market skepticism. This scenario is emblematic of broader industry trends, where companies grapple with investor confidence and funding challenges. Tango’s efforts to restructure and focus on clinical priorities reflect its strategy to adapt and sustain innovative cancer treatments amid financial constraints.

Reflections and Future Outlook

The restructuring at Tango Therapeutics is indicative of widespread industry challenges, with several notable biotech companies announcing layoffs and financial repositioning. The sector’s diminishing investment and regulatory uncertainties demand strategic agility and prudent resource management. Tango’s emphasis on key clinical programs and strategic partnerships illustrates its commitment to navigating the complex biotech landscape.

Moving forward, Tango Therapeutics aims to extend its financial runway and continue developing innovative cancer treatments despite setbacks. The company’s focus on its most promising clinical programs, coupled with strategic partnerships, sets a foundation for potential growth and stability. As Tango adapts to financial pressures and industry trends, its long-term resilience will depend on the successful advancement of its therapeutic approaches and sustained investor confidence.

In conclusion, Tango Therapeutics has taken necessary steps to streamline its operations, focusing on clinical priorities, and preserving financial stability. Industry-wide challenges required a strategic response, and Tango adapted by laying off employees while emphasizing promising programs. Financial partnerships played a critical role, and the company navigated a difficult landscape by maintaining a clear focus and prudent resource allocation.