Grail, a leading player in the cancer detection industry, is making a significant cut to its workforce, laying off approximately 350 employees, which represents about 25% of its total workforce. This substantial reduction is part of a major restructuring effort aimed at refocusing the company’s resources on its flagship product, the Galleri multi-cancer early detection test, and reducing overall expenditures. This decision follows Grail’s separation from Illumina, enforced by regulators to encourage competition in the liquid biopsy market. The restructuring aims to ensure that Grail can sustain its operations, achieve key regulatory milestones, and maintain its market-leading position in multi-cancer detection.

Strategic Shift Following Separation from Illumina

The workforce reduction is part of Grail’s broader strategy to navigate the challenges it faces post-separation from Illumina. This separation was enforced by regulators who were concerned that the merger could potentially stifle competition in the burgeoning liquid biopsy market. Grail’s decision to lay off a significant portion of its staff is an effort to realign resources toward better support for its flagship product, the Galleri test, which is central to the company’s mission of revolutionizing cancer detection.

Bob Ragusa, Grail’s Chief Executive Officer, emphasized the strategic importance of securing U.S. Food and Drug Administration (FDA) approval for Galleri. According to Ragusa, obtaining this approval is crucial for maintaining Grail’s market-leading position in multi-cancer detection. The restructuring will involve not only job cuts but also a streamlining of the commercial sales force, reducing management layers, and significantly cutting investment in research and development for products beyond Galleri. By concentrating on Galleri, Grail aims to channel its efforts and resources into achieving this vital regulatory milestone, which is viewed as a linchpin for the company’s future success.

Financial Performance and Restructuring Costs

Grail’s recent financial performance underscores the necessity of this strategic realignment. In the second quarter, the company reported a staggering net loss of $1.6 billion, a dramatic increase from the $193 million loss reported in the same period the previous year. Despite this significant loss, Grail’s revenue grew to nearly $32 million, marking a 43% increase year over year. These financial figures highlight the urgent need for the restructuring and resource reallocation to extend Grail’s operational runway and ensure its sustainability in the highly competitive cancer diagnostics market.

The cost-saving measures resulting from the job cuts are expected to incur a financial charge of $18 million to $23 million for severance and other termination-related expenses in the third quarter. This decisive move is aimed at extending Grail’s cash reserves, allowing the company to operate more sustainably from the second half of 2026 through to 2028. By providing a more stable financial foundation, Grail hopes to navigate its future challenges more effectively and position itself for long-term success. This financial discipline is essential as the company pursues its strategic objectives and seeks to make a transformative impact on cancer detection and patient care.

Focus on Galleri Multi-Cancer Early Detection Test

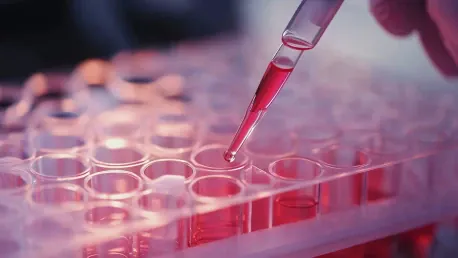

Launched in mid-2021 as a laboratory-developed test in the U.S., the Galleri test has quickly become a critical component of Grail’s mission to revolutionize cancer detection. Since its introduction, Grail has sold over 215,000 commercial tests, demonstrating the test’s significant market acceptance and potential. The Galleri test can detect a common cancer signal across more than 50 cancer types, offering the possibility of complementing existing single-cancer screenings and establishing a new standard of care in early cancer detection. This extensive capability positions Galleri as a groundbreaking tool in the ongoing fight against cancer.

However, despite its promising capabilities, there remains ongoing skepticism and uncertainty among oncologists and other physicians regarding the role of multi-cancer screenings in patient care. Overcoming this skepticism is crucial for Grail as it seeks FDA approval for Galleri. FDA approval would not only solidify the test’s credibility within the medical community but also potentially transform cancer detection practices on a broader scale. Addressing these concerns and securing regulatory approval is a top priority for Grail as it aims to make Galleri an integral part of the standard cancer screening protocol, thereby ensuring its widespread adoption and impact.

Navigating Regulatory Challenges and Market Dynamics

The primary strategic goal for Grail now is to secure FDA approval for Galleri, a pivotal move that would significantly boost the test’s credibility and adoption. The regulatory landscape for multi-cancer detection is complex, requiring Grail to navigate numerous challenges carefully to achieve its objectives. Successfully obtaining FDA approval would not only enhance Galleri’s standing but also affirm Grail’s leadership position in the cancer diagnostics market, providing a substantial competitive advantage.

In addition to regulatory challenges, the marketplace dynamics post-separation from Illumina present their own set of hurdles. Grail must not only convince physicians and other stakeholders of Galleri’s efficacy but also operate within a competitive landscape that is rapidly evolving with new technologies and players. By focusing its resources on Galleri and cutting back on other areas, such as research and development for additional diagnostic aids and evaluations of minimal residual disease, Grail aims to streamline its path to FDA approval and ensure long-term sustainability. This targeted approach is designed to consolidate Grail’s resources and optimize its strategic direction in the face of competitive pressures and regulatory demands.

Investment in Future Growth and Partnerships

Grail, a prominent player in cancer detection, is cutting its workforce significantly by laying off around 350 employees, equating to roughly 25% of its total staff. This major reduction is part of a larger restructuring initiative designed to refocus the company’s resources on its primary product, the Galleri multi-cancer early detection test, while also cutting overall expenses. This move comes in the wake of Grail’s separation from Illumina, a split mandated by regulators to foster competition in the liquid biopsy sector. The restructuring intends to ensure Grail can sustain its business operations, hit crucial regulatory benchmarks, and uphold its leading position in the multi-cancer detection market. By realigning its focus and resources, Grail aims to continue providing innovative solutions in early cancer detection, thereby improving patient outcomes. The company’s strategic shift underscores its commitment to advancing cancer diagnostics, even amidst challenging times, ensuring it remains at the forefront of the industry.