For millions of Americans navigating the annual health insurance marketplace, the stark reality of rising premiums forces a difficult calculation between financial solvency and physical well-being. This yearly ritual has become a high-stakes balancing act, where the allure of a lower monthly payment can obscure the potentially devastating gaps in coverage that lie just beneath the surface. As households grapple with escalating costs, the search for affordable options intensifies, pushing many to consider plans outside the familiar framework of the Affordable Care Act (ACA), a move that demands extreme caution and a clear understanding of the trade-offs involved.

When the Price Is Low, Is the Protection Too?

The dilemma facing a significant portion of the population is both urgent and profound: how to manage escalating health insurance premiums without sacrificing access to reliable, essential medical care. For healthy individuals, the choice may seem straightforward, but for those managing chronic illnesses or facing unexpected medical crises, the decision carries immense weight. The fear is not merely financial; it is existential. “We’re hearing from people with complex medical conditions who don’t think they can survive if they don’t have access to medical care,” stated Audrey Morse Gasteier, executive director of the Massachusetts Health Connector.

This intense pressure creates a marketplace where individuals with complex health needs feel trapped. They are acutely aware that a lapse in comprehensive coverage could mean losing access to life-sustaining treatments, specialty medications, or necessary surgical procedures. Consequently, the decision to switch to a seemingly cheaper plan is fraught with anxiety, as they weigh the immediate relief of a lower premium against the terrifying possibility of being underinsured when they need protection the most.

The Squeeze on Consumers Why Cheaper Plans Are So Tempting Now

The current ACA open enrollment period is occurring within a perfect storm of economic pressures. Consumers are not only seeing premium increases for 2026 plans but are also confronting the looming expiration of enhanced tax subsidies that have made coverage more affordable for millions in recent years. This convergence of factors has dramatically increased the financial burden on shoppers, making the prospect of any lower-cost alternative incredibly attractive.

Adding to the complexity is a significant degree of political uncertainty. While discussions in Congress about extending the enhanced subsidies continue, a resolution remains elusive. This leaves shoppers in a precarious position, forced to make critical, long-term health care decisions based on incomplete financial information. Without knowing the final status of these subsidies, many are unable to accurately predict their health care costs for the upcoming year, heightening the appeal of plans with lower upfront price tags.

The approaching enrollment deadline of January 15 for coverage beginning February 1 further intensifies this pressure. With the window to secure a plan closing, consumers feel a sense of urgency that can lead to hasty decisions. This compressed timeline discourages the thorough research required to understand the nuances of different plans, pushing some toward options that appear affordable at first glance but may harbor significant hidden risks.

The Junk Insurance Trap Unpacking Short-Term Plans

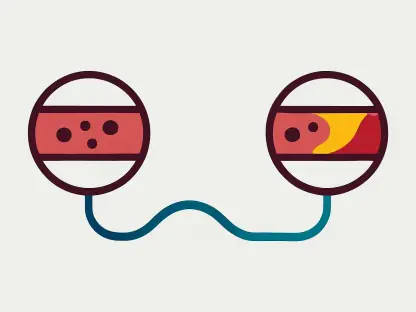

Among the most common alternatives to ACA coverage are short-term, limited-duration insurance plans. Originally designed to provide temporary coverage for individuals between jobs or recent graduates, these plans are now frequently marketed as a more affordable substitute for comprehensive health insurance. They often mimic the structure of traditional plans with familiar terms like deductibles and copayments, yet they operate under a completely different set of rules and do not have to comply with ACA standards.

The lower premiums of short-term plans come with significant trade-offs. Unlike ACA-compliant plans, they are not required to cover the ten essential health benefits, meaning services like maternity care, mental health treatment, preventive screenings, and prescription drugs are often excluded. Furthermore, these policies can impose annual or even lifetime caps on benefits, potentially leaving a policyholder with catastrophic expenses in the event of a major illness or injury.

Perhaps the greatest risk for consumers lies in the underwriting process. Applicants must typically complete a detailed medical questionnaire, and insurers can deny coverage or cancel a policy retroactively if they discover a preexisting condition that was not disclosed, even if the omission was unintentional. This practice can leave patients responsible for the full cost of their medical care. As Pennsylvania insurance broker Joshua Brooker advises, “If you’re going to enroll in short-term coverage, you need to know which boxes are unchecked.” Compounding these issues is a patchwork of state regulations; while 36 states permit their sale, others like California have banned them entirely or imposed strict limitations on their duration.

Beyond Short-Term Plans Other Coverage That Isn’t Comprehensive

The landscape of non-ACA plans extends beyond short-term policies to include other products that can be misleading. One such product is the indemnity plan, often marketed as a way to supplement traditional insurance by helping with out-of-pocket costs. However, these plans pay a fixed dollar amount for specific services—for example, a few hundred dollars per day for a hospital stay. This amount frequently falls far short of the actual cost of care, leaving the policyholder responsible for the remainder of the bill. Like short-term plans, they also typically require medical underwriting for preexisting conditions.

Another category is faith-based sharing plans, which involve members pooling their money to help cover each other’s medical expenses. It is critical to understand that these are not insurance products. They are not regulated by state insurance departments, are not required to maintain financial reserves, and offer no legal guarantee that claims will be paid. While they have expanded beyond their original faith-based communities, some have faced accusations of fraud from state regulators. Ronnell Nolan, president and CEO of Health Agents of America, offers a stark warning: “It would be my last resort.”

Staying in the Marketplace The High Deductibles of Bronze and Catastrophic Plans

For consumers committed to staying within the ACA marketplace but desperate for lower premiums, the “Bronze” and “Catastrophic” tiers present seemingly viable options. These plans offer the lowest monthly costs but do so by shifting a significant portion of the financial risk onto the consumer through extremely high deductibles. A Bronze plan, for instance, may have a low premium, but the national average deductible is nearly $7,500. This means an individual or family must pay thousands of dollars out-of-pocket before the plan’s primary coverage begins.

Eligibility for Catastrophic plans has been expanded for 2026, making them available to more people, including those losing subsidies. As their name implies, these plans are designed to protect against worst-case health scenarios, such as a severe accident or a major illness like cancer. However, this protection only kicks in after the consumer has spent an enormous amount out-of-pocket, with deductibles that can be as high as the annual limit—$10,600 for an individual or $21,200 for a family.

The financial strain of such high deductibles can be devastating, particularly for lower-income households. Oklahoma broker Lauren Jenkins noted that some clients who previously qualified for free or low-cost plans with enhanced subsidies may now face a choice between a more expensive monthly premium or a Bronze plan with a deductible they cannot afford. “For people only making $25,000 a year, that would be detrimental,” she explained, highlighting how a sudden medical need could lead to insurmountable debt.

A Proactive Guide to Making a Safer Choice

To avoid these financial traps, proactive and diligent research is essential. It pays to shop around carefully on the official ACA marketplace. Pricing can be counterintuitive; in some regions, a “Gold”-level plan with better coverage might paradoxically have a lower premium than a “Silver”-level plan. Consumers should compare all available tiers and insurers before making a final decision.

For self-employed individuals, it may be beneficial to investigate whether they qualify for a small group plan. In some states, a business owner with even one employee—sometimes including a spouse—can access the group market, where rates can occasionally be more affordable than individual policies. This is not a universal rule, and rates vary by region, but it represents another avenue worth exploring.

Given the uncertainty around federal subsidies, consumers were strongly encouraged not to wait until the last minute. By updating their application on the official marketplace website early, they could get the most accurate picture of their eligibility and potential costs for 2026. This allowed for more time to weigh options and make an informed choice rather than a rushed one. It was also critical for shoppers to ensure they were using official government websites, such as Healthcare.gov, as numerous look-alike sites exist to steer consumers toward non-compliant plans. Finally, the process was not complete until the first month’s premium was paid on time, as this final step was what officially activated the coverage.