I’m thrilled to sit down with Ivan Kairatov, a renowned biopharma expert with extensive experience in research and development, as well as a keen understanding of technological innovation in the industry. Today, we’re diving into the exciting developments surrounding Merck’s kidney cancer drug Welireg, which has recently shown promising results in two major Phase 3 trials. Our conversation will explore how Welireg works, the significance of its trial outcomes, its potential in different treatment settings, and what this could mean for Merck’s future in oncology. We’ll also touch on the challenges and opportunities that lie ahead for this drug as it aims to expand its impact in kidney cancer care.

Can you give us a broad picture of what Welireg is and why it’s such a critical focus for Merck at this moment?

Welireg is an oral medication developed by Merck that targets a protein called HIF-2 alpha, which plays a key role in tumor growth under low-oxygen conditions, a common feature in kidney cancer. It’s a novel approach because it tackles the disease at a molecular level, offering a different mechanism compared to traditional immunotherapies or targeted therapies. For Merck, Welireg is a cornerstone of their strategy to sustain growth, especially as their blockbuster drug Keytruda faces patent expiration in 2028. They see Welireg as a way to diversify their oncology portfolio and capture new revenue streams, particularly in kidney cancer where there’s still a significant unmet need.

How does Welireg specifically work to combat kidney cancer at the cellular level?

Welireg inhibits HIF-2 alpha, a transcription factor that helps cancer cells survive and grow in hypoxic, or low-oxygen, environments. In kidney cancer, especially clear cell renal cell carcinoma, this pathway is often overactive due to genetic mutations. By blocking HIF-2 alpha, Welireg essentially starves the tumor of the signals it needs to proliferate, slowing disease progression. It’s particularly exciting because it offers a targeted option for patients who may not respond well to other therapies, and it can be combined with other drugs to enhance efficacy.

Merck recently shared success stories from two Phase 3 trials for Welireg. Can you walk us through the highlights of these studies?

Absolutely. The first trial looked at Welireg combined with Keytruda in the adjuvant setting, which means after surgical removal of cancerous tissue. This combination showed a statistically significant improvement in disease-free survival compared to Keytruda alone, meaning patients stayed cancer-free for longer. The second trial tested Welireg with Lenvima as a second-line treatment for patients who relapsed after initial therapy with Keytruda. Here, the combo outperformed Cabometyx in delaying disease progression, again with statistically significant results. Both studies mark important steps in expanding Welireg’s potential applications.

Focusing on the adjuvant trial with Keytruda, why is this post-surgical setting so important for Merck’s strategy?

The adjuvant setting is a game-changer because it addresses patients at an earlier stage, right after surgery, when the goal is to prevent recurrence. For Merck, this is a huge opportunity to intervene before the disease advances, potentially reaching a larger patient population. Success here could shift treatment paradigms in kidney cancer, positioning Welireg as a go-to option early in the care journey. It also aligns with a growing focus in oncology on preventing relapse, which is a major concern for patients and clinicians alike.

What kind of financial impact could Welireg have for Merck if it secures approval in this adjuvant space?

Analysts are projecting a massive revenue boost if Welireg gets the green light for adjuvant use. Some estimates suggest it could nearly triple expected earnings in this area, potentially exceeding $6 billion. This is partly due to the drug’s high list price—around $30,000 a month, which is double that of Keytruda—and the extended 54-week treatment course. If adopted widely by physicians, Welireg could become a major pillar of Merck’s oncology revenue, especially as they prepare for Keytruda’s patent cliff.

Shifting to the second trial with Lenvima, there were hints that side effects might be influencing survival outcomes. Can you unpack what that means for Welireg’s future?

In the trial combining Welireg with Lenvima for second-line treatment, while progression-free survival improved significantly, there hasn’t yet been a clear benefit in overall survival. Some speculation points to Lenvima’s known side effect profile, which includes issues like high blood pressure and fatigue, as potentially impacting patient outcomes. This raises questions about whether the toxicity burden is offsetting some of the survival benefits. It’s something Merck will need to monitor closely with longer follow-up data, as it could influence how regulators and doctors view this combination.

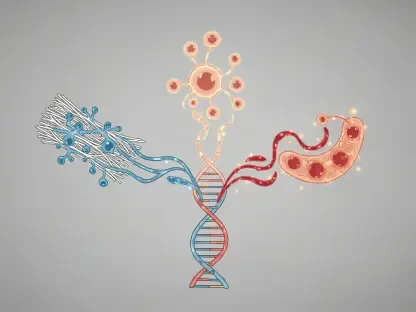

Welireg initially gained approval for a rare condition called von Hippel-Lindau disease. How does its application in kidney cancer build on that foundation?

The connection lies in the underlying biology. Von Hippel-Lindau disease involves mutations that disrupt the same HIF-2 alpha pathway that Welireg targets, leading to tumor growth, including in the kidneys. That initial approval in 2021 provided a proof of concept for the drug’s mechanism in a niche population. Expanding to broader kidney cancer applications, particularly renal cell carcinoma, leverages that same science but applies it to a much larger patient group. It’s a natural progression—starting with a rare disease to validate the approach, then scaling to more common cancers with similar molecular drivers.

Merck acquired Welireg through a strategic buyout in 2019. Can you share some insight into why they made that move and how it’s playing out now?

Merck’s decision to acquire Welireg in 2019 was a forward-thinking bet on targeted therapies in oncology. They saw the potential of HIF-2 alpha inhibition as a novel mechanism, especially in kidney cancer where treatment options were still evolving. At the time, they were looking to bolster their pipeline beyond Keytruda, anticipating future revenue gaps. Now, with Welireg showing success in these Phase 3 trials and already generating $300 million in sales in the first half of 2025, it’s clear the investment is paying off. It’s becoming a key asset in their portfolio, validating their strategy of acquiring innovative therapies.

Looking ahead, what is your forecast for Welireg’s role in the evolving landscape of kidney cancer treatment?

I’m optimistic about Welireg’s trajectory. If Merck can navigate the regulatory hurdles and address any concerns around combination side effects, I see it becoming a cornerstone in kidney cancer care, especially in adjuvant and second-line settings. The drug’s unique mechanism positions it well against competitors, and the potential revenue numbers speak to a significant market impact. Beyond that, I think we’ll see Merck explore Welireg in other cancers with similar molecular profiles, potentially broadening its reach. The next few years will be crucial as longer-term data and real-world evidence shape how it’s adopted, but the foundation is very promising.