In a world where the race to develop life-changing therapies is accelerating at an unprecedented pace, biotech innovators are turning to artificial intelligence to redefine the boundaries of drug discovery, and Absci Corporation, a Seattle-based company listed on NASDAQ under the ticker ABSI, stands at the forefront of this transformation. Founded with a vision to merge cutting-edge technology with biological innovation, Absci has carved a niche by integrating deep learning with high-throughput lab automation. Through its proprietary Integrated Drug Creation (IDC) platform, the company is streamlining the design and optimization of biologics like antibodies and enzymes. This approach not only accelerates the development process but also enhances precision, offering hope for faster delivery of novel treatments. Absci’s work is gaining traction, positioning it as a key player in the biotech landscape, with a growing pipeline of internal projects and collaborations with pharmaceutical giants that underscore its potential to reshape therapeutic development.

Pioneering Partnerships and Pipeline Progress

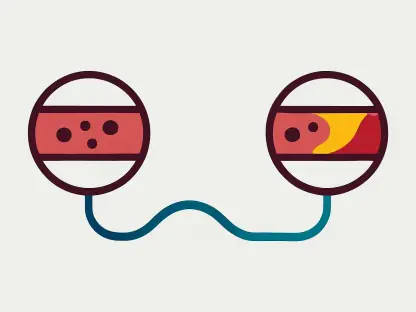

Absci’s strategic alliances and focused pipeline are central to its growing influence in the biotech sector. A notable expansion of its partnership with Almirall, a leader in dermatology pharmaceuticals, marks a significant milestone, as the collaboration now includes a second program targeting chronic skin conditions. This builds on the successful delivery of an AI-designed functional antibody, validating the capabilities of Absci’s technology. Beyond partnerships, the company is advancing its own dermatology initiatives, particularly with ABS-201, an AI-designed therapy aimed at addressing hair loss disorders such as androgenetic alopecia, with clinical evaluation slated for early 2026. To strengthen this effort, Absci has brought on board esteemed advisors, Dr. Rodney Sinclair and Dr. David Goldberg, whose expertise in dermatology adds depth to the program. These developments, combined with a robust internal pipeline including ABS-101, reflect a deliberate focus on high-impact therapeutic areas, positioning Absci to meet unmet medical needs with innovative solutions driven by artificial intelligence.

Technological Edge and Financial Fortitude

Underpinning Absci’s success is a commitment to leveraging advanced technology and securing the financial resources needed for sustained growth. Collaborations with industry giants like Oracle Cloud Infrastructure and AMD have bolstered its AI capabilities, with AMD’s strategic investment providing access to state-of-the-art chip technology and cloud resources for scaling model training and data processing. This technological backbone enables Absci to push the boundaries of drug discovery, ensuring that its IDC platform remains at the cutting edge. Financially, the company strengthened its position with a $64 million equity financing round completed in mid-2025, extending its operational runway through mid-2028. This capital infusion supports the advancement of key programs, enhances partnered projects, and fortifies AI infrastructure. While Absci’s trajectory appears promising, the broader AI investment landscape offers diverse opportunities, suggesting that a balanced approach to biotech investments might include exploring other undervalued AI-driven stocks with varying risk profiles.