The fourth quarter of 2024 witnessed a significant surge in hedge fund investments focused on the healthcare sector, particularly emphasizing advancements in artificial intelligence (AI), biotechnology, and medical technology (MedTech). This pivotal period showcased growing confidence among prominent institutional investors regarding the transformative potential embedded within next-generation healthcare innovations. The substantial investments made not only highlight the perceived value of these sectors but also underscore the promising outlook for AI-driven healthcare advancements.

Key Players and Strategic Investments

A prominent player in this investment wave is Armistice Capital, a hedge fund that has strategically fortified its portfolio with extensive investments in biotech and MedTech companies. In Q4 2024, Armistice notably increased its holdings in Neurocrine Biosciences, adding 710,619 shares, bringing its total to 892,000 shares, valued at approximately $121.76 million by the end of the year. This strategic move underscores Armistice’s focus on firms with promising drug pipelines, reflecting their staunch commitment to the biotech sector.

Additionally, Armistice Capital maintained significant positions in other biotech companies, including PTC Therapeutics and Supernus Pharmaceuticals. The fund backed PTC Therapeutics with 6,378,000 shares valued at $287.9 million, supporting the company’s endeavors in developing treatments for rare disorders. Similarly, their investment in Supernus Pharmaceuticals, comprising 4,836,000 shares worth $174.9 million, highlights their interest in companies dedicated to advancing neurological disease therapies. These strategic investments underline Armistice’s dedication to fostering innovation within the broader biotech landscape.

Expansion into MedTech

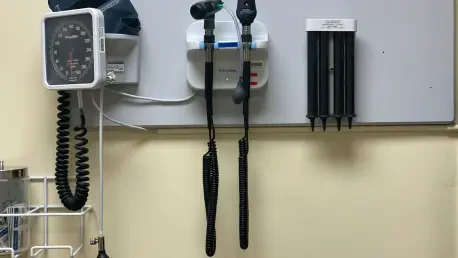

Beyond biotech, Armistice Capital has demonstrated a keen interest in MedTech, particularly in diagnostic technologies. In Q4 2024, the hedge fund initiated a new position in Exact Sciences, acquiring 1,617,000 shares worth $90.9 million. Exact Sciences is renowned for its AI-powered cancer diagnostics, including the widely recognized non-invasive colorectal cancer test, Cologuard. This investment highlights Armistice’s strategic focus on companies that leverage AI to drive advancements in medical diagnostics, thereby contributing to more accurate and efficient healthcare solutions.

Further emphasizing their commitment to MedTech, Armistice’s investment strategy reflects a broader trend among hedge funds and institutional investors. The focus on AI-powered diagnostic technologies indicates a recognition of the crucial role such advancements play in the future of healthcare. By investing in companies at the forefront of MedTech innovation, Armistice and its peers aim to capitalize on the growing demand for advanced diagnostic solutions that promise to improve patient outcomes and reduce healthcare costs.

Broader Institutional Interest

The interest in healthcare investments during this period was not limited to hedge funds like Armistice Capital. Major asset managers, including BlackRock Inc. and Capital World Investors, also increased their investments in healthcare. BlackRock, known for its substantial holdings in technology giants such as Microsoft and Nvidia, accentuated the pivotal role these companies play in advancing AI-driven medical solutions. Their strategic focus on digital health platforms and diagnostic technologies illustrates a concerted effort to capitalize on the intersection of technology and healthcare.

Similarly, Capital World Investors reinforced its positions in companies like Broadcom, Microsoft, Nvidia, and Tesla, aligning with the expansion into AI-driven drug discovery, medical imaging, and advanced health-focused semiconductor technologies. These investments underscore a broad institutional interest in the healthcare sector, driven by the recognition of the transformative potential associated with AI and other advanced technologies. The collective move by these investment giants signifies a strategic alignment with the anticipated growth and innovation within the healthcare industry.

Focused Investment Strategies

Hedge funds specialized in technology investments, such as S Squared Technology LLC, also committed significant resources to MedTech stocks during this period. With a $269.2 million portfolio, S Squared highlighted Marvell Technology as its largest holding, possessing 170,357 shares. This investment indicates strong confidence in AI-powered medical imaging, wearable health technologies, and diagnostics. The focus on MedTech underscores the belief in the sector’s potential to revolutionize healthcare through advanced technological solutions.

According to J.P. Morgan’s Q4 2024 insights, venture funding in MedTech reached $3.0 billion, contributing to a total of $19.1 billion for the year. This represented a 12% increase in venture capital, even with a 5% decrease in the number of rounds, highlighting larger deal sizes and heightened investor confidence. This trend showcases a robust investor interest in MedTech, driven by the potential for substantial advancements and efficiencies within the healthcare system. The alignment of hedge funds and major asset managers with these trends further solidifies the strategic importance placed on AI and MedTech innovations.

Projected Market Growth and Influences

In the fourth quarter of 2024, there was a remarkable surge in hedge fund investments within the healthcare sector. The focus was particularly on advancements in artificial intelligence (AI), biotechnology, and medical technology (MedTech). This period marked a significant turning point, demonstrating growing confidence among prominent institutional investors about the transformative potential of these next-generation healthcare innovations. The substantial capital inflows from hedge funds underscore the perceived value and promising outlook for sectors driven by AI. This confidence indicates that investors see immense potential for AI, biotech, and MedTech to revolutionize healthcare as we know it. The heightened interest and substantial funding reflect the anticipation of groundbreaking developments in diagnostics, treatments, and healthcare delivery systems. This trend suggests that we are on the brink of significant breakthroughs that could change patient outcomes and healthcare practices globally. Investors are not just betting on financial returns but are also expressing faith in the advancements that could enhance the quality of life and extend life expectancies.