The biotech and healthcare sectors in the United Kingdom experienced a remarkable year in 2024, marked by substantial financial investments, significant trends, and notable challenges. Grounded in a report by the UK BioIndustry Association (BIA), this analysis delves into the pivotal investment patterns and their implications for research and development (R&D) within the industry. The U.K. biotech sector welcomed an unprecedented influx of funds, signaling strong investor confidence and highlighting the dynamic developments within the sector.

Financial Surge in Equity Financing

Impressive Equity Financing Achievement

In 2024, the U.K. biotech sector raised approximately £3.5 billion ($4.36 billion) in equity financing, marking a substantial 94% increase from the preceding year, 2023. This financial surge signifies a renewed sense of confidence and the inherent resilience within the U.K. biotech industry. Steve Bates, the CEO of BIA, emphasized the significance of this achievement, noting that biotech represents a vibrant growth sector within the U.K. economy. The substantial increase in equity financing underscores the sector’s potential to attract significant global investment, as it continues to advance early-stage research and scale groundbreaking therapies that address some of the world’s most pressing health challenges.

This impressive figure represents more than just a numerical achievement; it exemplifies the industry’s potential to drive meaningful changes in healthcare. The substantial funds are being funneled into a range of initiatives, from supporting fledgling startups to backing major therapeutic advancements. Within this context, equity financing is seen as a critical enabler, providing the necessary capital to bridge the gap between innovative ideas and their practical application in medicine. As Bates pointed out, the steady rise in investments reaffirms the sector’s magnetism for investors, further solidifying its role as a cornerstone of the U.K. economy.

Rise in Venture Capital Investment

A central theme of the analysis is the significant rise in venture capital investment, with a notable 64.8% increase since 2023. The sector secured £2.06 billion ($2.56 billion), attracting considerable interest from North American investors, particularly in later-stage deals. Despite this influx, U.K.-based investors continued to dominate the industry, representing 51% of the total investments. The surge in venture capital is indicative of a broader trend where seasoned investors recognize the potential returns from mature biotech companies. Notably, later-stage deals, especially series B rounds, garnered substantial funding, as these firms demonstrate a clearer path to commercialization and profitability.

However, seed investments did not attract the same enthusiasm due to the inherent risks associated with early-stage projects. Such projects often face uncertain clinical trial outcomes and a protracted timeline required to bring drug candidates to fruition. The discrepancy between later-stage and seed investment highlights a cautious approach among investors, who prefer the relatively lower risk associated with more advanced companies. Nonetheless, the overall increase in venture capital signifies a positive outlook for the industry’s long-term growth prospects, supported by a robust pipeline of promising biotech innovations.

Leading Venture Deals

Top Venture Deals

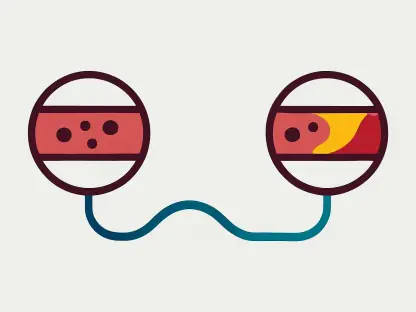

The analysis identifies leading venture deals, highlighting the top deal involving cancer therapeutics company Ottimo Pharma securing £110.5 million ($137.37 million) in a series A round. This deal underscores the high value placed on innovative cancer therapies and the willingness of investors to back promising solutions in oncology. Additionally, antibody-drug conjugate developers Pheon Therapeutics and Myrix Bio raised £95.7 million ($118.95 million) in a series B round and £89.8 million ($111.60 million) in a series A round, respectively. These substantial investments reflect the confidence investors have in these companies’ potential to revolutionize cancer treatment with cutting-edge technologies.

Moreover, Relation Therapeutics, a machine learning-driven biotech, secured the largest seed round worth £28 million ($34.78 million), with significant investment from Abcam’s CEO and co-founder, Jonathan Milner. The success of Relation Therapeutics highlights the growing interest in the intersection of artificial intelligence and biotechnology. Machine learning’s ability to accelerate drug discovery processes and enhance predictive accuracy makes it a valuable asset in modern biotech research. These notable venture deals illustrate the diverse range of innovations attracting significant financial backing, from oncology advancements to AI-driven research.

Influx of International Investors

An overarching trend is the influx of international life science investors to the U.K., particularly from North America, which led 38% of series B rounds. This international interest highlights the global appeal of U.K. biotech ventures and their perceived potential for high returns. In contrast, seed funding predominantly came from U.K.-based funders, reflecting a more localized support system for nascent projects. The disparity in investor attitudes between the U.S. and the U.K. is highlighted, with U.S. investors demonstrating more optimism and a higher risk tolerance, resulting in quicker investment decisions.

The U.S. also boasts more venture capital hubs and a larger pool of biotech investors, contributing to a more established venture capital market with substantial dedicated funds for life sciences. This well-developed ecosystem enables quicker capital deployment, fostering rapid growth and innovation. Within Europe, the U.K. stood out, securing 37% of total capital investment in European life science companies, followed by Switzerland with 19%. The influx of international investors and the U.K.’s prominence in the European biotech landscape underscore the sector’s robust appeal and strategic importance on the global stage.

Challenges in the IPO Market

Stagnant IPO Market

Despite these positive trends, the initial public offering (IPO) market remained stagnant for the second consecutive year, with no U.K. biotech companies going public in 2024. This stagnation reflects a challenging macroeconomic environment characterized by high interest rates and geopolitical uncertainties, which have dampened investor confidence in public markets. The reluctance to engage in IPOs signifies a cautious approach by companies and investors alike, preferring to seek alternative financing routes that mitigate exposure to volatile market conditions.

The stagnation also highlights the broader economic challenges impacting investor sentiment, such as inflation and political instability. These factors create an environment where the risks associated with going public may outweigh the potential benefits. Companies might also perceive current market conditions as suboptimal for achieving desired valuations, leading them to postpone IPO plans until a more favorable climate emerges. This cautious stance, while prudent, also underscores the need for strategic innovation in financing models to navigate the complexities of the current economic landscape.

Follow-On Financing Activity

However, the follow-on financing arena saw significant activity, with precision medicine developer Bicycle Therapeutics securing $555 million through a private placement equity investment. This considerable capital injection highlights the sector’s ability to attract large-scale investments even in the absence of IPO activity. U.K. biotechs raised £1.47 billion ($1.83 billion) in follow-on deals, marking the highest level in four years. This trend underscores continued confidence in the U.K.’s life science sector, despite a 30% decline in grants, possibly due to the U.K. general election in July and the conclusion of the government’s spending review period.

The robust follow-on financing activity indicates a strong commitment to fueling the growth and development of promising biotech firms. It also reflects investors’ willingness to support established companies through additional funding rounds, ensuring they have the necessary resources to advance their projects. The decline in grants, attributed to political and economic factors, further amplifies the importance of private investment in sustaining the momentum of the biotech sector. This dynamic interplay between private and public funding sources is crucial in maintaining a steady pipeline of innovation and development.

Mergers and Acquisitions

Significant M&A Deals

On the mergers and acquisitions (M&A) front, the total deal value reached approximately £3.2 billion ($3.97 billion), excluding undisclosed transactions. This figure reflects a robust M&A environment, driven by strategic consolidations and acquisitions aimed at enhancing technological capabilities and expanding market reach. Significant deals included Merck’s £2.4 billion ($2.98 billion) acquisition of British biotech EyeBio, a move poised to strengthen Merck’s ophthalmology portfolio. Additionally, Recursion’s acquisition of U.K.-based AI drug discovery company Exscientia for £535 million ($664.37 million) exemplifies the increasing integration of AI technologies within the biotech industry.

These high-value transactions underscore the strategic importance of M&A activities in fostering innovation and competitive advantage. By acquiring specialized companies, larger firms enhance their technological prowess and accelerate the development of advanced therapeutic solutions. Furthermore, GSK, headquartered in London, engaged in notable licensing deals to enhance drug development in antibody-drug conjugates (ADCs) and neuromedicines. These licensing agreements reflect a concerted effort to capitalize on emerging therapeutic areas and bolster research capabilities.

Resilience of the U.K. Life Sciences Sector

In 2024, the biotech and healthcare sectors within the United Kingdom experienced an exceptional year characterized by significant financial commitments, emerging trends, and considerable challenges. According to a report from the UK BioIndustry Association (BIA), this overview investigates the essential investment patterns and their effects on research and development (R&D) in the industry. The U.K. biotech sector saw an unprecedented surge in funding, demonstrating strong investor trust and underscoring the sector’s dynamic advancements.

This influx of capital has not only reinforced the existing infrastructure but has also spurred innovative research and technological advancements. With enhanced financial backing, the industry has been able to pursue groundbreaking projects and explore new frontiers in medical science. However, alongside these opportunities, the sector has faced challenges such as regulatory hurdles and the need for skilled professionals. Overall, the year has been a pivotal one for the biotech and healthcare sectors in the U.K., highlighting their potential for growth and the critical role they play in advancing medical research and care.