The medical and life sciences manufacturing sector is experiencing rapid transformations, bringing forth a plethora of challenges and opportunities for industry professionals. Ascential’s “2025 State of Medical & Life Sciences Manufacturing” report delves into key areas such as regulatory constraints, reshoring obstacles, and technological integration, providing comprehensive insights.

Regulatory Constraints

Compliance and Approval Processes

The report underscores that regulatory constraints remain the most significant hurdle in bringing new medical products to market expeditiously. Over 42% of industry professionals cited these constraints, which encompass rigorous compliance standards, extensive approval processes, and ever-evolving guidelines that continuously reshape product development timelines. Navigating this intricate regulatory landscape necessitates a deep understanding of international standards and local requirements, which often vary significantly. Companies face prolonged waits for approvals, resulting in delayed market entry and increased costs. Additionally, the complexity of standards across different regions can lead to inconsistencies in product quality and safety, further complicating the process.

Regulatory bodies such as the FDA and the European Medicines Agency constantly update their guidelines to reflect new scientific discoveries and technological advancements. To keep pace with these changes, manufacturers must invest in regulatory expertise and maintain open lines of communication with these authorities. Adapting to new requirements involves thorough documentation, regular audits, and continuous monitoring, all of which demand significant resources. Companies that successfully navigate these hurdles can achieve faster product launches and maintain compliance across diverse markets, ultimately enhancing their competitiveness in the global arena.

Strategies for Regulatory Navigation

Industry professionals are encouraged to engage proactively with regulatory bodies to better understand and anticipate evolving standards. This proactive approach involves not only staying updated with the latest regulatory changes but also participating in industry forums and regulatory workshops where these guidelines are discussed and dissected. Building strong relationships with regulatory authorities can facilitate smoother approval processes and allow for more predictable timelines. Companies should invest in developing robust compliance strategies, which include comprehensive documentation processes, regular internal audits, and continuous quality improvement programs.

Consulting with experienced regulatory experts can provide invaluable insights and guidance, helping organizations navigate complex regulatory frameworks more efficiently. These experts can assist in interpreting ambiguous regulations, preparing detailed submissions, and managing interactions with regulatory agencies. Leveraging advanced regulatory technology platforms can also streamline compliance efforts by automating documentation, tracking regulatory changes, and facilitating real-time communication with regulatory bodies. By implementing these strategies, companies can mitigate regulatory risks, reduce time to market, and ensure that their products meet the highest standards of safety and efficacy.

Reshoring Barriers

Costs and Labor Shortages

Reshoring manufacturing operations to the United States faces significant barriers, primarily due to high labor costs and operational expenses. The report reveals that 56.8% of respondents identified these factors as the main deterrents. The financial burden of establishing and maintaining manufacturing facilities domestically can be substantial, making it difficult for companies to justify the move. In addition to direct costs, reshoring also requires significant investment in infrastructure, technology, and workforce training. Furthermore, the shortage of skilled labor poses a considerable hurdle, with nearly 19% of respondents citing this issue. Recruiting and retaining qualified personnel are crucial for successful manufacturing operations, yet the competitive job market in the U.S. exacerbates this challenge.

To address these concerns, companies must consider strategies to optimize labor productivity and reduce operational costs. Automation and advanced manufacturing technologies can play a vital role in achieving these objectives. By investing in automation, companies can enhance efficiency, reduce reliance on manual labor, and improve overall production capabilities. Additionally, collaborative partnerships with educational institutions and vocational training programs can help bridge the skills gap by developing a trained workforce equipped to handle the demands of modern manufacturing. Adopting such measures can make reshoring a more viable and cost-effective option.

Evaluating Cost-Efficiency and Risk

Balancing cost efficiency with risk mitigation is crucial for companies considering reshoring operations. The decision to reshore must be evaluated from multiple perspectives, including geopolitical stability, environmental risks, and supply chain resilience. Geopolitical factors such as trade policies, tariffs, and international relations can significantly impact the feasibility and profitability of reshoring. Companies must assess the potential risks associated with political instability, regulatory changes, and trade disputes that could disrupt operations and supply chains. Similarly, environmental considerations, such as sustainability and compliance with environmental regulations, play a vital role in reshoring decisions.

Near-shoring, an alternative strategy, involves relocating operations closer to key customer bases, reducing dependency on distant supply chains while maintaining cost efficiency. This approach can offer several advantages, including enhanced supply chain agility, reduced transportation costs, and improved market responsiveness. By positioning operations closer to end markets, companies can better manage risks associated with geopolitical uncertainties and environmental challenges. Moreover, near-shoring allows for greater collaboration with local suppliers and partners, fostering innovation and efficiency. Evaluating cost-efficiency and risk comprehensively enables companies to make informed decisions that align with their long-term business objectives.

Supply Chain Adaptation

Post-COVID Realities

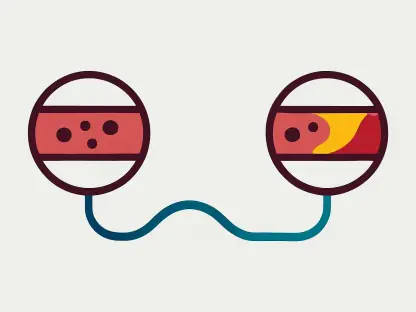

The COVID-19 pandemic has fundamentally altered supply chain dynamics, necessitating a strategic reevaluation of procurement, production, and distribution processes. Companies must now prioritize supply chain reliability, maintain production capacity, and uphold quality standards amid ongoing disruptions. The pandemic exposed vulnerabilities in global supply chains, highlighting the need for greater resilience and flexibility. Manufacturers must adopt adaptive strategies to mitigate risks and ensure continuous operations. This involves diversifying suppliers, increasing inventory reserves, and implementing real-time tracking and predictive analytics to foresee and address potential issues.

The shift towards more localized supply chains, or near-shoring, has gained traction as companies seek to mitigate risks associated with distant and complex supply networks. Near-shoring strategies position manufacturing operations closer to key customer bases, reducing lead times and transportation costs while enhancing overall supply chain responsiveness. Companies can better navigate post-COVID realities by developing robust supply chain networks that balance cost and risk, ensuring a steady flow of materials and products even in the face of unforeseen disruptions. Leveraging advanced technologies and data-driven insights will be key to achieving this resilience.

Near-Shoring Strategies

Near-shoring has emerged as a balanced approach to managing cost and risk in supply chain adaptation. By relocating operations closer to end markets, companies can create more resilient and adaptive supply chains. This strategy helps mitigate the impact of global disruptions, such as geopolitical tensions, natural disasters, and public health crises, by reducing dependency on distant suppliers. Near-shoring also allows for greater control over production processes, ensuring consistent quality standards and faster response times to market demands. Additionally, it fosters stronger relationships with local suppliers and partners, promoting collaboration and innovation.

Implementing near-shoring strategies requires careful planning and investment in infrastructure, technology, and workforce development. Companies must evaluate potential near-shore locations based on factors such as proximity to key customer bases, availability of skilled labor, and supportive regulatory environments. Building strong logistics networks and optimizing transportation routes are essential to maximizing the benefits of near-shoring. Furthermore, leveraging digital tools and predictive analytics can enhance supply chain visibility and efficiency, enabling companies to make data-driven decisions and respond swiftly to changing conditions. By adopting near-shoring strategies, companies can achieve a more agile and resilient supply chain, better equipped to navigate the complexities of the modern business landscape.

Technological Integration

Automation and Workforce Training

Technological integration, particularly automation, offers significant potential for enhancing efficiency and productivity in the medtech sector. However, the adoption of automation remains uneven, with over 50% of respondents reporting only partial or limited automation within their facilities, and 31.4% not using automation at all. The main barriers to implementing automation include high initial costs, lack of interoperability with existing legacy systems, and the need for workforce upskilling. Despite these challenges, automation can streamline operations, reduce human error, and improve overall production capabilities.

Investing in phased automation strategies can help companies gradually integrate new technologies while managing costs and minimizing disruptions. These strategies involve starting with smaller, manageable projects that demonstrate the value of automation and build confidence within the organization. Workforce training is equally important, as employees must be equipped with the necessary skills to operate and maintain automated systems. Upskilling initiatives, such as training programs and workshops, can enhance employee competencies and foster a culture of continuous improvement. By addressing these barriers and adopting phased automation approaches, companies can unlock the full potential of technological integration.

Embracing Emerging Technologies

The adoption of emerging technologies such as artificial intelligence (AI) and machine learning (ML) holds transformative potential for the medtech sector. These technologies can revolutionize various aspects of manufacturing, from predictive maintenance and quality control to supply chain optimization and product development. However, their integration faces challenges similar to those of automation, including high costs, compatibility with existing systems, and workforce readiness. Companies are encouraged to start with pilot projects to showcase the value of AI and ML and overcome initial barriers to broader industry acceptance.

Pilot projects can demonstrate the tangible benefits of AI and ML, such as improved efficiency, reduced downtime, and enhanced decision-making based on data-driven insights. By showcasing successful pilot projects, companies can build momentum for wider adoption and secure buy-in from stakeholders. Collaboration with technology providers and research institutions can also facilitate the integration of these advanced technologies. Investing in workforce training and development programs is crucial to ensure employees are equipped to harness the power of AI and ML. Embracing these emerging technologies can position companies at the forefront of innovation, driving growth and competitiveness in the medtech sector.

Conclusion

The medical and life sciences manufacturing sector is undergoing significant and rapid changes, presenting both challenges and opportunities for professionals in the industry. According to Ascential’s “2025 State of Medical & Life Sciences Manufacturing” report, there are several key areas of focus. The report highlights regulatory constraints as one of the major hurdles that companies must navigate. Reshoring, or bringing manufacturing back to domestic locations, also presents its own set of obstacles. Additionally, the integration of new technologies is transforming the sector, offering innovative solutions but also requiring adaptation and investment. The report provides comprehensive insights into these areas, making it a valuable resource for industry professionals looking to stay informed and competitive in a rapidly evolving landscape. By understanding these key factors, industry players can better navigate the complexities and seize the opportunities that come with modern advancements in medical and life sciences manufacturing.