The pharmaceutical industry finds itself at a pivotal juncture, marked by a significant transformation in drug approvals. According to insights from the CPHI Annual Industry Survey, approvals for complex molecules are poised to surpass those for small molecules for the first time. This shift underscores a growing focus on intricate molecular structures like biologics and Tides (peptides and oligonucleotides), heralding a new era in pharmaceutical development and manufacturing.

A New Frontier in Drug Approvals

The Rise of Complex Molecules

2023 witnessed the approval of 55 new drugs, notably including nine Tides (comprising five peptides and four oligonucleotides) and 17 biologics. This emphasis on complex molecular structures contrasts starkly with the traditional dominance of small molecules. The reasons behind this shift are multifaceted, ranging from the enhanced therapeutic efficacy and specificity of complex molecules to the evolving landscape of disease treatment.

Pharmaceutical companies are increasingly investing in the development of biologics and Tides, recognizing their potential to address unmet medical needs. These advanced therapies offer promising avenues for treating complex and previously intractable conditions, driving forward the industry’s innovation frontier.

Steady Inflow of New CDMOs

Despite the growing focus on complex molecules, the market for small molecules remains robust, evidenced by a steady influx of new Contract Development and Manufacturing Organizations (CDMOs). This multifaceted expansion suggests that the industry is not experiencing a simple trend replacement but rather a comprehensive advancement across various therapeutic modalities.

CDMOs specializing in small molecules continue to thrive, catering to the ongoing demands for traditional drug development. This dynamic landscape highlights the industry’s capacity to accommodate both old and new paradigms simultaneously, ensuring a holistic approach to pharmaceutical innovation.

Investment Trends and Manufacturing Innovations

Prioritizing Investments in Biologics and Tides

The CPHI survey, capturing responses from nearly 300 companies, highlights a clear investment preference for biologics (53%) and Tides (43%) over small molecules (35%). This investment shift reflects the perceived lucrative returns and strategic importance of complex molecules in the future pharmaceutical landscape.

Large pharmaceutical and biotech companies are channeling significant resources towards developing and refining these advanced therapies. The substantial capital influx into biologics and Tides is expected to spur further innovations and technological breakthroughs, propelling the industry towards new heights of therapeutic excellence.

Revolutionizing Biologic Manufacturing

Efforts to reduce the cost of manufacturing biologics, particularly monoclonal antibodies (mAbs), are gaining momentum. Continuous bioprocessing has emerged as the leading technology to achieve this goal, favored by 62% of survey respondents. This method surpasses other techniques like perfusion (7%) and new cell lines (27%) in cost-reduction potential.

Continuous bioprocessing promises to enhance efficiency, streamline production workflows, and lower overall manufacturing costs. As the demand for biologics soars, the adoption of innovative manufacturing approaches becomes imperative to sustain production capabilities and meet market needs effectively.

CPHI Milan: The Global Pharma Convergence

Spotlight on Bioproduction

CPHI Milan, the world’s largest pharma event held annually in October, serves as a hub for industry stakeholders to converge and explore the latest advancements. The 2023 event anticipates over 62,000 attendees, including 2,500+ exhibitors and 600+ CDMOs, underscoring its significance in the global pharmaceutical landscape.

A dedicated Bioproduction zone will feature prominently at the event, hosting over 150 speakers and 100+ content sessions. Key highlights include the Next-Gen Bio Theatre discussing mRNA vaccines, roundtables on global bio-manufacturing trends, and keynotes on the EU’s biotech strategy. These sessions aim to foster knowledge exchange and collaborative efforts, driving the industry forward.

Networking and Collaboration Opportunities

As pharmaceutical development becomes increasingly sophisticated, early sourcing of outsourcing partners gains critical importance. CPHI Milan provides a platform for biotech companies and small collaborations to secure essential contractual services crucial for advancing projects towards commercialization.

The event facilitates networking opportunities, enabling stakeholders to forge strategic partnerships and alliances. By bringing together diverse segments of the pharmaceutical supply chain, CPHI Milan ensures a robust and responsive industry capable of adapting to emerging trends and technological advancements.

Embracing the Paradigm Shift

The pharmaceutical industry is undergoing a critical transition, experiencing a dramatic shift in drug approval trends that suggest a significant transformation in the focus of drug development. Insights from the CPHI Annual Industry Survey indicate that for the first time, approvals for complex molecules are set to outnumber those for small molecules. This development heralds a new chapter in the pharmaceutical field, emphasizing the growing importance of intricate molecular structures such as biologics, peptides, and oligonucleotides, collectively known as Tides.

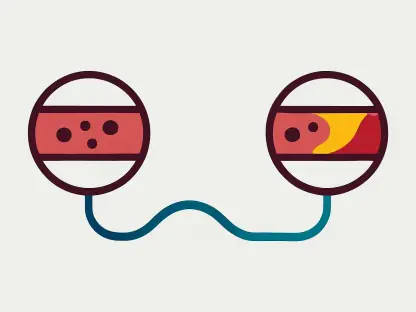

Biologics and Tides are complex compared to traditional small molecule drugs. Biologics, for instance, encompass a range of products derived from living systems, including monoclonal antibodies and vaccines. Tides, comprising peptides and oligonucleotides, offer unique therapeutic benefits due to their ability to target specific biological processes at a molecular level.

The shift toward these complex molecules represents a broader evolution in pharmaceutical innovation and manufacturing. This transformation could lead to more effective treatments for a range of diseases, opening new frontiers for medical science and advancing the industry’s capabilities in developing sophisticated therapeutic options.