The intricate global network that delivers life-saving medicines has proven remarkably fragile in recent years, prompting a fundamental rethinking of how and where these complex therapies are produced. In this context, Samsung Biologics’ recent acquisition of a major US-based manufacturing facility from GSK is not just a headline-grabbing transaction; it is a strategic maneuver that could reshape the competitive landscape of the biopharmaceutical industry. This move signals a significant pivot toward localized production and supply chain resilience. This article serves as an FAQ to dissect this development, exploring the key questions surrounding the deal and what its implications are for the future of biopharma manufacturing. Readers can expect to gain a deeper understanding of the strategic rationale, the operational advantages, and the broader industry trends that this acquisition represents.

Key Questions or Key Topics Section

What Are the Details of the Samsung Biologics Acquisition

This landmark agreement, announced on December 22, 2025, involves Samsung Biologics acquiring Human Genome Sciences, a manufacturing entity, from GSK for $280 million. The centerpiece of this deal is a substantial production facility in Rockville, Maryland, which provides Samsung with its first physical manufacturing footprint in the United States. This is a significant expansion beyond its massive operations in South Korea.

The Rockville site is a turnkey asset, featuring two current good manufacturing practice (cGMP) plants with a combined drug substance capacity of 60,000 liters. This capacity is versatile, capable of supporting both clinical-stage development and full-scale commercial production of biologic drugs. As part of the transaction, which is expected to close by the end of the first quarter of 2026, Samsung Biologics has committed to retaining the facility’s existing workforce of over 500 skilled employees, ensuring operational continuity and integrating their expertise into its global network.

Why Is a US Presence a Strategic Imperative

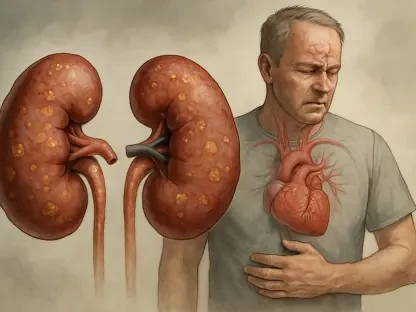

Establishing a manufacturing base within the United States has become a crucial objective for global contract development and manufacturing organizations (CDMOs). The move directly addresses the growing demand from customers and regulatory bodies for more secure and responsive domestic supply chains. Recent global events have exposed the vulnerabilities of long, complex supply lines, making localized production a powerful tool for risk mitigation.

By onshoring capacity, Samsung Biologics can effectively shield its operations and clients from geopolitical uncertainties, unpredictable trade barriers, and fluctuating tariff policies that can disrupt the flow of essential medicines. Furthermore, a domestic presence enables the company to respond more rapidly to public health emergencies, a key consideration for government partners and pharmaceutical clients alike. This strategic placement is less about convenience and more about building a resilient, dependable manufacturing ecosystem in the world’s largest biopharmaceutical market.

What Operational Gains Does Samsung Achieve with This Move

The immediate operational advantage of the Rockville facility is a significant reduction in lead times for clinical and commercial drug supplies destined for the American market. Proximity eliminates transatlantic shipping and logistical hurdles, enhancing service delivery and strengthening partnerships with US-based clients. This improved responsiveness is a core component of the company’s risk mitigation strategy, ensuring a more stable and predictable supply of therapeutics.

Moreover, Samsung Biologics views this acquisition not just as an addition of existing capacity but as a foundation for future growth. The company has publicly stated its intention to make further capital investments to expand the site’s capabilities and integrate advanced technologies. This aligns with the industry’s shift toward flexible, multi-modal manufacturing platforms that can produce a diverse range of biologic products. The facility is poised to support next-generation therapies, including antibody-drug conjugates (ADCs), cell and gene therapies, and organoid-based platforms, solidifying Samsung’s position as a forward-looking CDMO.

How Does This Acquisition Reflect Broader Industry Shifts

This transaction is a clear manifestation of several overarching trends reshaping the biopharmaceutical industry. First, it underscores the consensus that geographic diversification of manufacturing is no longer a strategic choice but a fundamental necessity for global players. This move complements Samsung’s ongoing expansion in South Korea, including the commissioning of its fifth plant, creating a dual-hemisphere manufacturing network designed for maximum resilience and market access.

Second, the deal highlights a sharpening of corporate focus within the CDMO sector. It follows Samsung Biologics’ organizational spin-off in November 2025, which repositioned it as a “pure-play” CDMO dedicated entirely to contract manufacturing services. This acquisition is a direct execution of that focused strategy, capitalizing on the heightened demand for reliable and technologically advanced biologic production. It solidifies the company’s standing as a leading global CDMO and presents a direct challenge to competitors by establishing a formidable operational hub in their home market.

What Is GSKs Rationale for the Divestment

For GSK, the sale of the Rockville facility represents a strategic realignment rather than a retreat from the US market. Regis Simard, President of Global Supply Chain at GSK, clarified that the divestment allows the company to concentrate its resources more effectively. The focus now shifts to building greater agility and capacity within its proprietary manufacturing network to support its own pipeline of next-generation specialty medicines and vaccines.

This move should be viewed in the context of GSK’s broader investment strategy. The company has separately committed a massive $30 billion to its US-based research and development and manufacturing operations over the next five years. Therefore, selling the Rockville site appears to be a calculated decision to optimize its asset portfolio, channeling capital toward internal innovation while entrusting a portion of its manufacturing to a specialized partner. It is a strategic maneuver designed to enhance its core competencies in drug discovery and development.

Summary or Recap

The acquisition of the Rockville facility by Samsung Biologics is a pivotal event in the biopharmaceutical contract manufacturing sector. It synthesizes major industry trends, demonstrating a decisive shift toward supply chain resilience, geographic diversification, and the development of flexible, multi-modal manufacturing capabilities. This move fundamentally recalibrates how global CDMOs approach capacity planning, market access, and strategic risk management. John Rim, CEO of Samsung Biologics, emphasizes that this investment underscores the company’s commitment to advancing global healthcare through a more robust US manufacturing presence and deeper collaboration with federal and state stakeholders. The transaction positions Samsung for significant growth and influence within the critical American market, setting a new benchmark for its competitors.

Conclusion or Final Thoughts

Ultimately, this strategic acquisition was more than a simple transfer of assets; it signaled an inflection point for the global biopharma manufacturing landscape. The decision reflected a hard-earned lesson from recent years: that proximity and control over the supply chain are paramount to ensuring the stable delivery of life-saving medicines. For Samsung Biologics, it represented a bold step to embed itself within its largest market, moving from a distant partner to an integral part of the domestic healthcare ecosystem. For the industry at large, it served as a powerful confirmation that the era of highly centralized, single-region manufacturing was giving way to a more distributed, resilient, and responsive global model.