Sutro Biopharma, Inc. has caught the eye of institutional investors recently, marking a significant development in the clinical-stage oncology company’s journey. With its innovative approach to developing antibody-drug conjugates (ADCs) using proprietary platforms, Sutro Biopharma has seen a notable uptick in shareholding from major investment firms. This article delves into the recent investment activities, analyst ratings, financial performance, and the company’s developmental pipeline, providing a comprehensive picture of Sutro Biopharma’s current standing and future prospects.

Significant Increase in Institutional Holdings

Susquehanna Fundamental Investments LLC’s Major Stake Increase

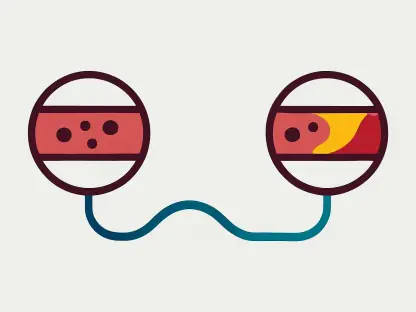

Susquehanna Fundamental Investments LLC has demonstrated robust confidence in Sutro Biopharma by significantly increasing its holdings. During the second quarter, Susquehanna Fundamental boosted its stake by 78.2%, now holding 225,367 shares of the company. This strategic move shines a strong light on Susquehanna’s faith in Sutro’s potential for growth and innovation in the oncology sector. This substantial increase indicates Susquehanna’s commitment to the company’s innovative ADC development programs, which rely heavily on Sutro’s proprietary cell-free protein synthesis platforms, XpressCF and XpressCF+.

The notable increase in investment reflects Susquehanna Fundamental’s positive evaluation of Sutro’s future capabilities, especially in the oncology field. Sutro’s business model, focusing on developing novel-format ADCs, positions it advantageously in the competitive landscape of cancer treatments. As the company progresses through different phases of clinical trials, Susquehanna’s augmented stake signals market trust in Sutro’s research and development operations. The confidence shown by such a prominent investment firm is likely to attract additional institutional and perhaps even retail investors, further appealing to the company’s potential for trailblazing in cancer therapeutics.

Other Notable Institutional Stake Adjustments

Beyond Susquehanna Fundamental, several other institutional investors have shown changing interest in Sutro Biopharma. For instance, ProShare Advisors LLC increased its holdings by 49.1%, now owning 16,316 shares. Similarly, Lazard Asset Management LLC acquired a new position in the company valued at $92,000 during the first quarter. Another significant investor, The Manufacturers Life Insurance Company, raised its holdings by 27.4%, accumulating a total of 32,943 shares. Price T Rowe Associates Inc. MD also boosted its stake by 24.8%, now holding 18,027 shares.

Moreover, HSBC Holdings PLC increased its position by 9.7%, totaling 60,858 shares. These varied adjustments highlight a growing institutional interest, signifying a strategic reallocation of positions that reflects a collective optimism about the company’s future. The influx and redistribution of shares indicate that market participants are taking calculated bets on the long-term potential of Sutro Biopharma. The company’s focus on advancing its proprietary ADC technologies and aligning them with high-need medical areas like cancer therapy provides a promising outlook that validates these investment shifts. This momentum showcases the shared belief among institutional investors in the strategic trajectory and innovative capabilities of Sutro Biopharma.

Analysts’ Ratings and Price Target Revisions

Overview of Analysts’ Positive Outlook

Analysts have largely maintained a positive outlook on Sutro Biopharma, supported by the company’s innovative pipeline and developmental progress. The consensus among financial experts is evidently optimistic, as reflected in the various “buy” ratings and upward price projections. The average analyst consensus target price stands firmly optimistic, signaling a potential for stock growth that aligns with the company’s progress in clinical trials and product development. This ongoing analyst endorsement reinforces market sentiment regarding Sutro’s potential to achieve significant milestones in cancer treatment technologies.

This positive outlook is grounded in Sutro’s proprietary platforms, which enable the production of precise and potent ADCs. These drug conjugates hold immense promise for targeted cancer therapies, presenting a substantial market opportunity. Analysts’ confidence is further buoyed by the company’s steady progression through clinical trial phases, indicating a near-term realization of these therapeutic advancements. The firm’s cutting-edge approach to oncology and its robust product pipeline collectively augment the analysts’ favorable projections, painting a promising picture for Sutro’s future performance in the biotech sector.

Individual Analyst Ratings and Revisions

Several analysts have issued consistent “buy” ratings for the company, reflecting a strong vote of confidence in Sutro Biopharma’s prospects. JMP Securities has upheld a “market outperform” rating with a price target of $17.00. Similarly, HC Wainwright continues to support a “buy” rating, maintaining a target price of $12.00. Meanwhile, Truist Financial has retained its “buy” rating, albeit with a revised price target from $18.00 to $15.00. These price target adjustments signify cautious confidence, acknowledging the company’s potential while also accounting for the inherent complexities of operating a clinical-stage biotech firm.

The tempered revisions by some analysts underscore the balance between optimism and realism, particularly within the challenging landscape of clinical trials and regulatory approvals. While Sutro Biopharma exhibits substantial promise, the path to commercial success is fraught with systemic hurdles that necessitate careful navigation. Even with these tempered expectations, the consistent “buy” ratings from multiple analysts underline steadfast faith in Sutro’s long-term potential. The analyst community’s overall optimism and rigorous analysis offer a comprehensive outlook, reinforcing the positive sentiment surrounding Sutro Biopharma’s future trajectory.

Current Stock Performance and Financial Metrics

Stock Trading Range and Moving Averages

Sutro Biopharma’s stock performance has exhibited the fluctuations typical of clinical-stage biopharma companies. The stock opened trading at $3.51, covering a 52-week range that spans from $2.01 to $6.13. These trading metrics reflect the inherent volatility faced by companies deeply invested in research and development phases. The fluctuations in stock prices highlight the market’s responsiveness to updates on Sutro’s clinical trial progress and other significant corporate developments.

The company’s 50-day moving average currently stands at $4.03, while its 200-day moving average is $3.94. These figures illustrate both the short-term volatility and the medium-term steadiness of Sutro Biopharma’s stock. The moving averages serve as indicators of market sentiment and provide insights into trading behaviors. The variability in stock prices presents potential opportunities for investors willing to endure the inherent risks associated with investing in a clinical-stage biotech firm. The moving averages also suggest a general perception of balanced optimism, where sustained progress in clinical trials could trigger positive market responses.

Market Cap and Earnings Data

Sutro Biopharma holds a market capitalization of $287.10 million, a figure that encapsulates its standing within the competitive biotech industry. The company’s price-to-earnings ratio is -1.87, indicative of ongoing losses as Sutro invests heavily in research and development. Despite these current losses, the company’s earnings figures signify a determined investment in its pipeline, underscoring a strategic focus on long-term gains over short-term profitability. Furthermore, Sutro’s beta of 1.18 denotes higher market volatility, a common attribute for companies on the cutting edge of biotechnological innovation.

For the second quarter, Sutro Biopharma reported a loss of $0.59 per share, which was better than the anticipated $0.79 loss predicted by analysts. The company’s revenues for the quarter stood at $25.71 million, slightly below the consensus estimate of $26.28 million. These financial metrics reveal a company that is closely aligning its performance with market expectations while also navigating the financial challenges specific to its industry. The better-than-expected earnings loss underscores Sutro’s ability to manage its operational costs effectively, even as it advances complex clinical trials. Investors may interpret these figures as a sign of prudent fiscal management paired with ambitious clinical objectives.

Development Pipeline and Strategic Focus

Advanced Clinical Trials and Product Candidates

Sutro Biopharma continues to focus on high-need medical areas, notably cancer treatment, through its robust pipeline of product candidates. Leading the charge is STRO-002, an ADC targeting folate receptor-alpha, which is currently in Phase II/III trials for ovarian and endometrial cancers. The advancement of STRO-002 through these critical trial phases symbolizes a pivotal juncture in Sutro’s journey toward potential commercial success. Another promising candidate is MK-1484, which is in Phase I trials and also targets cancer treatment, showcasing Sutro’s multi-pronged approach in the oncology domain.

Additionally, Sutro is working on VAX-24 and VAX-31, pneumococcal conjugate vaccine candidates that are in Phase II/III trials. These vaccines aim to address significant public health needs, broadening Sutro’s impact beyond oncology. The progress of these candidates through the clinical trial stages is crucial, as it not only validates the company’s scientific approach but also underscores its dedication to tackling pressing medical challenges. The varied pipeline highlights Sutro’s strategic focus on diversifying its product portfolio to include both therapeutic and preventative solutions in critical health sectors.

Proprietary Platforms and Innovation

Sutro Biopharma, Inc. has recently garnered attention from major institutional investors, marking a pivotal development for the clinical-stage oncology company. Known for its innovative development of antibody-drug conjugates (ADCs) using unique proprietary platforms, Sutro Biopharma has experienced a significant increase in shareholding from leading investment firms. This uptick in investment interest highlights confidence in the company’s potential and future growth.

Sutro Biopharma’s approach involves a nuanced method in the creation of ADCs, attracting analysts’ attention and leading to favorable ratings. The company’s financial performance also reflects a promising trajectory, buoyed by recent investments and the development of its robust pipeline. Through this article, readers will gain a holistic view of Sutro Biopharma’s current status, including detailed insights into its recent investment activities, analyst ratings, financial standings, and prospective advancements in their developmental pipeline. This comprehensive analysis underscores the company’s evolving journey and future prospects in the field of oncology.