In a surprising move to address ongoing financial difficulties and strategic challenges, CVS Health has made a significant leadership change by replacing CEO Karen Lynch with David Joyner, head of Caremark. This transition underscores the pressing need for CVS to stabilize its operations and refine its approach amid escalating medical costs and market pressure. As one of the largest healthcare and pharmacy companies in the United States, CVS’s decision comes at a time when it is grappling with substantial financial headwinds, particularly within its Aetna health benefits segment.

Leadership Transition: From Lynch to Joyner

Karen Lynch’s tenure as CEO of CVS Health, starting in 2021, was marked by her previous success at leading Aetna. However, her departure by mutual agreement with the Board of Directors signals a strategic pivot. David Joyner, a company veteran, has been appointed to navigate CVS through turbulent financial waters. This transition aims to leverage Joyner’s extensive experience within the organization to address the immediate challenges facing the company.

Joyner’s leadership might foster stability, yet it raises questions about the future direction of CVS amid the changing healthcare landscape. With internal restructuring tools at his disposal, Joyner’s task will involve managing the company’s efforts to cap costs and improve efficiency while maintaining service quality. The leadership shift is seen by some as a necessary move to bring in a seasoned insider who understands the company’s complex operations. However, it’s also seen as a gamble that relies heavily on an internal perspective that may or may not align with what outsiders believe is needed to steer CVS back on course.

Additionally, Joyner’s tenure will be closely scrutinized by investors and market analysts keen to understand how his leadership will impact CVS’s strategic direction. His previous roles within the company provide him with a deep understanding of CVS’s internal dynamics, which could be advantageous as the company seeks to stabilize. However, whether this insider knowledge translates into effective external market-facing strategies remains to be seen. Still, Joyner’s familiarity with CVS’s pain points might hasten the implementation of necessary changes.

Financial Challenges and Rout in Market Confidence

Notably, CVS has pulled its recent earnings guidance due to spiraling medical costs within its Aetna segment, particularly Medicare Advantage. This development precipitated a steep decline in CVS’s stock value by more than 9%, highlighting investor apprehension regarding the company’s financial health and strategic direction. The rising costs have posed significant challenges not only to the company’s bottom line but also to its overall operational strategy, forcing CVS to reevaluate its financial outlook regularly.

The inflated medical costs have forced CVS to adjust its earnings outlook three times in the recent year. This repeated need for revision indicates the depth of financial strain. As a response, the company announced the layoff of 2,900 workers as part of a broader cost-cutting initiative aimed at saving $2 billion over the coming years. These layoffs represent a substantial effort to reduce operational expenses, yet they also come with their own set of risks, such as potential service disruptions and decreased employee morale.

The stock market’s reaction to these financial measures has been swift and unforgiving, reflecting broader investor concerns about CVS’s ability to manage its costs and maintain profitability. While the layoffs and other cost-cutting measures are seen as necessary steps to address the financial strain, they also signal market uncertainty about the company’s long-term strategy. The downturn in stock value serves as a tangible indicator of this skepticism, emphasizing the urgent need for CVS to regain market confidence through effective leadership and operational efficiency.

Operational Restructuring: Streamlining Services and Cutting Costs

In addition to leadership changes, CVS is making concerted efforts to streamline its operations by shedding non-essential and underperforming segments. The company has ceased offering certain infusion services via its Coram specialty infusion business and announced plans to close or sell 29 pharmacies. These steps are part of a strategic move to focus on more profitable and sustainable segments of the business. This targeted approach aims to fortify CVS’s core operations while eliminating those areas that drain financial resources without sufficient return.

These cost-efficiency measures, though painful, reflect a broader strategy to ensure resources are invested wisely. The discontinuation of low-margin services and closure of pharmacies aim to mitigate financial drain and improve overall profitability. However, such strategies also risk alienating some customer segments and employees, adding layers of complexity to operational management. The transition phase will require meticulous planning and execution to minimize any adverse impact on service delivery and customer satisfaction, which are critical to the company’s long-term success.

Additionally, these operational changes are being closely monitored by industry analysts who view them as a necessary, though challenging, part of CVS’s broader strategy to regain financial stability. Restrategizing service offerings can help focus efforts on the company’s most profitable segments, but the success of these measures will depend largely on their execution. Effective communication with stakeholders, including employees, customers, and investors, will be vital to ensure a smooth transition and sustain long-term growth. The challenge lies in navigating the delicate balance between cutting costs and maintaining quality service.

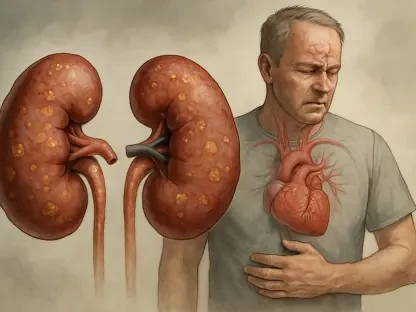

Increased Medical Costs: The Aetna Dilemma

A core challenge behind CVS’s financial woes is the high medical costs within its Aetna health benefits segment. The Medicare Advantage plans, which are crucial to CVS’s service offering, have been particularly affected by unexpected cost surges. These pressures underscore the importance of strategic review and optimization in healthcare cost management. Effectively managing these costs is not only essential for Aetna’s profitability but also for maintaining the competitive edge that CVS relies on within the healthcare market.

Further complicating matters, CVS’s costing challenges extend beyond Medicare to also encompass ACA exchange markets, amplifying the need for a comprehensive and effective cost-control strategy. Addressing these issues is critical for Joyner and his team, as stabilization of medical costs is fundamental to restoring CVS’s financial health. Solutions may involve contract renegotiations, improved medical cost forecasting, and investments in preventive healthcare measures that can reduce long-term expenses.

However, medical cost management is an intricate process that requires careful balancing of multiple factors, including patient care quality, regulatory compliance, and market competitiveness. CVS’s ability to implement effective cost-control measures will be a key determinant of its financial recovery. The complexity of these challenges underscores the high stakes involved in Joyner’s new role, where strategic decisions will need to be both swift and well-calculated. The overarching goal is to reduce costs without compromising the essential services that patients rely on, a feat easier said than done.

Market Reactions and Investor Sentiment

The reshuffling of leadership and financial restructuring measures have not gone unnoticed by the financial markets. The immediate drop in CVS’s stock price following the announcement reflects broader investor skepticism about the effectiveness of the company’s current strategies. Investors are particularly concerned about the potential for prolonged financial instability and the impact of internal leadership changes on long-term strategic goals. The clear and immediate decline in stock prices has amplified the urgency for CVS to not only communicate its strategic plans effectively but also show quick and tangible signs of progress.

Investors’ concerns are mainly centered around the uncertainty regarding the company’s future financial performance and the efficacy of internal leadership amid ongoing restructuring. The lack of external perspectives in the leadership change might not be sufficient to instill renewed investor confidence, highlighting the crucial need for transparent and strategic communications from CVS. The market is keenly watching for signals that Joyner’s leadership will be able to steer the company through these challenging times and restore its financial health.

Moreover, the investor sentiment is also influenced by the broader healthcare market trends, which add another layer of complexity to CVS’s situation. As Joyner and his team work towards stabilizing operations, clear communication about the strategic priorities and expected outcomes will be essential to regain investor trust. The leadership will need to not only outline their plans but also demonstrate early wins to show that CVS is on the right path to recovery. In the end, investor sentiment will play a significant role in CVS’s ability to navigate these turbulent financial waters and achieve long-term stability.

The Future of CVS Health: Strategic Imperatives

In an unexpected move to tackle its ongoing financial struggles and strategic challenges, CVS Health has announced a major leadership overhaul by replacing CEO Karen Lynch with David Joyner, the current chief of Caremark. This leadership transition highlights the urgent necessity for CVS to stabilize its operations and refine its strategy as it faces increasing medical costs and intense market competition. As one of the largest healthcare and pharmacy chains in the United States, CVS is making this significant shift at a critical juncture. The company deals with substantial financial pressures, especially within its Aetna health benefits division, which has been a particular point of concern. Lynch’s departure and Joyner’s appointment aim to bring a new perspective and leadership style that could potentially navigate CVS through these troubled waters. Joyner’s experience and expertise are hoped to guide the company towards a more balanced and efficient operation, addressing both immediate challenges and long-term goals. This move underscores CVS’s commitment to staying competitive and responsive in an ever-evolving healthcare landscape.