Are Biopharma Companies Ready for Today’s Regulatory Challenges?

The biopharmaceutical sector is rapidly evolving, with companies constantly innovating to develop new treatments for a variety of diseases. However, navigating the regulatory landscape remains a significant challenge. Stricter regulatory standards and the need for extensive clinical data have underscored the complexities involved in bringing new drugs to market. This article aims to explore whether biopharma companies are equipped to handle these regulatory challenges, using recent developments as case studies.

Regulatory Hurdles and Scrutiny

PTC Therapeutics and Translarna

PTC Therapeutics has been grappling with regulatory challenges for their drug Translarna, intended for treating specific cases of Duchenne muscular dystrophy (DMD). Despite receiving initial approval in 2014 conditioned on additional data, the European Medicines Agency (EMA) has issued negative opinions four times due to unconvincing efficacy data. This pattern of approval and disapproval illustrates the stringent standards that regulatory bodies uphold to ensure drug effectiveness and safety before full market authorization.

The EMA’s repeated negative opinions on Translarna exemplify the agency’s commitment to only approve drugs that meet rigorous efficacy and safety benchmarks. Initially authorized with the condition that additional data would be collected, Translarna has struggled to conclusively prove its effectiveness. This regulatory battle highlights the uphill path that companies face when initial data falls short of expectations. PTC Therapeutics’ experience demonstrates the critical importance of having robust, compelling data that can withstand the scrutiny of agencies like the EMA.

Amylyx Pharmaceuticals and AMX0035

Amylyx Pharmaceuticals illustrates the dynamic nature of regulatory approvals and market confidence. The company’s drug AMX0035, developed for treating neurodegenerative diseases, saw its shares fluctuate based on small-scale study results showing potential in treating Wolfram Syndrome. However, past experiences with the drug underscore the unpredictable path from trial success to regulatory approval, emphasizing the need for robust and conclusive efficacy data.

AMX0035 was initially approved for ALS (amyotrophic lateral sclerosis) treatment but was later pulled from the market after follow-up trials indicated it was no better than a placebo. This scenario underscores the volatile journey of drug approval processes, where early breakthroughs can be undermined by subsequent findings. Amylyx’s story highlights the need for biopharma companies to brace themselves for rigorous, ongoing evaluations and to invest heavily in comprehensive trials to mitigate the risk of market withdrawals, which can severely impact financial stability and investor confidence.

Strategic Acquisitions and Global Collaborations

Novartis Acquires Small Molecule from Chengdu Baiyu Pharmaceutical

Novartis’ recent $70 million acquisition of global licensing rights for a small molecule cancer drug from Chengdu Baiyu Pharmaceutical underscores the trend of strategic acquisitions to bolster drug pipelines. This deal, potentially worth up to $1.17 billion based on developmental and commercial milestones, reflects the increasing importance of global collaborations. These partnerships are particularly notable with companies in emerging markets, like Chengdu Baiyu, which focuses on botanical research and cancer treatment innovations.

Such acquisitions are strategic moves in the biopharma industry, aimed at filling the product pipeline gaps and creating a robust portfolio of innovative treatments. The partnership with Chengdu Baiyu Pharmaceutical not only provides Novartis with a potential cancer drug but also brings in the expertise in botanical and traditional medicine research. This innovative angle on drug development can offer unique solutions and a fresh avenue for cancer treatment, highlighting the multifaceted approach required to stay competitive and meet global health challenges.

Market Exclusivity and Patent Settlements

Amicus Therapeutics demonstrates the critical role of protecting market exclusivity through strategic legal maneuvers. The company successfully delayed competition for its Fabry disease drug, Galafold, by reaching a settlement with Teva Pharmaceuticals. This settlement, which allows Teva to market a generic version starting in 2037, exemplifies how biopharma companies use patent litigation to extend market exclusivity and maximize revenue. Such strategies are vital in maintaining the competitive edge in a crowded marketplace.

By delaying the entry of generic versions, Amicus can continue reaping significant financial benefits from Galafold without facing immediate price-cutting competition. This type of strategic settlement helps mitigate risks that would arise from patent expiration, ensuring prolonged revenue streams. It also underscores the importance of robust patent portfolios and aggressive defense strategies to fend off legal challenges, maintain market position, and fund ongoing research and development efforts. The case of Amicus and Teva highlights how legal frameworks and intellectual property rights play crucial roles in the biopharmaceutical industry’s dynamics.

Drug Efficacy and Safety Evidence

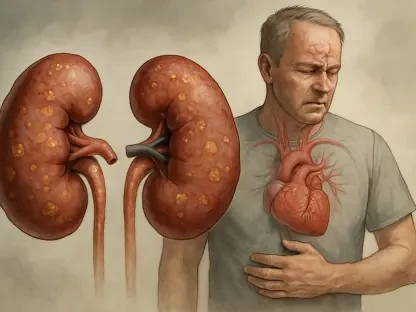

Intercept Pharmaceuticals and Ocaliva

Intercept Pharmaceuticals faces challenges in securing full FDA approval for Ocaliva, used in treating primary biliary cholangitis. Despite its accelerated approval in 2016, recent confirmatory trials failed to demonstrate the needed evidence of efficacy in preventing liver transplants and deaths. The FDA’s decision delay and the advisory panel’s negative recommendation underscore the crucial need for solid efficacy and safety data in the approval process.

The initial accelerated approval allowed Intercept to market Ocaliva while additional data was being collected, a common practice to get promising treatments to patients faster. However, the failure of subsequent trials to meet the FDA’s stringent benchmarks demonstrates the risks associated with this pathway. Intercept’s predicament illustrates the high stakes involved in confirmatory trials and the essential nature of producing irrefutable evidence of a drug’s long-term benefits and risks. The added scrutiny and data requirements remain significant hurdles for companies aiming to transition accelerated approvals into full market authorizations.

Eisai and Biogen’s Leqembi

The rejection of Alzheimer’s disease drug Leqembi by Australia’s Therapeutic Goods Administration (TGA) reflects the stringent scrutiny regulatory bodies employ. Despite approval for early-stage Alzheimer’s treatment in the U.S., Leqembi faces resistance elsewhere due to safety concerns. Eisai and Biogen’s struggle illustrates that even drugs approved in one region must meet diverse regulatory standards globally, underlining the complexity and regional variability in drug approval processes.

Safety concerns highlighted by the TGA surpass the potential benefits outlined by the drug’s initial approval in the U.S., demonstrating how varying regional regulatory frameworks can impact a drug’s global market strategy. Eisai plans to challenge the TGA’s decision, which underscores the continuous dialogue required between biopharma companies and regulatory agencies. The case of Leqembi reveals the intricacies of global regulatory environments and the importance of aligning safety and efficacy standards to achieve wider market acceptance.

Overall Trends in Regulatory Landscape

Stringent Regulatory Scrutiny

An overarching trend in today’s biopharma landscape is the heightened regulatory scrutiny from agencies like the EMA, FDA, and TGA. Companies must prepare for rigorous evaluations emphasizing robust data to meet efficacy and safety criteria. This scrutiny ensures that only the most effective and safe drugs reach patients, reinforcing the importance of comprehensive clinical trials and evidence.

The increased rigor in regulatory processes serves to protect public health by ensuring new treatments carry more benefits than risks. Biopharma companies must adapt by investing heavily in initial research and comprehensive trial phases to meet these elevated standards. The ongoing stringent evaluations also indicate a shift towards a more cautious approach in the approval process, with agencies taking greater time and care in examining new drug applications to safeguard patients effectively.

Emphasis on Comprehensive Data

From PTC Therapeutics to Intercept Pharmaceuticals, the emphasis on comprehensive efficacy and safety data is apparent. Drugs are subjected to thorough evaluations, requiring extensive trial data to prove their effectiveness conclusively. Regulatory agencies are becoming less tolerant of incomplete or inconclusive data, pushing companies to invest heavily in rigorous trial phases.

The insistence on exhaustive data highlights the critical importance of detailed, transparent, and reproducible clinical studies. Biopharma firms must align their development strategies to focus on gathering high-quality, long-term data that can stand up to intense scrutiny. This approach not only ensures adherence to regulatory standards but also builds confidence among healthcare providers and patients regarding the safety and efficacy of new treatments.

Global Collaborations and Acquisitions

The trend of global collaborations, as seen with Novartis and Chengdu Baiyu Pharmaceutical, signifies a strategic movement towards leveraging international expertise and resources. These partnerships help bridge gaps in research and development, allowing companies to access broader market potentials and innovative solutions from different regions.

Collaborating with firms from diverse geographical areas can bring new perspectives and novel approaches to drug development, helping to solve complex medical challenges more effectively. This globalized research and development model not only enhances the scientific rigor and innovative capacity but also expedites the development timelines, enabling faster access to revolutionary treatments. Additionally, such collaborations often facilitate entry into emerging markets, opening new revenue streams while addressing unmet medical needs in different regions.

Market Exclusivity and Legal Strategies

Amicus Therapeutics’ actions to protect Galafold’s market exclusivity through legal settlements highlight the ongoing importance of patent protection. Such legal strategies are pivotal for biopharma companies to fend off generic competition and safeguard revenue streams, ensuring they can recoup the substantial investments needed for drug development.

In this highly competitive industry, maintaining an edge through extended exclusivity periods is crucial for financial stability and continued innovation. By delaying generic competition, companies like Amicus can secure more time to maximize returns on their investments in research and development. The legal battles over patent rights and market exclusivity are testament to their importance in sustaining the economic viability of groundbreaking therapies and ensuring long-term profitability.

Overall, the current biopharma landscape reveals a multifaceted approach to meeting regulatory challenges through strategic, adaptive tactics. The integration of comprehensive data collection, global collaborations, and aggressive intellectual property strategies indicates that biopharma companies are evolving to navigate and thrive within an increasingly stringent regulatory environment. Through rigorous preparation and strategic alliances, biopharma firms can not only meet but also exceed regulatory expectations, ultimately ensuring that safe and effective treatments reach those in need.

Conclusion

The biopharmaceutical industry is undergoing rapid evolution, driven by constant innovation aimed at developing new treatments for a wide range of diseases. Yet, one of the most formidable challenges these companies face is navigating the complex regulatory landscape. With increasingly stringent standards and a growing demand for extensive clinical data, the process of bringing new drugs to the market has become more complicated than ever.

This article seeks to examine whether biopharma companies are prepared to manage these regulatory hurdles effectively. By analyzing recent developments and case studies, we can gain insights into how well-equipped these companies are to meet the rigorous demands of regulatory bodies. The escalating requirements for clinical trials, safety assessments, and efficacy data mean that companies must invest significant resources in compliance measures.

Moreover, the global nature of the biopharma industry adds another layer of complexity. Different countries have their own regulatory frameworks, which means that companies often must navigate multiple sets of rules and guidelines. This can lead to delays in drug approvals and added costs.

To succeed in this challenging environment, biopharma companies need to be agile and adaptable, continuously updating their strategies to align with evolving regulatory requirements. By doing so, they can not only ensure compliance but also expedite the process of bringing life-saving treatments to patients worldwide.