The American Hospital Association (AHA) has put forth a series of recommendations aimed at reforming policies to mitigate health insurers’ growing dominance in the market, focusing on recent developments that exacerbate competition challenges. The AHA has submitted these recommendations to the Trump administration, specifically targeting the Department of Justice (DOJ) and Federal Trade Commission (FTC) to address various competitive disparities in the healthcare sector. With the increasing consolidation and vertical integration among insurers, the AHA is concerned about an imbalance of power that could potentially restrict consumer choices and hike premium rates. The association is pushing for a thorough assessment of laws and regulations currently in place, which may have unknowingly encouraged such dominance by massive insurers like UnitedHealth Group. By addressing these core issues, the AHA aims to promote a fair and equitable healthcare system for providers and consumers.

Challenging Insurers’ Market Dominance

Central to the AHA’s concerns is the assertion that the immense scale of major insurers contributes to significant competition issues, hindering smaller players in the market. According to the association, this has resulted in skyrocketing premiums and limited options for consumers, as a few companies monopolize a substantial portion of the market share. While hospitals control a relatively smaller segment, these insurance behemoths are said to use their size to influence market dynamics unfavorably. This dominance not only alters competition but also puts undue financial stress on healthcare systems, which struggle to compete on an uneven playing field. The dynamic between larger insurers and smaller health systems is critical to understanding the shifting landscape of healthcare, significantly impacting how services are provided, how much they cost, and who has access to them. The AHA’s submission highlights such disparities as a clarion call for immediate federal interventions to re-establish balance in the healthcare ecosystem.

Exploiting Regulatory Loopholes

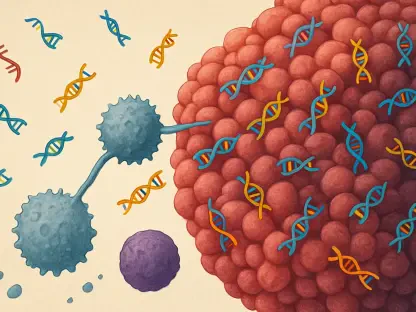

A catalyst for this consolidation, per the AHA, is the Affordable Care Act’s (ACA) medical loss ratio (MLR) requirement, initially intended to regulate premium revenue spending by insurers. Designed to limit the share of insurers’ premium earnings that can be retained as profit, the MLR requirement has, however, unintentionally facilitated insurers’ strategic acquisitions of healthcare providers. By absorbing medical practices within their structures, insurers seemingly retain more revenue under the guise of meeting MLR requirements, effectively dodging the intended profit limits. This scenario, referred to as “MLR abuse” by the AHA, presents considerable implications for market fairness. The AHA emphasizes the need to prioritize curbing this behavior in future regulatory assessments. While hospitals face stringent regulations like the Stark Law when pursuing similar acquisition strategies, insurance companies often bypass these challenges due to existing statutory exceptions. This asymmetry underscores the urgent need for policy reforms, aiming to dismantle the “ample runway” enabling insurers to outmaneuver regulatory checkpoints and thus tilt competitive parity.

Antitrust and Unified Oversights

In its submission, the AHA also calls for a unified antitrust approach to enforcement policies concerning insurers, advocating for consolidating oversight responsibilities under a single agency. Currently, the DOJ manages insurers, while the FTC oversees hospital mergers, creating potential gaps in regulatory scrutiny. Given that insurers are increasingly active in healthcare delivery, breaking traditional boundaries in service provision, unified oversight becomes crucial to avoid competitive conflicts. The AHA argues that such a consolidation would better address issues as insurers blur lines and heighten competitive tensions. By restructuring antitrust enforcement under one body, policymakers could ensure more consistent, fair, and effective regulation. This change could provide insights into insurers’ strategic maneuvers and impact on competition. Moreover, this oversight could also prevent market strategies from unfairly disadvantaging new or smaller entrants, foster healthy competition, and ultimately benefit consumers with more choices and fair pricing.

Streamlining Processes and Reforming Quotas

Beyond acquisitions and mergers, the AHA criticizes certain utilization management practices employed by insurers, which they argue are inherently anticompetitive. For instance, the “prior authorization processes” create significant hurdles for healthcare providers and patients, elongating pathways to necessary care and decision-making processes. The AHA recommends streamlining these policies, suggesting that existing systems place unnecessary burdens on stakeholders involved. Emphasizing the Interoperability and Prior Authorization Final Rule, the AHA views it as merely a stepping stone in the broader quest for systemic balance. Additionally, there is a call to shift the responsibility of collecting cost-sharing payments, such as copays and deductibles, from hospitals to insurers. Insurers are initially responsible for setting these payments; thus, they should bear the collection duties instead of thrusting hospitals into this complex role. Furthermore, the association encourages prompt payment from insurers to prevent delays in covering services, including Medicare coverage, which could lead to fairer operations across the system.

Easing Regulatory Constraints on Healthcare Providers

In addressing insurers’ influence, the AHA also brings broader regulatory constraints on hospitals and health systems to the forefront. The submission advocates for the FTC to reconsider outdated regulations and expand reviews of restrictive laws hindering operational efficiency. Such laws include Stark Law exemptions and certain telehealth rules. By reducing these regulatory burdens, the AHA argues, it would relieve healthcare providers of an undue weight contributing to clinician burnout and systemic inefficiencies. These calls align with the association’s previous communications to the Office of Management and Budget, which also highlighted ongoing administrative challenges within the sector, albeit without explicitly targeting insurers. The broader narrative underscores the importance of periodic regulatory updates that reflect evolving market realities. By streamlining operations and reducing unnecessary complexities, hospitals can better focus on maintaining competitiveness against insurers wielding greater financial leverage.

Pursuing Equitable Competition through Regulatory Reforms

At the heart of the American Hospital Association’s (AHA) concerns is the belief that the vast scale of major insurers presents significant competitive problems, hampering smaller market players. They claim this leads to skyrocketing premiums and fewer choices for consumers, as just a few companies dominate a large portion of the market. Hospitals hold a relatively minor segment, while these insurance giants allegedly use their magnitude to negatively affect market dynamics. Such dominance alters competition and imposes substantial financial strain on healthcare systems, struggling to keep up in an imbalanced market. Understanding the relationship between larger insurers and smaller health systems is crucial to grasping the evolving healthcare landscape, impacting service delivery, costs, and access. The AHA’s document underscores these inequalities as an urgent appeal for federal action to restore equilibrium within the healthcare realm, aiming to provide fairness and accessibility for all involved stakeholders.