The biopharmaceutical sector is entering a new era. After last year’s market disruptions, the industry faces a harsh truth: scientific breakthroughs alone are no longer enough to keep ahead of the competition, maintain investor confidence, and position for a brighter future.

The defining challenge for 2026? Balancing strategic resilience with new technological investments.

Success now hinges on the unique ability to commercialize innovation while navigating a form of regulatory chaos, fierce global competition, and shifting public trust. The rules are being rewritten in real-time, and the upcoming year will separate survivors and leaders from casualties, rewarding not just the most innovative institutions, but the most agile as well.

The Volatile Dynamics of Capital and Strategy

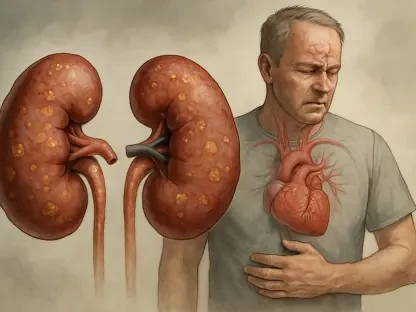

In the present, the financial climate comes with a cautious feeling of optimism. Last year, biotech M&A picked up again in September and October, following a terrible start to the year. The lifting of concerns related to prices and sector tariffs led to the beginning of an interest-rate cutting cycle, which encouraged dealmaking further. And many large pharmaceutical firms are now on the hunt to snatch up new assets, facing a patent cliff that, by 2032, threatens losses of exclusivity for best-selling brands are worth at least $173.9 billion in annual sales. Paired with a smaller brand, the estimates on the total amount of revenue are placed somewhere between $200 billion and $350 billion.

This M&A activity, however, is not a free-for-all. Bloated valuations and overcrowding in popular therapeutic areas like oncology and immunology create significant risk. To bridge the gap, dealmakers are starting to use creative instruments like contingent value rights, built to tie payments to future milestones and de-risk acquisitions for buyers.

What’s happening represents a strategic pivot. Acquirers are moving beyond single-asset targets to pursue scalable platforms with repeatable pipelines. A large number of enterprises are prioritizing risk diversification and predictable long-term value in order to avoid new risks and reduce potential disruptions. This means that companies with foundational technologies capable of generating multiple, future-focused products will command the highest premiums. A clear example: the acquisition of a mid-sized biotech organization with a novel messenger RNA delivery platform is no longer focused on the short-term profits the investment might bring, but rather on how owning the technology could generate a dozen more points of revenue-driving innovation.

Meanwhile, a formidable competitive threat is solidifying in the East. Chinese drugmakers, backed by strong government support and lower development costs, are moving from producing “me-too” drugs to “first-in-class” medicines, signaling a potentially permanent shift in the global innovation map.

Western biopharmaceutical manufacturers will need to rise to the challenge: meet the innovation standards brought in by the competition, maintain trust and quality, and continue pushing progress.

Resilience as a Core Commercial Capability

What emerges from these new dynamics is a reframing of resilience itself. In biopharma, resilience has shifted from a defensive posture (seen as a contingency plan for downturns) to an offensive capability that directly drives growth. Companies that embed resilience into their operating models are finding that they can move faster, allocate capital more efficiently, and absorb shocks without losing strategic momentum. In this sense, resilience has become a blockbuster asset: invisible to the patients you’re serving, yet increasingly more decisive in determining which therapies ever reach them.

In today’s context, operational resilience spans the entire value chain. Supply networks are being redesigned to avoid single points of failure, particularly when it comes to active pharmaceutical ingredient manufacturing, after geopolitical exposure has proven costly. An increasing number of firms are diversifying suppliers, regionalizing production, and investing in advanced manufacturing technologies such as continuous processing and modular facilities. These moves might increase short-term costs, but they will dramatically reduce long-term volatility, a trade-off that investors see as increasingly rewarding.

At the same time, resilience is reimagining R&D portfolios. Companies are becoming more selective, pruning bloated pipelines and reallocating resources toward programs with clearer regulatory paths, differentiated mechanisms of action, and stronger real-world evidence potential. The emphasis is shifting from volume to quality. There are fewer shots on goal, but better aimed. This disciplined approach reflects a recognition that capital efficiency, not sheer scientific ambition, will define competitive advantage in the coming decade.

Is Regulatory Complexity the New Strategic Stress Test?

The resilience gap is most visible in regulatory affairs. Global regulatory frameworks are fragmenting, with varying standards across the United States, Europe, and Asia complicating global clinical trial design and approval strategies.

Should you view this as an obstacle? The answer is no. Leading biopharma companies are treating regulatory uncertainty as a stress test for organizational agility and resilience. Those with strong regulatory intelligence functions and early, proactive engagement are better positioned to adapt trial designs, anticipate policy shifts, and avoid costly delays. Firms that still rely on legacy playbooks are finding themselves exposed to unexpected data requests, approval setbacks, and reimbursement challenges.

And digitalization is becoming a core critical enabler here. Advanced analytics, AI-driven trial optimization, and integrated data platforms are helping companies model regulatory scenarios, identify risk earlier, and generate evidence more efficiently.

But technology on its own isn’t sufficient. True resilience requires cross-functional alignment between R&D, regulatory, commercial, and legal teams with shared incentives and real-time communication.

Digitalization is becoming a critical enabler here. Advanced analytics, AI-driven trial optimization, and integrated data platforms are helping companies model regulatory scenarios, identify risk earlier, and generate evidence more efficiently. However, technology alone is insufficient. True resilience requires cross-functional alignment between R&D, regulatory, commercial, and legal teams, with all parts of the business operating with shared incentives and real-time communication. This organizational cohesion is proving just as valuable as any scientific breakthrough.

Conclusion

With 2026 presenting new opportunities for long-term success and innovation, resilience is emerging as one of the biopharmaceutical industry’s most vital assets. It is not a single initiative or function, but a unifying philosophy that shapes capital strategy, R&D prioritization, regulatory engagement, technological adoption, and public trust. In a world defined by uncertainty, resilience is what allows innovation to translate into enduring impact.

The industry’s next chapter will not be written by those with the most advanced science, but by those who present the operational and strategic strength to sustain it. Resilient companies will weather market cycles, outperform their competitors, and earn the confidence of regulators, investors, and patients alike.