By 2030, the tissue-engineering market is projected to exceed $32.45 billion, reflecting a profound shift in how biopharma is redefining the future of medicine. Once limited to academic labs, it has become a powerful engine of innovation in biopharma, transforming how businesses develop drugs, create personalized treatments, and model diseases. As biology, materials science, and engineering come together, this field is reshaping therapeutic strategy and redefining competitive advantage. This article addresses how forward-thinking biopharma companies can harness tissue engineering to accelerate research and development (R&D), reduce risk, and promote long-term growth.

Transforming How Human Biology Is Built and Studied

Tissue engineering is no longer just about repairing damaged tissues; it’s about recreating human biology from the ground up. By integrating living cells with scaffolds and bioactive molecules, this science is now powering a new wave of precision tools for drug discovery. It improves disease modeling and experimental systems that closely mimic real human responses. The result? Richer, more predictive preclinical data.

For biopharma, that translates into fewer failed trials, faster development timelines, and smarter resource allocation. In short, tissue engineering is rewriting what’s possible in the life sciences, and it’s doing so with real commercial impact. That impact becomes even clearer when you explore the strategic opportunities tissue engineering is unlocking for forward-looking companies.

The Business Implications and Opportunities

For biopharmaceutical companies, tissue engineering is emerging as a critical business advantage, not just a scientific breakthrough. By bridging innovation with real-world application, it has the potential to streamline development, sharpen decision-making, and deliver more targeted, competitive therapeutics. That potential is already coming to life, particularly in one key area: redefining preclinical testing and unlocking major R&D efficiencies.

Enhancing Preclinical Testing and Reducing R&D Costs

Drug development remains one of the most time-consuming and costly undertakings in biopharma, with estimates topping $2.3 billion and stretching over a decade per therapy. A key driver of that cost is the reliance on traditional preclinical models, which often fail to accurately predict real human responses.

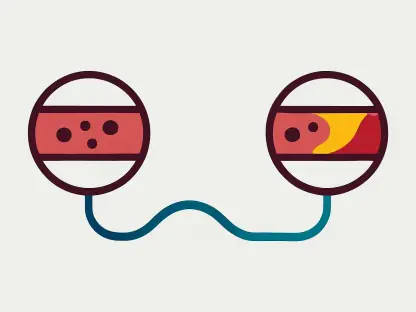

Tissue engineering offers a smarter path forward. Using advanced solutions like organ-on-a-chip systems and 3D-bioprinted tissues, researchers can replicate complex human biology with unprecedented precision. This leads to more accurate toxicity and efficacy screening, the early elimination of weak candidates, and meaningful reductions in both development time and cost.

But the benefits go beyond speed and savings. These technologies are also laying the foundation for more custom approaches to care. They are ushering in the next era of personalized medicine.

Driving Innovation Through Personalized Medicine

Tissue engineering is helping biopharma turn the promise of precision medicine into a practical reality. By leveraging induced pluripotent stem cells from individual patients or specific populations, companies can create customized tissue models that provide unprecedented clarity into how therapies work across diverse genetic contexts.

These personalized models allow developers to pinpoint how different genotypes respond to targeted treatments, minimize the risk of adverse reactions, and design drug regimens tailored to specific patient profiles, an approach that improves both outcomes and regulatory appeal. As healthcare systems and regulators increasingly prioritize tailored medicine, this strategy is shifting from optional to essential. Tissue engineering is also accelerating progress toward a long-standing industry ambition: regenerative therapies that can restore or replace damaged tissues and organs.

Accelerating Regenerative Therapies

Tissue engineering isn’t just transforming research; it’s expanding the very definition of what biopharma can deliver. Beyond the lab bench, this field is enabling entirely new classes of regenerative therapies, from functional skin grafts to complex bioartificial organs. A study published in the Cureus journal of medicine confirms that over 85% of patients report minimal scarring and that over 90% are satisfied with using tissue engineering solutions.

To enjoy these benefits, industry leaders are already moving in, investing in startups that develop bone and cartilage grafts, bioengineered vascular conduits, and even pancreatic islet cell replacements for diabetes care. As chronic conditions and age-related diseases rise globally, demand for these restorative solutions is expected to grow steadily, creating a pipeline of long-term, high-value opportunities.

But delivering on this promise requires more than innovation alone. To bring regenerative therapies to market at scale, it’s just as crucial to navigate the evolving regulatory landscape.

Regulatory Considerations: Challenges and Clarifications

For biopharma companies exploring tissue engineering, meeting regulatory demands is one of the biggest hurdles. As many of these technologies are first-of-their-kind, agencies like the Food and Drug Administration and the European Medicines Agency are still refining frameworks to keep pace.

Current areas of focus include Good Manufacturing Practices standards for living and scaffold-based constructs, ensuring quality control for personalized materials, and establishing consistent biocompatibility testing protocols. While these evolving requirements can introduce complexity, they also offer early movers an opportunity to help define the rules of the journey.

Encouragingly, regulators are receptive, especially when the science demonstrates clear therapeutic potential. Companies that engage early, participate in pilot programs, and invest in regulatory strategy will not only de-risk their pipelines but also gain influence in shaping future policy.

With those foundations in place, businesses can position themselves to tap into the industry’s growing momentum, driven by market trends and accelerating investment.

Market Trends and Investment

Tissue engineering is no longer an emerging concept; it’s a fast-scaling sector drawing substantial capital and attention. Advances in bioprinting technologies are driving significant momentum across the industry. They’re fueling demand for animal-free and cosmetics testing, speeding up the shift to faster, safer drug pipelines, and expanding the adoption of regenerative therapies in healthcare.

For biopharma companies, the message is clear: now is the time to act. Organizations can grow internal capabilities by investing in R&D or partnering with and acquiring companies that already have proven expertise. Companies like Mattek are already offering advanced platforms for drug discovery and disease modeling that can shorten timelines and improve clinical relevance.

However, capturing these opportunities also demands the right infrastructure and the talent to power it. The next step is to build the workforce and technical strategies needed to make tissue engineering a scalable core competency.

Workforce and Infrastructure Implications

To fully integrate tissue engineering into core business capabilities, biopharma companies need to align resources with long-term scale. That starts with hiring interdisciplinary talent across bioengineering, materials science, and cell biology. These are people who can bridge science with application. Just as critical is the development of specialized production infrastructure, including facilities equipped for high-performance cell culture and real-time imaging.

Equally important are robust data analytics systems that can handle the complexity of biological outputs, turning experimental insights into actionable decisions quickly and accurately. These foundational investments do more than fuel innovation; they position companies as attractive partners for collaboration and funding, while also earning trust from regulators.

As companies build these internal growth capabilities, there’s another aspect they can’t afford to ignore: the ethical and environmental impact tissue engineering brings to the industry.

Sustainability and Ethical Implications

Tissue engineering offers more than clinical and commercial promise; it delivers meaningful progress on both ethical and environmental fronts. By reducing dependence on animal testing and advancing more accurate in-vitro models, companies can align with global ethical standards and respond to growing Environmental, Social, and Governance demands from investors.

This shift accomplishes two key objectives: it enhances scientific rigor and strengthens a company’s commitment to corporate social responsibility. Businesses that openly embrace these models will not only build trust with stakeholders and regulators but also improve their chances of attracting funding, avoiding reputational risks, and leading the way in sustainability reporting.

Case Studies: Industry Examples in Action

Tissue engineering is delivering real results across the biopharmaceutical landscape. Major industry players are actively integrating engineered tissue platforms to de-risk development pipelines, enhance safety profiling, and unlock new product categories.

Johnson & Johnson is taking a more therapeutic route, investing in regenerative skin tissue technologies to support its wound care portfolio. These platforms not only align with the company’s broader interest in next-generation health solutions but also open new markets in advanced biologics and personalized treatments.

Meanwhile, Pfizer is expanding its innovation strategy with a targeted focus on stem cell research. For over a decade, the company has used animal and adult stem cells in its labs to screen new drug compounds and improve safety profiles. Now, backed by promising results, Pfizer is exploring collaborations with leading academic, biotech, and pharmaceutical partners worldwide to access human embryonic stem cell technologies, ensuring that all work aligns with the highest ethical standards. Guided by its formal Stem Cell Policy, Pfizer’s approach reflects a commitment to responsible innovation and next-generation drug discovery.

These real-world applications highlight what happens when companies move beyond theory and put tissue engineering to work in strategic, high-impact areas. The payoff is clear: faster development cycles, sharper insights, and innovation that’s both scientifically sound and commercially actionable. It’s reshaping expectations across R&D teams, executive leadership, and the broader industry.

Strategic Next Steps: Turning Tissue Engineering into Competitive Advantage

As the biopharma landscape shifts toward more personalized, predictive, and regenerative pathways, tissue engineering isn’t just a scientific opportunity; it’s a strategic imperative. Companies that treat these technologies as core capabilities, rather than add-ons, will be far better positioned to lead.

To capitalize on this, organizations should begin by evaluating their internal R&D pipelines for areas where tissue models could replace or enhance traditional methods. Early experimentation through pilot projects using organ-on-a-chip platforms or 3D bioprinting can deliver quick wins and build institutional expertise. Forward-looking companies are also forming strategic partnerships with academic labs and biotech startups, tapping into cutting-edge research and accelerating innovation cycles.

Success in the tissue engineering space requires building multidisciplinary teams that bring together talent from biology, materials science, and computational modeling to manage complex biological systems. To stay ahead of shifting compliance standards, companies must closely monitor regulatory developments and engage early with regulators to shape and adapt to evolving policies.

Tissue engineering is no longer a future consideration. For companies ready to lead, it’s a now-or-never moment with wide-reaching implications for science, strategy, and shareholder value.

Conclusion

Tissue engineering is reshaping everything from how clinicians screen drugs to how they treat disease. With its potential to improve prediction, personalize treatments, and deploy regenerative solutions, it offers tangible strategic value to every biopharmaceutical enterprise. Companies that invest in these emerging medical solutions will be better positioned to outpace their competition, reduce R&D risks, shorten time-to-market, and deliver more effective, ethical, and personalized therapies.

The future of biopharma is being built, one tissue at a time, and leaders who act quickly won’t get left behind. Whether you’re a startup seeking an edge or an established industry leader aiming to future-proof your pipeline, the opportunity is clear: embrace tissue engineering as a core pillar of your innovation strategy. The technologies are ready, the market is moving, and those who lead will shape the next era of medicine.