The biopharmaceutical industry is undergoing a profound transformation this year, as financial strategies adapt to a landscape shaped by economic pressures and groundbreaking innovation. With venture capital tightening its grip on risk, mergers and acquisitions gaining momentum, and licensing deals hitting record highs, the sector is navigating a delicate balance between caution and opportunity. Strategic investments are increasingly focused on areas like obesity treatments, biologics, and collaborations in emerging markets such as China. These shifts are not just numbers on a balance sheet—they reflect a broader recalibration of how biopharma companies prioritize growth and innovation in an era of regulatory uncertainty and elevated interest rates. This exploration delves into the nuances of these financial currents, shedding light on where the industry stands and how it is positioning itself for the future.

Investment Shifts and Venture Capital Dynamics

Cautious Capital Deployment in Early-Stage Ventures

Venture capital investment in biopharma has taken a conservative turn in the third quarter, with a total of $5.8 billion invested, marking the lowest third-quarter figure since 2022. This cautious approach is driven by heightened interest rates and regulatory uncertainties, prompting investors to shy away from high-risk, early-stage ventures like Seed and Series A rounds. Instead, funding is gravitating toward Phase II companies, where median round values have climbed to $63 million from $50 million last year. This shift signals a clear preference for assets with more defined clinical outcomes and commercial potential, as investors seek to minimize exposure to uncertainty. For drug discovery teams, this means a sharper focus on delivering robust data and clear development pathways to secure much-needed capital in a selective funding environment.

Dominance of Later-Stage Funding Rounds

Later-stage funding rounds, particularly Series B and beyond, have emerged as the cornerstone of biopharma investment activity, with $11.1 billion raised across 158 rounds so far this year. This trend underscores a strategic pivot toward de-risked programs that offer greater certainty of success, reflecting a broader industry emphasis on financial discipline. Unlike early-stage ventures, these later-stage initiatives often come with established proof-of-concept data, making them more attractive to risk-averse investors. Additionally, the focus on later-stage assets is reshaping how smaller biopharma firms structure their pipelines, pushing them to prioritize projects with near-term milestones over speculative, long-term innovation. This dynamic is creating a funding gap for nascent ideas, potentially stifling groundbreaking research unless alternative financing models emerge to bridge the divide.

Strategic Growth Through Deals and Partnerships

Surge in Licensing Transactions and Upfront Payments

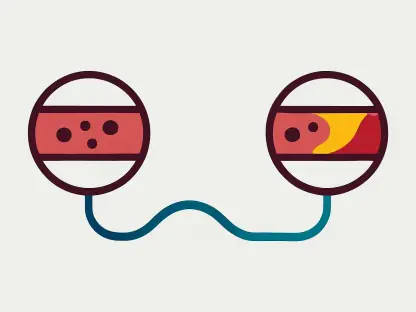

Licensing transactions have soared to unprecedented levels, with announced deal values totaling $181.5 billion this year, driven by fierce competition among large-cap biopharma companies with market capitalizations exceeding $50 billion. Median upfront payments for Phase I programs have nearly doubled to $350 million from $168 million last year, highlighting the intense demand for promising early-stage assets. This surge reflects a strategic imperative to bolster pipelines with innovative therapies, particularly in high-growth areas like biologics and antibody-drug conjugates, which alone have attracted $10 billion in upfront licensing payments. Such aggressive deal-making suggests that large players are willing to pay a premium to secure cutting-edge solutions, even as they navigate a landscape of economic caution and regulatory scrutiny.

Record-Breaking Mergers and Acquisitions Activity

Mergers and acquisitions have become a critical engine for growth, with dollar volume this year already surpassing the full-year total for the prior period. Notably, mid- and small-cap firms account for 57% of acquisition deals by count through the third quarter, indicating a targeted strategy by larger entities to acquire innovative smaller players to refresh their portfolios. This wave of consolidation is not merely about scale but about accessing novel technologies and therapies that can address unmet medical needs. The focus on smaller firms also reveals a preference for nimble, specialized entities over broader, riskier bets, aligning with the industry’s overarching theme of balancing innovation with financial prudence. As a result, M&A activity continues to reshape the competitive landscape, driving both growth and transformation.

Unprecedented Focus on Obesity and Diabetes Treatments

Investment in obesity and diabetes research and development partnerships has reached historic heights, with 18 deals signed this year totaling $18.2 billion in potential value and $2.7 billion in upfront cash and equity. This remarkable focus stems from the urgent global need for effective treatments in these therapeutic areas, coupled with the promise of substantial commercial returns. Large biopharma companies are prioritizing these high-demand sectors, viewing them as cornerstones of future growth amid a competitive market. The financial commitment to obesity and diabetes therapies also underscores a shift toward addressing chronic, widespread health challenges, positioning these areas as key battlegrounds for innovation and market leadership in the coming years.

Rising Influence of Chinese Biopharma Collaborations

Global pharmaceutical companies have increasingly turned to China as a hub for biopharma innovation, committing $3.5 billion in upfront payments for in-licensing deals, which represent 38% of large deals with upfront payments of $50 million or more worldwide. This growing collaboration reflects China’s rapid emergence as a center for cutting-edge research and development, offering both cost advantages and access to a vast talent pool. The strategic partnerships are not just transactional but indicative of a deeper integration into the global biopharma ecosystem, with Chinese firms playing a pivotal role in shaping therapeutic advancements. This trend highlights a broader industry recognition of the value in diversifying geographic focus, especially as traditional markets face saturation and regulatory hurdles, paving the way for a more interconnected innovation landscape.