I’m thrilled to sit down with Ivan Kairatov, a renowned biopharma expert with extensive experience in research and development, as well as a keen understanding of technological innovation in the industry. Today, we’re diving into the world of Tissue Regenix Group, a key player in regenerative medicine, and exploring their recent performance within the FTSE All-Share index. Our conversation touches on their unique position in the market, the factors influencing their standing, potential challenges ahead, and what investors should consider when looking at a company like this. Let’s get started.

Can you give us an overview of Tissue Regenix Group and what sets their focus apart in the biopharma space?

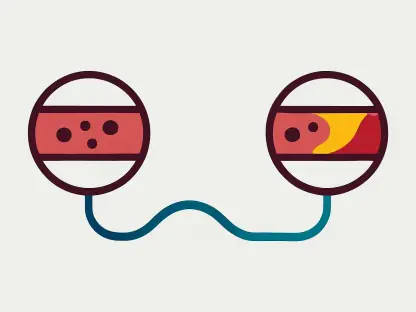

Absolutely. Tissue Regenix Group is a fascinating company in the regenerative medicine sector, primarily focused on developing technologies that repair and replace damaged tissues and organs. Their proprietary dCELL technology, for instance, is a game-changer—it decellularizes tissues to create a scaffold that the body can use to regenerate itself. What sets them apart is their emphasis on using biological materials that minimize the risk of rejection, which is a significant hurdle in this field. Compared to other biotech firms, their approach is less about synthetic solutions and more about harnessing the body’s natural healing processes, which positions them uniquely in the market.

How has Tissue Regenix Group been performing lately within the FTSE All-Share index?

Their performance on the FTSE All-Share has been noteworthy, especially given the volatility in the broader market. Recently, they’ve shown resilience with steady stock activity, reflecting growing investor interest in regenerative medicine. While I don’t have the latest figures at my fingertips, their ability to maintain stability amidst fluctuating market conditions speaks volumes. Compared to peers in the same sector on the index, they seem to be carving out a niche, though they’re not yet among the top performers. It’s more about consistent progress than explosive growth at this stage.

What do you think are the main drivers behind their current market position?

Several factors are at play here. On one hand, their innovative dCELL platform and expanding product pipeline have caught the eye of investors looking for cutting-edge solutions in healthcare. Partnerships and collaborations, especially in the U.S. market, have also boosted their visibility. On the other hand, broader market sentiment towards biotech—particularly regenerative medicine—has been positive, as investors see long-term potential in aging populations and chronic disease management. However, they’re not immune to economic headwinds, which can temper enthusiasm if capital becomes tighter.

Why is inclusion in the FTSE All-Share index significant for a company like Tissue Regenix Group?

Being part of the FTSE All-Share is a big deal because it increases visibility among institutional investors and fund managers who track the index. It’s almost like a stamp of credibility, signaling that the company meets certain financial and operational benchmarks. This can translate into greater access to capital, as more investors are likely to consider them for their portfolios. Strategically, it also pushes the company to maintain transparency and performance standards, which can shape their long-term growth plans by aligning them with market expectations.

What challenges might Tissue Regenix Group face in the coming months or years?

Like many in the biotech space, regulatory hurdles are a constant concern. Getting approvals for new products or expanding into different markets can be a slow and costly process, especially with stringent standards in places like the EU and U.S. Competition is another issue—there are other players innovating in regenerative medicine, and staying ahead requires continuous investment in R&D. On top of that, global economic conditions, like rising interest rates or inflation, could dampen investor appetite for riskier sectors like biotech, potentially impacting their funding and growth plans.

From an investor’s perspective, what should people keep in mind when considering Tissue Regenix Group as an investment?

Investors need to weigh both the opportunities and risks carefully. On the upside, the regenerative medicine field is poised for growth, especially with an aging global population and increasing demand for innovative treatments. Tissue Regenix has some promising milestones on the horizon, like potential product launches or expanded market reach. However, the risks are real—biotech investments often come with long timelines for returns, high R&D costs, and the possibility of clinical or regulatory setbacks. It’s a sector for those with patience and a high tolerance for uncertainty.

Looking ahead, how do you see Tissue Regenix Group evolving within the FTSE All-Share landscape over the next few years?

I think they have the potential to strengthen their position if they can capitalize on their current momentum. We might see them shift focus towards scaling their commercial operations, especially if new products gain traction. Their market position could improve as regenerative medicine becomes more mainstream, but that depends on their ability to execute and stay competitive. External factors, like advancements in biotech or shifts in healthcare policy, will also play a huge role. I’d expect them to aim for more consistent growth rather than dramatic leaps, building a solid foundation within the index.

Do you have any advice for our readers who are intrigued by the potential of companies like Tissue Regenix Group?

My advice would be to do your homework and think long-term. Regenerative medicine is an exciting field with transformative potential, but it’s not a get-rich-quick space. Look closely at the company’s pipeline, partnerships, and financial health before investing. Diversify your portfolio to manage risk, and consider consulting with a financial advisor who understands biotech. Above all, stay informed about industry trends and regulatory changes—they can make or break companies in this sector. Patience and diligence are key.