The foundational technologies that underpin modern medicine are undergoing a profound transformation, positioning the global cell culture consumables and equipment market for unprecedented expansion. Projections indicate that this critical sector, valued at US$ 13.06 billion in 2025, is on a trajectory to exceed US$ 29.53 billion by 2035, driven by a robust compound annual growth rate (CAGR) of 8.50%. This remarkable growth is not merely a reflection of increased demand but a testament to the escalating complexity and promise of biologics, next-generation vaccines, and revolutionary cell and gene therapies. As these sophisticated treatments move from research laboratories to clinical applications, the need for reliable, scalable, and efficient cell culture solutions has become paramount. The industry’s expansion is therefore inextricably linked to the success of these advanced therapeutic modalities, which depend on the precise and controlled cultivation of living cells to produce life-saving medicines and diagnostic tools for a new era of healthcare.

Shifting Paradigms in Biopharmaceutical Manufacturing

The Rise of Single-Use Systems

A fundamental structural shift is reshaping the landscape of biopharmaceutical manufacturing, as the industry strategically moves away from its reliance on traditional, large-scale stainless-steel tanks. This evolution is driven by a collective push toward greater flexibility, scalability, and operational efficiency, with single-use systems (SUS) emerging as the technology of choice. The preference for disposable bioreactors, tubing, and connectors minimizes the risk of cross-contamination, eliminates the need for costly and time-consuming cleaning and sterilization processes, and allows for rapid facility changeovers between different product campaigns. This trend is quantified by a high SUS adoption rate, which reached 87% in facilities as of 2024. Concurrently, the average size of the largest bioreactors has contracted to 3,664 liters, signaling a pivot from massive, monolithic production facilities to more nimble, decentralized manufacturing models that can better adapt to the diverse and often smaller-batch demands of personalized medicines and targeted therapies.

Fueling Innovation with Modular Architectures

The consensus pivot towards agile and modular manufacturing architectures is creating a cascade of new revenue opportunities for suppliers specializing in automated and closed bioprocess solutions. As biopharmaceutical companies reconfigure their operations around single-use technologies, their procurement priorities are changing dramatically. There is a growing demand for integrated systems that seamlessly connect different stages of the production workflow, from upstream cell culture to downstream purification, while minimizing manual interventions. This has opened the door for innovative suppliers to provide end-to-end platforms that are not only efficient but also compliant with stringent regulatory standards. The move towards modularity allows for a “plug-and-play” approach to facility design, enabling companies to scale production up or down quickly in response to clinical trial outcomes or market demand. This new paradigm rewards suppliers who can deliver not just individual components, but holistic, intelligent solutions that enhance process control and accelerate the journey from lab to market.

Key Market Segments and Regional Dynamics

Consumables as a Resilient Revenue Engine

An in-depth analysis of the market reveals the clear dominance of the consumables segment, which commands the largest market share and exhibits the most rapid expansion. The strength of this category is propelled by the recurring revenue generated from high-margin, proprietary products such as specialized cell culture media, reagents, and sera. Genomic and molecular testing reagents, in particular, serve as powerful drivers of growth within this segment. A compelling illustration of this dynamic is seen in the resilience of sequencing consumables, where revenue continued to grow even during periods when instrument sales softened. This establishes a robust “captive revenue generator” model for companies, wherein the initial placement of a hardware platform creates a long-term, high-value stream of income from the subsequent sale of necessary disposables. This model provides suppliers with predictable financial performance and insulates them from the cyclical nature of capital equipment sales, making the consumables segment the economic cornerstone of the cell culture market.

End-User and Geographic Leadership

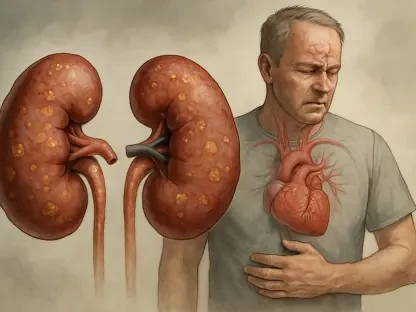

Among the diverse end-users of cell culture technologies, hospitals and diagnostics laboratories are projected to lead the market in terms of growth and adoption. This trend is fueled by the increasing integration of cell-based assays and molecular diagnostics into routine clinical practice for disease detection, patient stratification, and monitoring treatment efficacy. As personalized medicine becomes a reality, the ability to culture patient-derived cells for diagnostic and therapeutic purposes is becoming indispensable. From a regional perspective, North America is set to maintain its position as the largest contributor to the global market. The region’s leadership is anchored by a confluence of factors, including substantial government and private investment in life sciences research, a high concentration of leading biopharmaceutical and biotechnology companies, and a well-established regulatory framework that supports the development and commercialization of advanced therapies. This powerful ecosystem ensures that North America will continue to be a primary driver of innovation and market growth.

Redefining the Biomanufacturing Landscape

The strategic decisions made across the industry ultimately reshaped the biomanufacturing landscape into a more agile and resilient ecosystem. The decisive pivot from rigid stainless-steel infrastructure to flexible single-use systems unlocked new levels of operational efficiency and significantly reduced the capital investment required to bring new facilities online. This shift, coupled with the economic stability provided by the high-margin consumables sector, created a robust foundation for sustained innovation. These developments had a profound impact, enabling accelerated development timelines for critical vaccines and therapies and fostering a more competitive environment where smaller, research-focused firms could more readily scale their manufacturing capabilities to challenge established players. The industry’s trajectory was set toward a future of decentralized, responsive, and increasingly automated production.